Daily Comment (June 5, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market remains focused on the latest developments in the tax bill. Today’s Comment examines why the weak PMI reading may not be as significant as some fear, breaks down how the CBO scoring offered both positive and negative implications for the White House, and covers other key market updates. As usual, the report will also include a summary of today’s domestic and international data releases.

Economic Jitters: Just a day after markets breathed a sigh of relief over surprisingly strong job numbers, fresh data casts doubt on that optimism.

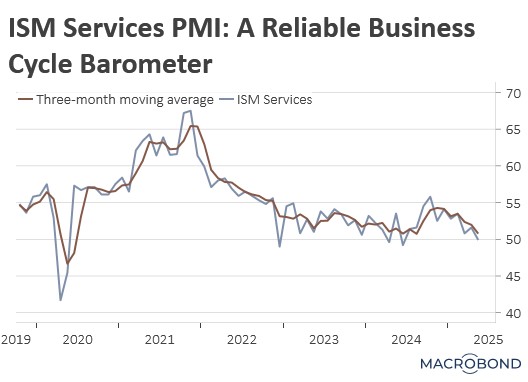

- The ISM Services PMI unexpectedly fell from 51.6 to 49.9 in June. While a reading below 50 indicates potential contraction in the services sector, which represents nearly two-thirds of US economic activity, it appears that the decline more likely reflects statistical noise rather than fundamental weakness. The deterioration was concentrated in inventory and new orders components, which were particularly vulnerable to normalization effects following tariff front-running by firms.

- While much attention has been paid to the weak June figure, we believe the moving average is a more reliable indicator. Notably, the index has dipped below 50 three times since the pandemic without triggering a downturn, suggesting that a single weak month may not be significant. However, if the three-month moving average falls below 50, that would be more consistent with an impending downturn.

- While the indicator may not yet signal a downturn, it does suggest inflationary pressures are building. The key component to watch is prices paid. Not only is that hovering well above 60 (indicating strong expansion), but it also appears to be gaining momentum. If this trend continues, firms may be able to absorb higher costs through squeezed margins, reduced employment, or an increase in consumer prices.

- The economy is sending mixed signals — some good, some not so good — and inflation is still a worry. Because of this, the Fed is unlikely to cut interest rates at this time. Even if Friday’s jobs report is weaker than expected, we don’t think that will be enough to sway their decision. Right now, fed fund futures suggest that the central bank will cut rates 2-3 times this year, with the first being in September.

Budget in Better Balance: Despite criticism of the president’s sweeping bill, the White House received favorable budget news.

- The Congressional Budget Office (CBO), a nonpartisan group, projects that the recently passed House budget will increase the national deficit by $2.42 trillion over the next decade. The bill shows expected increases in spending of $3.67 trillion along with a decline in spending of $1.25 billion. This estimate, however, does not factor in potential economic growth, which could partially offset the increase in the deficit.

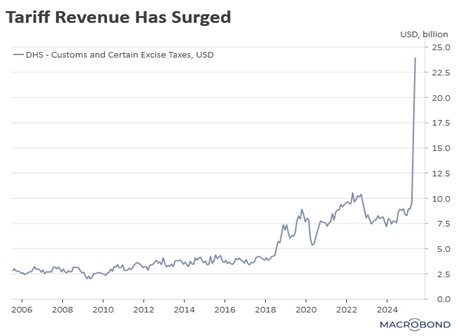

- There was some good news. The CBO’s analysis suggests that the tariffs imposed as of May 13, could offset a significant portion of the new spending, potentially even pushing the federal budget into surplus. According to the agency’s estimates, these tariffs could generate up to $2.8 trillion in offsets, which may substantially reduce the deficit. Additionally, the CBO projects that the policy would lower interest expenses, further improving the fiscal outlook.

- However, the head of the CBO included several caveats in the agency’s analysis. The CBO warned that tariffs could reduce overall GDP by 0.6% over the forecast period and might increase inflation by 0.9% by 2026, before stabilizing afterward. Additionally, the agency cautioned that the estimates were subject to significant uncertainty, given the lack of historical precedent for tariffs of this size and scope. That said, we have already seen that tariffs are a strong revenue generator.

- The latest CBO estimates are likely to fuel arguments both for and against the president’s new tax bill. Republican senators will likely need near-unanimous support to ensure passage — a feasible goal given their 53-seat majority and control of the White House, which provides a three-vote cushion. Given the high stakes, we anticipate the bill could be signed into law as early as next month, though passage by the end of summer appears more likely.

US-NATO Rift: While NATO members are boosting military expenditures, US strategic priorities appear to be rebalancing from the Russian threat to the Chinese challenge.

- The Pentagon has informed Congress of its intent to reallocate advanced anti-drone technology originally destined for Ukraine to US forces. This decision follows Russia’s vow to retaliate against Ukraine after a successful drone strike deep inside Russian territory destroyed more than 40 aircraft. While the US president, who was not briefed on the operation beforehand, privately praised the attack, some reports suggest he also expressed concern that it might undermine his diplomatic peace efforts.

- Additionally, the US has declined to support a European proposal for an American security guarantee following any potential ceasefire agreement. Despite pressure from the UK and France, who have urged Washington to provide air defense systems to support a coalition of European forces that would deter Moscow from any future reinvasion, the US remains unwilling to commit to enforcing the terms of a future Russia-Ukraine peace deal.

- These developments are likely to raise concerns among European leaders about the need to increase defense spending as the US shifts its strategic focus toward the Indo-Pacific. According to Secretary of Defense Pete Hegseth, NATO members appear poised to raise their defense spending target to 5% of GDP. Germany, Europe’s largest economy, is positioned to take the lead, planning a significant military expansion that would add 60,000 active-duty personnel to its armed forces.

- The US strategic pivot away from NATO is expected to pressure European nations to increase defense spending. While this could lead to higher debt issuance among member states, potentially pushing up sovereign bond yields, the accompanying fiscal stimulus may provide support for equity markets.

Data Credibility: Growing concerns are emerging that budget cuts may compromise the reliability of official government statistics.

- The Trump administration has proposed cutting the Bureau of Labor Statistics‘ (BLS) budget by 8%, along with an equivalent reduction in staff. This comes as the agency — responsible for critical price and employment data — has faced years of underfunding that have compromised its data collection capabilities. These constraints have drawn particular criticism following significant downward revisions to last year’s payroll figures, which undermined confidence in the agency’s reporting.

- Budget cuts could lead to an increased reliance on private-sector data for economic assessment. However, these alternative sources may prove less reliable and more limited in scope than official government statistics, potentially distorting economic analysis and undermining informed policy decisions. Moreover, the reduced transparency could fuel market uncertainty, driving up risk premiums as investors grapple with diminished data quality and consistency.