Daily Comment (June 1, 2018)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT]

Happy employment day! We cover the data in detail below but the quick snapshot is that the numbers are showing clear and increasing evidence of a tightening labor market. The unemployment rate dipped to 3.8% (out to three digits, it was 3.755%), payrolls exceeded expectations and earnings ticked up to 2.7%. The data all support further policy tightening by the FOMC and thus the initial market reaction is a bit bearish for equities, dollar bullish and bearish for bonds.

A side note: The WP[1] is reporting that President Trump appeared to break protocol in a tweet that read, “Looking forward to seeing the employment numbers at 8:30 this morning,” about 69 minutes before the release. Given that the numbers were very strong, it would appear the president tipped off the financial markets to the data. The White House gets the numbers about a day before they are officially released (news media gets it a bit in advance as well—that’s why they can write stories on the data so quickly), but previous presidents hadn’t commented on the reports before the official release. Here is why this matters: financial markets are like poker players, all looking for a “tell.” Finding something that gives one advance information is highly prized. For the markets, if next month he doesn’t signal anything, will the financial markets then assume the data is weak? Or, if the president knows it’s weak and tries to preempt the information by discrediting it in advance, will that lead to early sell-offs? This act has added another layer of uncertainty surrounding this report; we will be watching next month for clues to the numbers.

Italy gets a government: President Mattarella approved a coalition government of populist parties, the two main groups being the Five-Star Movement and the League. The new PM is Giuseppe Conte, with Giovanni Tria, a professor of political economy, as finance minister. It was the finance mandate that led the president to scuttle an earlier configuration. Paolo Savona, the Euroskeptic, will be the minister for EU affairs (that should be interesting). The coalition’s fiscal plans are estimated[2] to cost about 6% to 7% of GDP. If those plans are acted upon, it will lead to a confrontation with the EU (read: Germany). The financial markets are taking this outcome as better than new elections but it isn’t a good outcome for financial markets. At the same time, the two major coalition parties barely won 50% of the vote and this may end up being a short-lived government anyway.

Rajoy out: This morning, Mariano Rajoy lost the no-confidence vote and was replaced by socialist party (PSOE) leader Pedro Sanchez. Upon accepting the position, Sanchez promised to keep the budget plan of the previous administration as well as open up dialogue with secessionists in Catalonia. Even though PSOE does not support secession, the group has historically been open to making concessions to appease Catalonia. That being said, Sanchez’s legitimacy has been questioned by political rivals Cuidadanos and PP because he doesn’t have the backing of the people; he lost the previous two elections. Sanchez’s party currently holds 84 seats in parliament, making it unclear how long his administration will last. In the event of an election, the party we will pay close attention to is Ciudadanos, which will likely pose a challenge to the establishment parties PSOE and PP.

The problem with trade policy: The private sector in capitalist economies are remarkably flexible. It is part of the reason capitalism triumphed over communism. Capitalist economies react better to change; production methods, supply chains, customers, etc. can all be adjusted to maximize profits, sales or whatever the business is trying to accomplish. Businesses constantly complain about regulation, for example. For the most part, however, history shows that industries do manage to adjust.

But, this system functions only if conditions are reasonably stable. Rapidly changing price levels, regulations that vary on a whim or the perception of a wide range of potential outcomes can freeze managers into a position where it becomes difficult to make long-term plans. How does one invest when conditions are rapidly changing? Only with great difficulty.

Herein lies the problem with the administration’s trade policy. It is becoming difficult to tell what future trade arrangements will emerge. If the aluminum tariffs are going to remain in place, a consumer should probably build stockpiles to protect against future price increases…unless the policy changes for some other reason. And, what should a company do if it finds itself as the target of trade retaliation? Invest in lobbying to try to reverse the policy? Woo foreign governments to change their minds?

