Daily Comment (June 30, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment begins with a farewell to LIBOR and ends with a few comments on the overnight news.

The End of LIBOR: As of today, the use of the London Interbank Offering Rate, or LIBOR, will end. LIBOR developed in London as an ad hoc arrangement in 1969 to set the rate on an $80 million syndicated loan to the Shah of Iran. By the mid-1980s, the process of establishing the LIBOR rate was formalized by the British Bankers Association (BBA). A set of London banks would submit their borrowing rates for 15 different maturities and up to 10 different currencies. The LIBOR rate originally was tied to the Eurodollar market, which represented unregulated dollar deposits held offshore, but over time (especially with the end of Regulation Q in the U.S., which set deposit rates), LIBOR was designed to reflect bank cost of funds. The BBA would calculate a trimmed-mean average by removing the top and bottom four rates.

During the Great Financial Crisis, it was discovered that banks were manipulating the submissions to help their respective institutions and, in the most egregious cases, encouraging other banks to do the same as “a favor.” Because LIBOR was the rate tied to the Eurodollar futures market, this manipulation ran afoul of U.S. commodity trading regulations. In the wake of the scandal, the Federal Reserve and other regulators moved to end LIBOR and shifted to the Secured Overnight Financing Rate (SOFR). And so, effective today, LIBOR is no longer being calculated and will not be available for loans.

What are the ramifications?

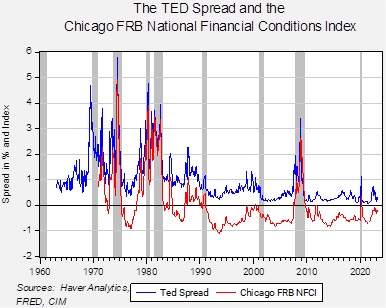

We lose a market indicator: For years, one of the key indicators of market stress was the T-bill over Eurodollar spread, commonly called the “TED spread.” Since LIBOR represented non-government guaranteed dollar deposits, there was credit risk embedded in the rate. Market participants began to notice that when credit stress developed in the financial markets, the TED spread would widen, with LIBOR rates rising above T-bill rates.

The Chicago FRB National Financial Conditions index rises when financial stress develops. As the chart shows, the TED spread tends to widen when stress increases; in fact, the two series are correlated at 92.6%. Since the SOFR rate is secured lending, meaning it is collateralized by a safe asset, it should not exhibit the same reaction to financial stress. Essentially, the SOFR/T-bill spread will not likely exhibit the same characteristics as the TED spread, meaning that traders and investors will lose the TED spread as a market indicator.

Banks will lose a buffer: Bank loans are often tied to LIBOR as a base rate. A typical floating loan is LIBOR plus a spread. Since LIBOR rates would rise during periods of financial stress, banks were provided a modicum of protection from such events. In other words, the rate on LIBOR-based loans would rise as stress levels rose. Assuming the borrower remains current, the rise in the loan’s rate would exceed the level of the risk-free rate by a wider margin. This protection would allow banks to offer more competitive rates to borrowers, knowing that the lender had some protection from financial stress events. Since SOFR is collateralized, the rate relative to the risk-free rate shouldn’t rise when credit conditions deteriorate. Eventually, we would expect loan pricing to change to reflect the shift.

Credit lines could be utilized during periods of stress: Banks routinely issue credit lines to corporate borrowers, assuming few will use them. Tying the credit line to a LIBOR rate tended to discourage credit line use because (as noted above) the LIBOR rate would rise when credit conditions weakened. Since SOFR is secured, the rate probably won’t rise when stress emerges, which may encourage the use of credit lines just at the moment when banks would rather see them lay dormant.

At the end of May, some $700 billion of high-yield loans remained priced at LIBOR. We do expect some loans will slip through the deadline. The rate behavior of these loans will depend on the loan covenants in place. It is not inconceivable that the loans become essential fixed rate at today’s closing LIBOR rate. Although the financial industry has had ample time to adjust and prepare, some issues may still emerge. But, as we note above, the bigger issue is that this change could lead banks to inadvertently take risk. From our perspective, the loss of the TED spread is a disappointment; although other credit signals exist, the TED spread was an easily accessible way to view financial stress. Adieu, TED…

In Other News: Inflation is falling in the Eurozone, and currencies in the two largest Asian economies are plummeting against the dollar. Meanwhile, France is still trying to get protests under control.

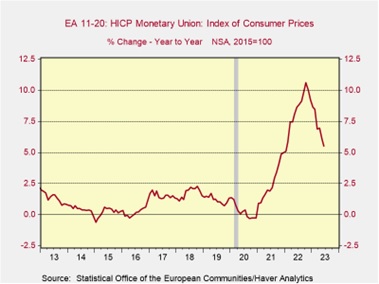

- June CPI for the Eurozone declined from 6.1% to 5.5%. The reading was lower than the consensus estimate of 5.6% but still above the European Central Bank’s 2% target. Although the decline will be welcomed by the central bank, it is unlikely to dissuade policymakers from further tightening. The ECB has raised rates in eight consecutive meetings and is expected to do so again in July and September. Futures contracts show that traders are pricing in an additional rate increase of 50 bps by the end of the year.

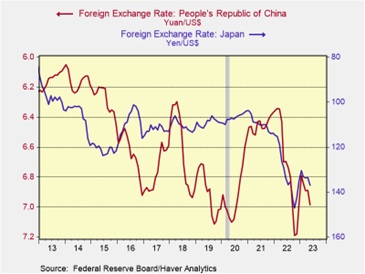

- Japanese and Chinese currencies are weakening relative to the dollar for opposite reasons. The yen is weakening as traders doubt that the Bank of Japan (BOJ) will tighten monetary policy to counteract rising inflation. In contrast, the yuan has dropped as China’s central bank, the People’s Bank of China (PBOC), refuses to provide sufficient stimulus to support its struggling economy. The currency weakness has led the PBOC to intervene through fixing to support the yuan and is expected to lead to action from the BOJ.

The chart above is inverted to show that an increase in the price of a U.S. dollar in another currency reflects a depreciation.

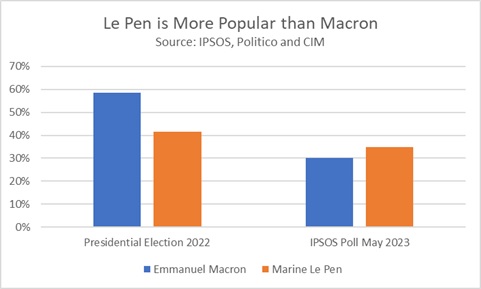

- In France, President Emmanuel Macron is struggling to contain protests following a police shooting of an unarmed teenager. Over 875 people were arrested in France on Friday in the third consecutive night of protests. Prime Minister Elisabeth Borne is considering setting up a crisis meeting to deal with the situation. The unrest in France is likely to further diminish President Macron’s popularity, which was already hurt by his handling of pension reforms and other protests.