Daily Comment (June 28, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning and happy Monday. U.S. equity futures are mixed and trading quietly as we close out the second quarter this week. We lead off today with the Western heat wave. Up next, we discuss U.S. airstrikes in the Syrian/Iranian region. Economics and policy news begin our regular coverage, followed by China news. The international news roundup is next, and we close with the pandemic update.

Western heat wave: The Western U.S. is suffering through a drought and heat wave. Droughts for the Southwest are clearly nothing new, but triple-digit temperatures in the usually temperate Northwest are something different. Portland hit 112o and Seattle 104o. The Canadian city of Lytton hit 116o, a new record for the country. Areas that frequently get hot have adapted. Air conditioning is common, and officials have experience in opening cooling centers. However, the Northwest does not have the same level of experience with intense heat, and thus, will struggle to cope with the temps. What is occurring is a classic heat dome; these are often seen in the Midwest. The jet stream cuts off weather systems that could bring rain and cooler temperatures. Such events in the nation’s midsection usually touch off grain rallies as drought fears trigger worries about corn and soybean crops being adversely affected. These domes are hard to shift. It often takes a major cold front to break them up (in the Midwest, a dissipating tropical storm can do the trick). Not only do the temperatures stress people, but they can put pressure on electrical grids that lead to brownouts and outages. High temperatures can also boost natural gas demand to meet the rise in electricity production.

Airstrikes: The U.S. conducted airstrikes against Iranian-backed militia groups in the border region of Syria and Iraq. The U.S. is accusing these groups of launching drone strikes against U.S. troops in the region. The targets were weapons storage and operational facilities. Although negotiations to return to the 2015 nuclear deal continue, the war conducted by Iranian proxies will make the talks difficult. We expect a return to the deal, but there won’t be much progress beyond these talks.

Economics and policy: The White House continues to balance its interests for infrastructure spending, the labor market remains unsettled, and Fed officials continue to make hawkish statements.

- After a dustup last week, when President Biden linked passing the bipartisan infrastructure package with the broader budget bill, the White House appears to have smoothed over the dispute. The president actively worked to overcome the apparent mistake of linking the two measures. Although the pundits slammed the “own goal” of linking the budget bill and the infrastructure package, the reality is that the White House is trying to keep a shaky coalition together. If it leans toward the bipartisan measure, the LWP might withdraw support. We note that Manchin (D-WV) has essentially scotched Sen. Sanders’s (I-VT) $6.0 trillion budget plan.

- The turmoil in the labor markets continues. The latest is the issue regarding unemployment insurance. The concern is that generous benefits may be keeping workers away from jobs. Although we don’t doubt there is some effect, our suspicion is that the issue is more complicated than just income support. The history of pandemics suggests that in their wake, labor power increases; there was a notable increase in real wages after the Black Death to the point where the English Crown tried to force workers to accept jobs (it didn’t work). We are watching the media framing of the issue. The WSJ is touting that initial claims are falling faster in states where benefits have been cut. At the same time, the NYT reports that even in states where benefits have been reduced, recruiters are still struggling to fill jobs. We suspect that underlying these reports is that the pandemic has encouraged workers to rethink their career choices. The surge in new business formation may be a clue. If this is the case, jobs in leisure and hospitality may only be filled at higher wages.

- A side note to this issue is immigration. We note a story from Oregon about an asparagus farm being unable to source foreign workers and opening up the farm to locals to pick for free. It details the impact of immigration policy.

- We continue to monitor comments from Fed officials about policy. Although the leadership remains strongly committed to continued stimulus, there is clear dissension in the ranks, especially among the regional bank presidents. The most recent to chime in has been Boston FRB President Rosengren, who commented that policymakers need to avoid a “boom/bust” cycle in residential real estate. We characterize Rosengren as a “financial sensitive,” meaning that he thinks monetary policy should also, in part, be conducted to prevent asset bubbles. This position, in our opinion, is theoretically justifiable but politically impossible. Imagine a Fed Chair trying to explain to Congress that the Fed raised rates to bring down market P/E’s. Greenspan took heat for his “irrational exuberance” comments in 1996. Still, this means Rosengren is probably supporting some level of stimulus withdrawal. We note he votes in 2022.

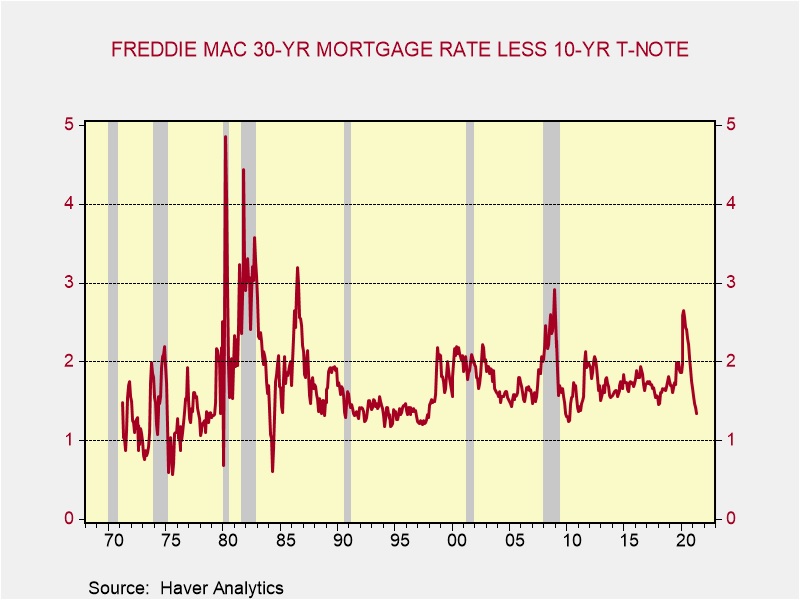

- The financial sensitives seem to be pushing for a tapering of mortgage purchases. Mortgage spreads have narrowed but are not reaching new lows.

