Daily Comment (June 26, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are intently focused on the latest Fed developments. Today’s Comment examines the growing conservative support for wealth taxes, the potential White House pressure on Chair Powell, and the new challenge facing the leader of the European Commission. As always, we’ll wrap up with a snapshot of today’s most important domestic and international data releases.

Taxing the Rich: Some conservative legislators now support raising taxes on top earners as part of efforts to protect low-income households from bearing disproportionate fiscal pressures.

- Senator Susan Collins (R-ME) has proposed raising taxes on individuals earning over $100 million annually. Her plan would allow the Trump-era tax cuts to expire for the wealthiest Americans and redirect the revenue to fund tax relief for middle- and lower-income households. If enacted, the top marginal rate would revert from 37% to 39.6%, matching the rate under the Obama administration.

- Collins’ tax proposal emerges as Republicans seek to prevent drastic cuts to essential social programs like Medicaid and Medicare. Previous attempts to reduce funding for these programs raised alarms about potential service disruptions for vulnerable populations. The debate over required funding levels has intensified, with Collins advocating for $100 billion in allocated funds while Florida Republican Senator Rick Scott has proposed a $6 billion alternative.

- According to Social Security Administration data, fewer than 293 taxpayers reported annual incomes above $50 million in 2023. Using this group as the sample, the proposed 2.6 percentage-point increase in their tax rate would theoretically generate an estimated $750 billion in additional revenue over 10 years. While exact figures aren’t available for those earning over $100 million specifically, it demonstrates how even a modest tax increase targeting ultra-high earners can yield substantial government revenue.

- As conservative lawmakers deliberate the path forward for the president’s $4.2 trillion tax cut proposal, political pressures, including the impending debt ceiling deadline, may ultimately compel passage. While the final legislation may incorporate some revenue-raising measures to reduce long-term costs and support bond markets, the package’s overall tax reductions could provide an economic boost, partially offsetting the dampening effects of current tariffs.

Shadow Fed Talks: The president is considering naming a successor for the Fed chair before Powell’s term expires in May of next year.

- The president is evaluating three to four potential nominees to lead the Federal Reserve. While no official announcement timeline has been established, speculation suggests a decision may coincide with the September-October window, the same period Chair Powell has indicated could warrant potential rate cuts. This consideration comes amid ongoing tension between the administration and the Fed, which has maintained its rate policy despite pressure for cuts from the White House.

- The president’s shortlist for Federal Reserve chair features both administration officials and current Fed leadership. Among the leading candidates are Treasury Secretary Scott Bessent, White House Economic Advisor and former Fed Governor Kevin Warsh, National Economic Council Director Kevin Hassett, and sitting Fed Governor Christopher Waller.