The U.S. has engaged in a reserve currency system that brings costs and benefits. The beneficiaries are most consumers (we get lots of imports that keep prices down) and the financial system (foreigners need U.S. dollar assets to hold their reserves until needed). The reserve currency is also a source of influence; Iranian sanctions were successful, in part, because other nations feared the loss of access to the U.S. banking system. The costs were borne by those working in import-competing industries. The dollar/reserve policy has been partly responsible for rising inequality. The U.S. has every right to change the rules of the game to help those adversely affected by the policy.

However, the dollar/reserve system is deeply imbedded in how the global economy functions and changing it requires careful adjustments to avoid causing an unexpected crisis. Moving fast and breaking things raises the risks of an unforeseen consequence that will tend to make investors cautious; this will likely play out in the equity markets in the form of multiple contraction.

Energy recap: U.S. crude oil inventories fell 3.6 mb compared to market expectations of a 0.9 mb draw.

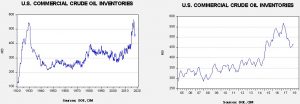

This chart shows current crude oil inventories, both over the long term and the last decade. We have added the estimated level of lease stocks to maintain the consistency of the data. As the chart shows, inventories remain historically high but have declined significantly since last March. We would consider the overhang closed if stocks fall under 400 mb.

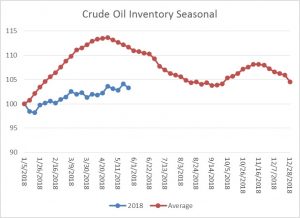

As the seasonal chart below shows, inventories are usually starting their seasonal decline this time of year. This week’s decline is consistent with that pattern. We expect steady stock withdrawals from now until mid-September. If we follow the normal seasonal draw in stockpiles, crude oil inventories will decline to approximately 426 mb by September.

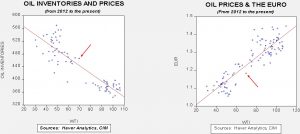

Based on inventories alone, oil prices are overvalued with the fair value price of $62.88. Meanwhile, the EUR/WTI model generates a fair value of $63.52. Together (which is a more sound methodology), fair value is $62.92, meaning that current prices are above fair value even with the recent pullback. The stronger dollar is putting downside pressure on oil prices, which is only partially being offset by falling stockpiles. Although we don’t expect a bear market to emerge (there is probably too much geopolitical risk for a decline below $50 per barrel), prices did get a bit ahead of themselves and some consolidation would be normal.

Assad threatens U.S. forces in Syria: Recent comments from Syrian President Assad are an example of the level of geopolitical risk we are seeing. Yesterday, he warned that his government would “wage war” to expel U.S. troops from northeastern Syria if negotiations for withdrawal fail.[3] U.S. troops have supported the Kurds who have established control in parts of Syria. Assad’s comments are really ill-advised. President Trump has already indicated he wants to leave Syria. At the same time, Trump is a Jacksonian; besmirch his honor and he will react harshly. Even threatening to attack U.S. troops could lead the president to react harshly. Assad appears to be overconfident; if he simply keeps quiet, it is likely the U.S. will exit without fanfare. It should be noted that without Russian and Iranian support, Assad would likely be out of power. We doubt either of his supporters would countenance a direct attack on U.S. troops. But, if conditions suddenly escalate, it increases the chances of a geopolitical event in the Middle East and could support oil prices if it spreads.

[1] https://www.washingtonpost.com/news/business/wp/2018/06/01/trump-breaks-protocol-sends-markets-a-clear-signal-on-jobs-report-before-numbers-are-released/?utm_term=.9f2569a198e7

[2] https://www.politico.eu/article/silvia-merler-italy-politics-populists-program-violates-all-eu-and-domestic-fiscal-rules/?utm_source=POLITICO.EU&utm_campaign=982742a3a1-EMAIL_CAMPAIGN_2018_06_01_04_26&utm_medium=email&utm_term=0_10959edeb5-982742a3a1-190334489

[3] https://www.washingtonpost.com/world/middle_east/assad-threatens-to-expel-us-troops-from-syria-by-force/2018/05/31/e4ba8400-64d3-11e8-81ca-bb14593acaa6_story.html?utm_term=.f48f971744b4&wpisrc=nl_todayworld&wpmm=1