- Politics does occasionally make for strange bedfellows. California Congress members don’t always agree on laws and regulations. But, when antitrust regulation threatens the tech industry, cooperation seems to be the order of the day. Speaker Pelosi is supporting the measure, but most California representatives and senators are not, warning about “killing the golden goose.”

- Denmark is looking at new rules that would force the tech news aggregators to pay for content.

- The GOP is warming to taxing big tech.

- Regulators are turning their attention to decentralized finance. The concern is that this area of the market is nothing more than a form of regulatory arbitrage and could be a source of market instability. The U.K. has banned the crypto exchange Binance (BNB, USD, 288.22).

China: There are renewed tensions on the India/China border, and internationalizing the CNY will require difficult choices.

- The India/China frontier has been tense for some time. The fact that the border is in high altitudes may be the best reason why a hot war hasn’t occurred since the 1960s. There are reports that the PLA is increasing training at high altitudes in the area. In response, the Indian military has sifted 50,000 additional troops to the region. Such behavior will tend to increase tensions between the two nations.

- The CPC in China is notorious for manipulating history. The story of Dong Zehua, a protestor who in 2019 called attention to the Tiananmen Square Massacre, is instructive. Dong and a couple of other students were arrested for the protest and given short stints in jail. What happened later is instructive. Not only does China suppress the history of the massacre, but the record of Dong’s arrest vanished from public records as well.

- Zhou Chengjun, the director of research at the PBOC, in a recent speech noted that as Beijing works to internationalize the CNY, it will have to give up control of the exchange rate. China has tried to have it both ways—it wants the geopolitical benefits of being a reserve currency without importing the potential market volatility that comes with that position. Zhou’s position continues to be opposed by the CPC leadership, who intend to maintain exchange controls. Maintaining these controls, even with a digital CNY, won’t allow the currency to displace the dollar.

- Major U.S. mutual fund companies apparently have holdings of companies that operate in Xinjiang. It is possible that the U.S. will force some sort of divesture at some point.

- The idea of a “NATO for trade” is being floated by policy hawks in the U.K. and U.S. The basic idea is that if China threatens a company with trade impediments or sanctions, it will trigger an “Article 5” event. In NATO, this is the collective defense clause.

- There has been increased scrutiny of Chinese academics working at U.S. universities and research institutes. It is important to note that not all of these academics are working for China, and some have been caught up in aggressive prosecutions that are probably not warranted. In addition, restricting researchers based on nationality may undermine American goals of innovation.

- China has appealed Australian anti-dumping measures on train wheels, wind turbines, and kitchen sinks to the WTO.

- As restrictions in Hong Kong increase, international media companies are steadily moving operations out of the former colony.

International roundup: Sweden may be facing elections, and Minsk blinks.

- In the wake of Sweden’s no-confidence vote, PM Löfven is trying to create a new coalition instead of being forced to call elections. The prospects of a new government don’t look favorable.

- Raman Pratasevich, the Belarusian opposition figure who was detained in a hijacking, has been moved from jail to house arrest. It suggests that external pressure has led Minsk to moderate his incarceration.

- In April, there were reports of a deep rift in the Jordanian royal family. The government is now conducting trials for figures implicated in what the King suggested was an attempt to oust him.

- Last week, we noted that Chancellor Merkel tried to force a summit meeting with Russia. The EU rebuffed her efforts, showing that as her career comes to a close, her ability to persuade has declined.

COVID-19: The number of reported cases is 181,167,056, with 3,924,865 fatalities. In the U.S., there are 33,625,392 confirmed cases with 603,967 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 381,282,720 doses of the vaccine have been distributed with 323,327,328 doses injected. The number receiving at least one dose is 179,261,269, while the number of second doses, which would grant the highest level of immunity, is 153,028,665. The FT has a page on global vaccine distribution.

- The WHO is signaling that vulnerable populations will probably require annual booster shots against COVID-19. This news isn’t a huge surprise, as it is clear the virus mutates rather quickly. However, the worry is that vaccine makers will focus more on booster shots for the wealthier developed nations before the emerging economies receive their first doses.

- Hong Kong announced it will ban passenger flights from the U.K. due to fears of the Delta variant.

- Israel, which was at the forefront of vaccinations and saw infections plunge, is seeing a new outbreak among teenagers. The Delta variant appears to be more infectious than earlier variants and may be playing a role in the increase. Overall, the rise isn’t significant compared to earlier periods, but it is raising the possibility of returning to some lockdown measures.

- We continue to monitor the reporting around the lab leak theory as the origin of COVID-19. One of the better background reports was penned by Zeynep Tufekci, an assistant professor at UNC’s School of Information and Library Sciences. Her latest report discusses the activities at research labs over the past few decades. In some respects, it may be just luck that we haven’t triggered a pandemic sooner.

- A surge in Delta+ strain infections in Russia has led to a return to social distancing measures. One response is to increase vaccinations; currently, only 13% of Russians have been vaccinated. There is a high degree of skepticism about the Sputnik vaccine in Russia. As new rules are implemented to require proof of vaccination, a thriving market for fake vaccine certificates has emerged.

- Accurate fatality and infection counts are always difficult in pandemics. Estimates of fatalities in the 1918 Spanish flu pandemic are quite wide. There are reports that India has dramatically undercounted deaths and infections.

- There is new research being done to create a universal vaccine for coronaviruses.