Daily Comment (June 30, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning. Markets remain squarely focused on the “One Big, Beautiful Bill.” Today’s Comment will begin with an analysis of the latest progress on President Trump’s tax bill, followed by an overview of recent trade developments. We’ll also examine other stories moving markets today. As usual, we’ll conclude with a summary of today’s key domestic and international economic data releases.

The Tax Bill Progresses: Senate Republicans advanced legislation on the president’s tax agenda over the weekend, aiming to meet an ambitious July 4 deadline for passage.

- The Senate voted 51-49 to advance debate on the bill after two Republicans sided with Democrats. Lawmakers are now finalizing the legislation ahead of a decisive vote, with negotiations centering on three key issues: the budget deficit impact, regulatory changes, and proposed cuts to investment and social spending programs.

- The latest Congressional Budget Office estimates project that the bill would increase the national deficit by $3.3 trillion over the next decade. This figure excludes additional borrowing costs, which could substantially worsen the shortfall. The legislation combines $4.5 trillion in reduced revenues with $1.2 trillion in spending cuts.

- The legislation modifies a controversial AI moratorium provision from the House bill, reducing restrictions on state-level AI regulations from 10 years to five years as a condition for accessing $500 billion in infrastructure funding. It also includes exemptions for AI rules concerning child protections and incorporates a Tennessee law banning the unauthorized use of musicians’ likenesses by AI systems.

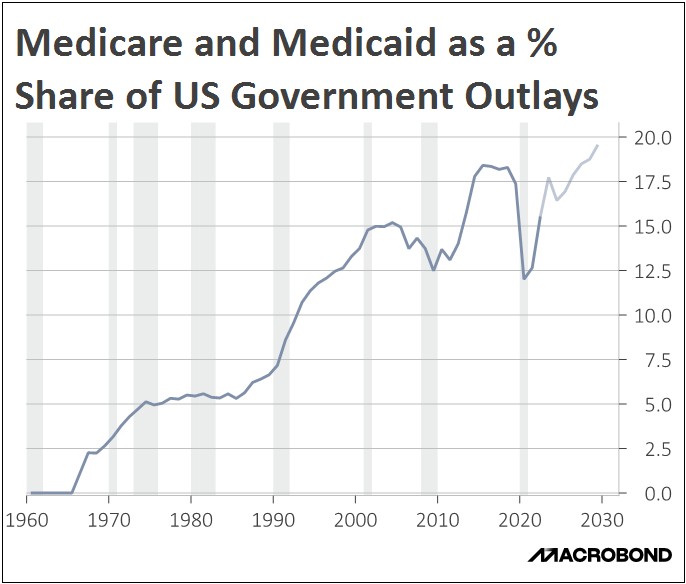

- The legislation also introduces significant changes to the social safety net, including new work requirements of 80 hours per month to qualify for benefits, along with restrictions on Medicaid provider taxes. While the new work requirements also apply to parents, exemptions are provided for those with children under 14. Additionally, the bill modifies food assistance programs by requiring states to contribute funding.

- The final bill contained several significant omissions. Most notably, the Senate removed the controversial “revenge tax” provision. Additionally, the Senate parliamentarian ruled that key provisions violated the Byrd Rule, forcing the removal of major healthcare, immigration, and financial reform as well as other measures

- While clear signs indicate that the bill remains unfinished, it appears to have strong momentum. We anticipate the legislation will likely pass within the coming days, with final approval expected by week’s end. Although the bill should provide a near-term boost to equities, investors will probably quickly shift their focus to earnings reports once it’s enacted.

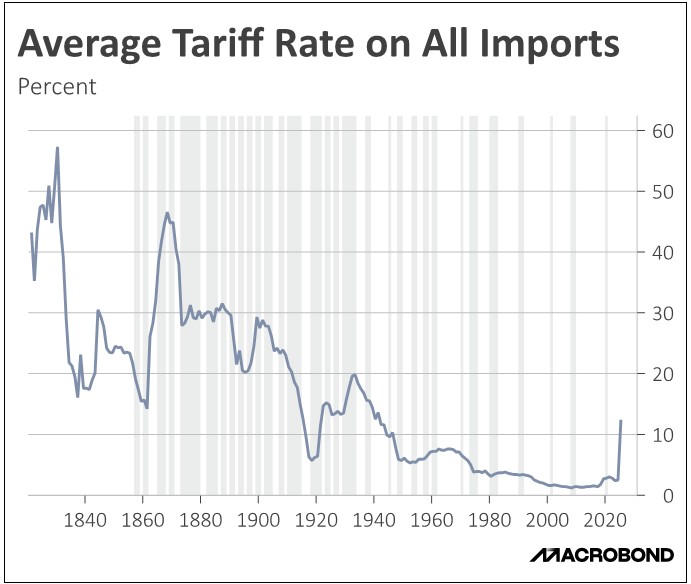

Trump Trade Policy: President Trump is expected to send out his trade letters this week, which may lead to market volatility

- With just over a week remaining until the president’s July 9 deadline, significant uncertainty persists regarding the tariff rates that will be imposed on key countries. The president has already begun drafting letters to affected nations outlining the specific tariff rates for their exports, while dismissing speculation that he might extend the deadline.

