Daily Comment (June 4, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market remains laser-focused on any signals that the US and China may resume trade talks. In today’s Comment, we’ll explore how a strong labor market could lead the Fed to postpone rate cuts, analyze why the new US steel tariffs represent a double-edged sword for global markets, and highlight other key, market-moving developments. As always, we’ll wrap up with a detailed breakdown of the latest domestic and international economic data releases.

Optimism Boost Hawks: The recent wave of positive economic data will likely keep the Fed from adjusting its monetary policy in the near term.

- The April Job Openings and Labor Turnover Survey (JOLTS) report pointed to stronger hiring activity, underscoring the labor market’s continued resilience. Job openings rose to 7.4 million, up from a revised 7.2 million. The rise was driven largely by increased demand in professional and business services as well as healthcare and social assistance sectors. Alongside the rise in vacancies, hiring also increased by 169,000. However, layoffs edged up by 191,000, signaling some offsetting pressures in the labor market.

- The strong job openings data is likely to discourage Fed officials from supporting interest rate cuts at their upcoming meeting. Atlanta Fed President Raphael Bostic recently emphasized that the central bank feels no urgency to lower rates as inflation remains above the 2% target. Meanwhile, Fed Governor Lisa Cook noted that recent tariffs are further complicating the Fed’s ability to ease monetary policy.

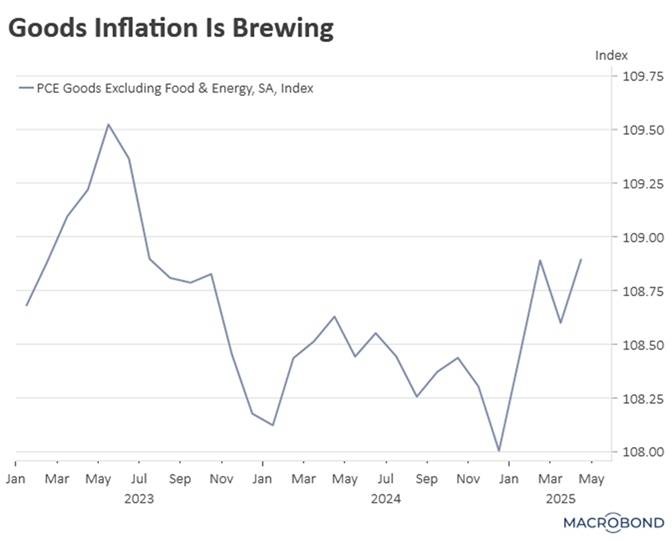

- While the Fed’s reluctance to cut rates has sparked considerable debate, emerging evidence may justify its cautious approach. The latest PCE report, showing inflation at its lowest level since 2021, provided positive signals, particularly regarding services inflation. However, this positive headline likely overshadowed subtle signs of accelerating prices on goods. Furthermore, it remains unclear how firms will manage pricing once they exhaust their existing inventory.

- The strong labor market is a key indicator for the Federal Reserve as it weighs the optimal timing for interest rate cuts. A major concern among Fed officials is the uncertain impact of tariffs on the economy. As a result, the central bank plans to wait until at least mid-summer before deciding on rate cuts. This delay should provide a clearer understanding of the economic effects from tariffs and more certainty regarding overall tariff policy.

Tariff Update: While the president’s steel tariffs aim to protect domestic industry, their global economic impact may be mixed — both beneficial and disruptive.

- Fifty percent tariffs on US steel officially went into effect on Wednesday under an executive order signed by the president. The new tariff rate effectively doubles the previous rate. The move follows the White House signaling its approval of the acquisition of US Steel by Japan’s Nippon Steel as the president seeks to demonstrate that the proposed merger will not weaken his commitment to bringing more manufacturing back to the US.

- Following these actions, the UK, which was the first to reach an initial agreement on future trade talks, has been granted an exemption from the tariff hike — keeping its rate at 25% — along with a new five-week deadline to finalize a deal. However, the accelerated timeline could complicate efforts for the country to secure favorable terms for the domestic metals industry, which British lawmakers worry is on the brink of collapse.

