Daily Comment (June 27, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets remain squarely focused on US-China trade developments as key deadlines approach. Today’s Comment will discuss the latest progress on the administration’s trade legislation, implications of downward GDP revisions, and other market-moving headlines. We’ll conclude with our regular roundup of critical international and domestic data releases.

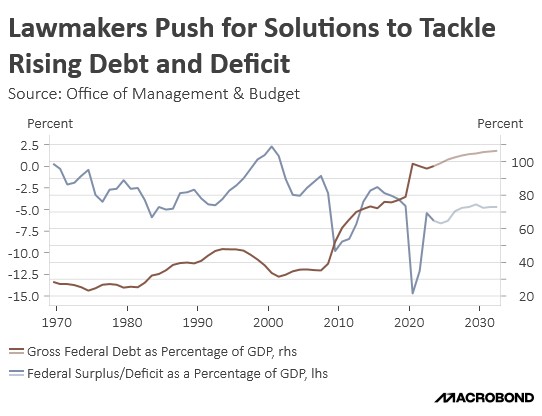

Big, Beautiful Test: The Senate is set to start voting on the final changes on the Trump tax bill, but there still seem to be major differences within the party.

- Republican senators are preparing to advance their flagship tax bill, though growing dissent in both chambers threatens to derail passage despite looming deadlines. While both Senate and House leadership have endorsed moving forward with votes to meet the president’s July 4 target, substantive disagreements over key provisions continue to surface, raising doubts about whether the legislation can clear Congress in its current form.

- Currently, the bill faces revisions ahead of its scheduled vote, with the Senate parliamentarian emerging as a key obstacle. In her advisory role on procedural compliance, she has ruled against several provisions, most notably a measure that would have reduced state tax charges for Medicaid providers from 6% to 3.5%. This change alone would have generated significant federal savings, and its rejection forces lawmakers to reconsider their fiscal approach.

- Significant disagreement persists among House and Senate Republicans regarding the SALT deduction cap. Lawmakers from high-tax states continue to push for a substantial increase above current levels, with some threatening to withhold support for the bill without modifications. Meanwhile, conservatives from low-tax states oppose raising the cap, arguing it would disproportionately benefit wealthier households.

- While the bill remains in legislative limbo, passage this week appears likely, though a short extension remains an option. Approval would likely provide sufficient momentum to propel the S&P 500 to record highs. Looking ahead, we anticipate market attention will quickly shift to the outlook for rate cuts and economic growth, both of which face unusual uncertainty due to ongoing trade policy developments.

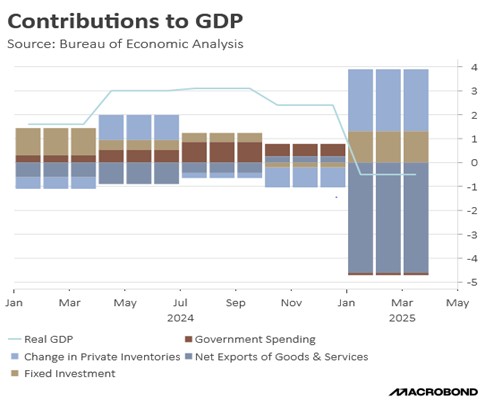

GDP Overstated: The third reading of the GDP showed that the economy did worse than originally expected.

- Economic output took a hit with the latest revision, which now reflects an annualized contraction of 0.5%, notably worse than the initial estimate of a 0.2% decline. This more significant downturn was largely fueled by moderation in personal consumption, specifically a slowdown in spending on services. While minor downward revisions to investment spending also contributed, a slight offset came from a less severe decline in net exports and government spending within the GDP figures.

- The sharper downturn in Q1 will likely prompt investors to closely monitor the Q2 economic performance. Current estimates from the Atlanta Fed’s GDPNow project a significant rebound, with an annualized growth rate of 3.4%. This anticipated increase is primarily attributed to a strong positive contribution from net exports and a pickup in consumer spending.

- Business investment will be a critical indicator for assessing whether recession risks have truly receded. Notably, first-quarter spending, particularly on information technology projects, served as a key buffer that possibly prevented an even deeper economic contraction. Going forward, we’ll be closely monitoring whether this resilience in capital expenditures persists amid tighter financial conditions and lingering uncertainty.

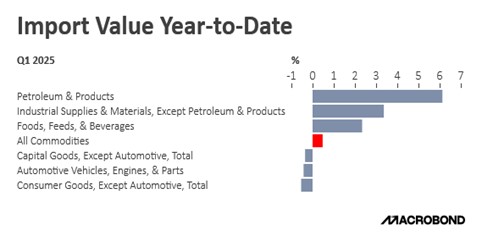

Updates on Trade Deals: With less than two weeks until the trade deadline expires, the president continues to make progress on key trade negotiations.

- Commerce Secretary Howard Lutnick announced that the administration has reached a trade deal with China. The agreement, pending signatures from Presidents Trump and Xi, would grant the US access to rare earth minerals. In return, the US is expected to resume ethane shipments to China upon finalization of the deal.

- The agreement should prove particularly beneficial for US tech stocks, as it secures access to critical production inputs. Rare earth minerals, essential components in everything from smartphones to advanced jet engines, represent just one example of the vital resources now more reliably available to these companies under the deal’s framework.

- While import tariffs dominate trade policy discussions, export controls represent a more systemic economic vulnerability. The fundamental asymmetry lies in substitution dynamics — markets can typically be replaced more readily than critical supply chains. Consequently, the economy’s resilience (and by extension, market performance) will depend heavily on its ability to prevent material shortages before they emerge.

Germany’s Past: The Social Democrats are set to clash over differences on how to deal with Russia.

- The party will convene on Friday to deliberate its future stance toward Russia, as members seek to reconcile their historical advocacy for détente — a policy many credit with helping to topple the Berlin Wall — with current demands for heightened defense expenditures. This strategic reassessment comes amid escalating geopolitical tensions.

- The ongoing dispute risks undermining the government’s ability to approve critical defense legislation. With the ruling coalition holding a fragile 13-seat majority, even limited defections from SPD members could stall key votes, potentially paralyzing security funding efforts.

- While German equities have been among this year’s top performers, much of the rally has been fueled by expectations of higher defense spending. As a result, we are closely monitoring intra-coalition tensions, particularly their potential to disrupt fiscal commitments, to assess whether this market strength reflects a sustainable trend or merely short-term optimism.