- On Friday, the Trump administration announced a new trade agreement with China that guarantees continued access to critical resources for US manufacturers. While existing tariffs will mostly remain in place, the deal alleviates concerns about potential shortages of key industrial inputs like rare earth minerals. The administration also revealed that it has successfully negotiated 10 additional trade agreements that it plans to roll out this week.

- In a weekend breakthrough, the president secured Canada’s agreement to scrap its digital services tax just before it was set to take effect Monday. This came after Friday’s hardline stance, when the administration suspended trade talks until the tax was withdrawn. The White House has consistently opposed these digital levies across multiple nations, with senior officials deriding them as attempts to use American tech firms as “piggy banks.”

- Markets will scrutinize the details of the Trump administration’s trade agreements, with particular focus on tariff provisions. Signs that rates will remain stable or decrease would likely reassure investors, while any unexpected increases in import taxes could prompt a reduction in risk exposure across financial markets.

Chile Nominated Communist: One of South America’s wealthiest economies was rocked by a surprise victory, as a Communist candidate triumphed in the country’s primary elections.

- Jeannette Jara secured a landslide victory, emerging as the left-wing presidential candidate. The former labor minister’s win is likely to unsettle markets, which had hoped for a more moderate nominee. She will now face a consolidated field of right-wing candidates who bypassed their primary process amid strong polling numbers for far-right conservatives.

- Chile faces mounting economic headwinds as sluggish GDP growth and rising unemployment strain the economy. Public discontent is growing over surging immigration and crime rates, adding pressure on policymakers. Despite these challenges, markets had remained resilient — until now — and were buoyed by expectations that the incoming administration would pursue business-friendly reforms.

- South American economies have demonstrated notable resilience to the trade tensions currently roiling Asia and Europe. However, the region’s political landscape presents risks, with a growing trend of anti-establishment candidates gaining traction. While markets typically view far-right politicians as more favorable than their far-left counterparts, this polarization introduces new uncertainties for investors.

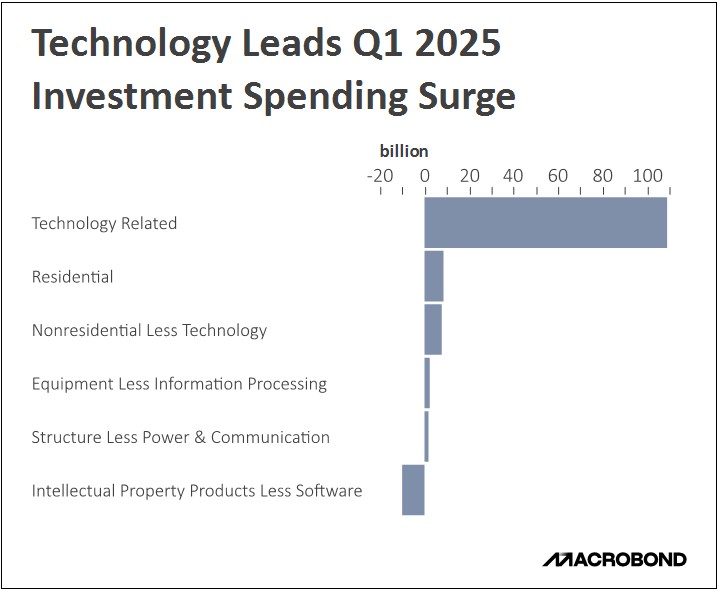

US Energy Spending: More companies are investing in power plants and transmission lines to meet the electricity demands of AI.

- Utilities companies are projected to boost capital expenditures to $212.1 billion in 2025 and will reach a record high of $228.1 billion by 2027. This sharp increase is driven largely by surging investments in energy-intensive data centers, fueled by the AI boom. However, the rapid growth in power demand has raised concerns that AI-driven energy consumption could lead to higher electricity prices, potentially exacerbating inflationary pressures.

- US electricity demand has rebounded strongly since the pandemic and is now growing faster than overall inflation. This surge is primarily demand driven, with projections showing consumption increasing 25% by 2030 and 78% by 2050. To mitigate household cost impacts, regulators have implemented solutions requiring major hyperscale developers, including Amazon, Microsoft, and Meta, to contribute through either direct capacity investments or special tariff arrangements.

- We are closely tracking technology-investment trends due to their pivotal role in the broader economy. Last quarter, tech spending accounted for the largest share of capital expenditure, solidifying its position as a key engine of economic growth. That said, we note that a slowdown in the AI boom could trigger widespread spillover effects, with potential repercussions across financial markets and the broader economy.