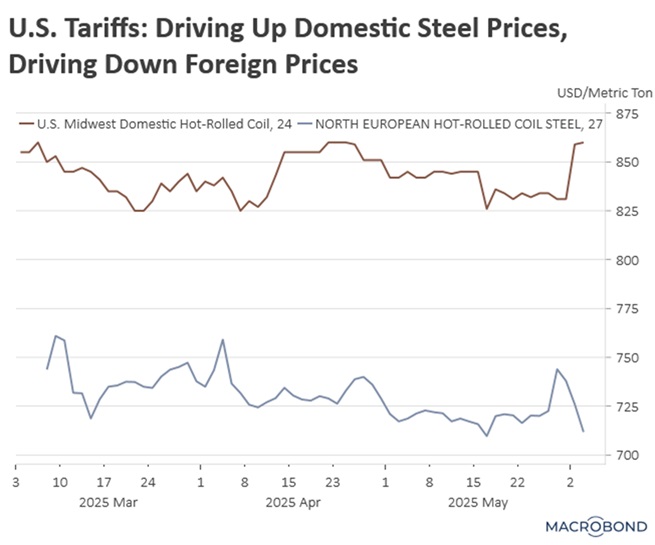

- Following the president’s announcement of steel tariffs, US and foreign steel prices have moved in opposite directions. Futures prices for US steel have surged, contrasting with a decline in foreign steel prices. This disparity exemplifies the significant influence tariffs can exert on particular commodities. In essence, such tariffs contribute to domestic inflationary pressures, while simultaneously alleviating them in international markets.

- This inverse relationship will likely present both benefits and challenges for international markets. In the short term, it could facilitate other countries’ efforts to meet their inflation targets, given their probable increase in supply. However, in the long term, this dynamic is likely to contribute to higher unemployment in key sectors. Consequently, we suspect that international firms heavily reliant on raw materials could benefit from this deflation, while their suppliers might require additional government assistance to remain viable.

US and China Bickering: The two economic powerhouses remain at odds in trade negotiations, each determined to project strength rather than compromise.

- In a recent late-night post on his Truth Social account, President Donald Trump stated his belief that Chinese President Xi Jinping is “extremely hard to make a deal with.” This comment suggests Trump’s likely weariness regarding the prospects of a trade deal, especially given his efforts in recent days to secure face-to-face trade talks with his Chinese counterpart. The president’s remarks are likely to raise concerns about the fragility of the recent truce between the two sides in May.

- In another sign of heightening tensions between the two economic powers, China has announced plans to consider purchasing hundreds of Airbus aircraft during upcoming meetings with European leaders. While no final decision has been made, analysts suggest this move could target specific US companies — particularly Boeing — as strategic leverage in ongoing trade negotiations.

- Renewed tensions threaten to undermine confidence that the two sides will be able to avert a damaging trade war. Markets have largely priced in expectations that the administration will seek to roll back any trade measures that could negatively impact equities. This outlook has encouraged many investors to adopt a “buy the dip” mentality, anticipating that near-term disruptions may lead to favorable policy responses.

- This trend has helped push the market back to levels seen at the start of the year, though not enough to reach new highs. The true test will come ahead of the July 9 deadline, when the president announces whether he will: (1) maintain current tariff rates, (2) grant extensions to certain countries, or (3) implement the higher rates proposed on April 2. Market analysts anticipate the third option would likely trigger the most negative reaction from investors.

Russia Expands: Following its invasion of Ukraine, there is speculation that Russia may try to expand its influence in other countries.

- The Moldovan prime minister has accused Russia of attempting to interfere in Moldova’s elections, aiming to install a government more sympathetic to Moscow. He warned that Russia could exploit a pro-Moscow political party to legitimize the deployment of over 10,000 troops in the region. His remarks are a reminder that countries feel they could be a target after the conflict ends in Ukraine.

- Furthermore, the Kremlin appears to be actively working to undermine Bulgaria’s EU accession process. While Bulgaria is set to adopt the euro on January 1, 2026, a surging populist movement that is widely believed to be backed by Moscow is advocating for a referendum that could block the currency transition. Analysts suggest Russia aims to maintain Bulgaria within its sphere of influence through these efforts.

- The alleged interferences in Bulgaria and Moldova highlight Moscow’s potential strategy of shifting focus to other countries once it reaches a resolution in its war with Ukraine. Such actions are likely to prompt EU leaders to increase defense spending as they seek to counter Russia’s growing influence.