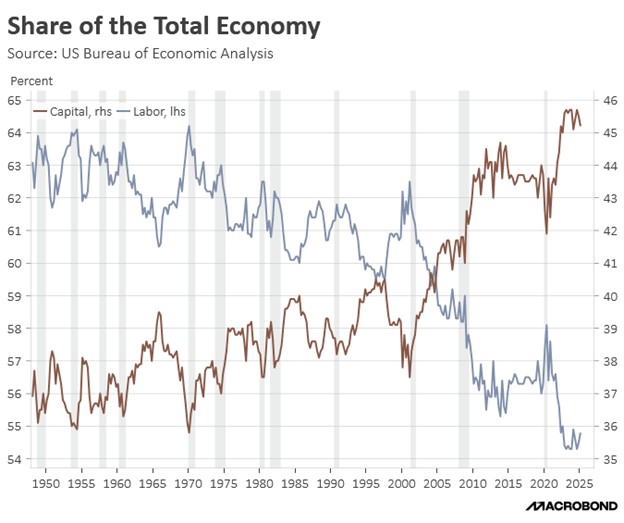

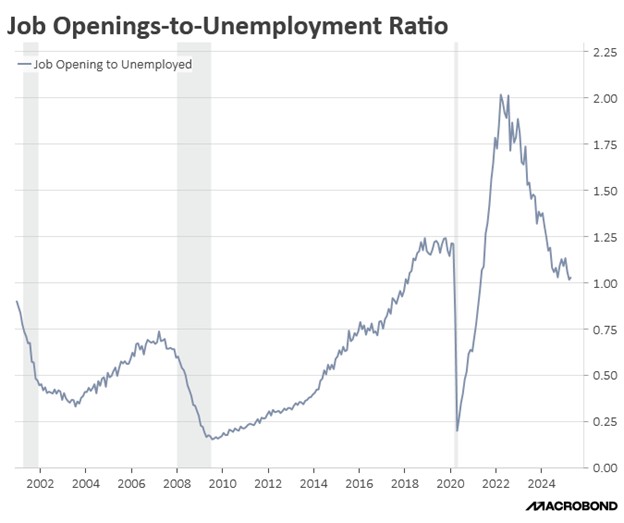

- The Fed leadership race appears increasingly likely to narrow to Warsh and Waller. Warsh, a previous Fed chair finalist, has notably softened his once hawkish stance from his first board tenure, a shift that is likely to raise suspicions about his ability to resist political pressure when setting policy. In contrast, Waller’s research correlating job openings with labor demand provides a data-driven case for rate cuts, though his votes this year to maintain current rates could lead Trump to go in another direction.

- That said, the uncertainty with leadership is likely to fuel bond market volatility and weaken the dollar. While Fed policy and long-term interest rates are closely linked, prolonged ambiguity could exacerbate rate swings and even intensify inflationary pressures. Moreover, diminished central bank credibility may reduce the appeal of US assets to foreign investors. One potential hedge against this risk is diversification into international markets, as a weaker dollar could enhance returns for domestic investors.

EU Head in Trouble: A recent ruling may present challenges for European leaders as they work to maintain unity amid growing pressures facing the bloc.

- European Commission President Ursula von der Leyen faces a no-confidence vote following allegations connected to pandemic-era vaccine procurement. Far-right lawmakers have reportedly gathered sufficient signatures to advance a motion — widely referred to as “Pfizergate” — seeking the removal of current leadership. While the motion is expected to fail, it highlights the deepening divisions within the EU.

- The controversy centers on transparency regarding vaccine negotiations. While von der Leyen successfully secured contracts for the bloc, questions persist about missing text messages between her and Pfizer CEO Albert Bourla during critical negotiation periods. The apparent deletion of the messages became a focal point after a European court ruled in May that the Commission must either locate the communications or provide a credible explanation for their absence.

- While the no-confidence vote is unlikely to succeed, its political ramifications could still trigger a parliamentary shake-up. The 1999 precedent of Jacques Santer’s Commission, which resigned en masse amid fraud and transparency allegations despite surviving a no-confidence vote, looms large. That said, four subsequent motions failed, underscoring the high threshold for actual removal.

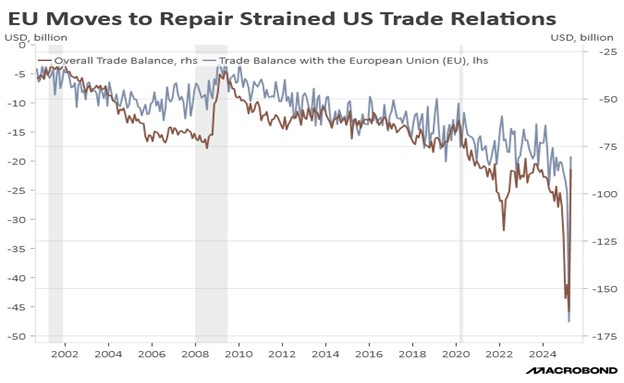

- The broader concern is how the scandal might impact the EU’s trade negotiations with the US. Although recent progress includes a provisional deal on non-tariff measures, the bloc remains prepared to retaliate if the US imposes new tariffs, a possibility the Trump administration has floated with rates as high as 50%. The uncertainty risks complicating delicate talks, particularly if the leadership changes disrupt the EU’s strategic cohesion.

- That said, we do not expect the controversy to have significant short-term market implications. However, it warrants close monitoring as the EU navigates a delicate balancing act between trade pressures, primarily from the US and, to a lesser extent, China. The White House has historically preferred bilateral negotiations, meaning any fragmentation within the bloc could strengthen Washington’s hand in securing more favorable trade terms.