Daily Comment (June 24, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The markets are carefully assessing the implications of the latest truce between Iran and Israel. In today’s Comment, we’ll analyze the ongoing Middle East conflict and its potential market impact, examine why a Fed rate cut at next month’s FOMC meeting is now a realistic possibility, and highlight other key developments shaping the financial landscape. As always, we’ll conclude with a concise overview of today’s most important domestic and international economic data releases.

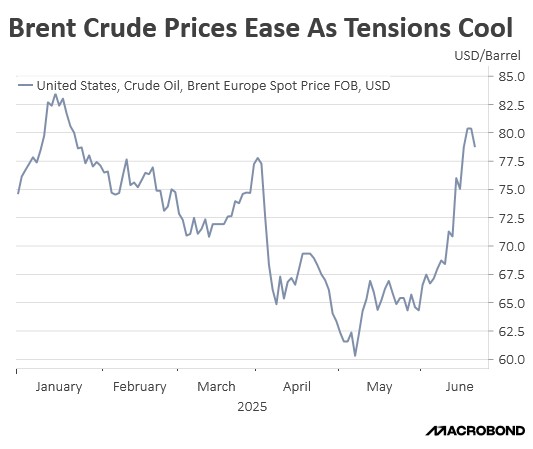

Respond and Relax: Iran’s retaliation to the US attack on its nuclear facility has paved the way for de-escalation.

- Iran launched an attack on a US military base in Qatar, home to the US Central Command’s headquarters. The initial strikes sparked market concerns over a widening conflict. However, reports indicated that most of the missile attacks were intercepted, resulting in relatively limited damage and no reported casualties, which helped ease fears. Additionally, it was later revealed that Iran had provided advance warning of the strike, suggesting the move may have been more for show than a genuine escalation.

- Following the attack, Iran moved to de-escalate tensions by announcing it planned no further strikes and agreed to a tentative ceasefire with Israel and the US. This sentiment echoed Washington’s stance after its own strikes on Iranian nuclear facilities, when the US similarly declared it sought no additional attacks and had no intention of pursuing regime change.

- Assuming the dust will settle soon, the two sides appear poised to resume nuclear talks. However, it remains unclear who holds the upper hand, as the full impact of US strikes on Iran’s nuclear program is still uncertain. For instance, there are no traces of the 400kg of enriched uranium, suggesting Iran may have relocated it to a secure facility before the attack. Moreover, initial assessments indicate that while targeted sites sustained severe damage, they may not have been fully destroyed.

- So far, the ceasefire remains in place but is fragile. Israel has accused Iran of violating the truce — a claim Tehran denies. Meanwhile, Iran’s refusal to allow IAEA inspections of its nuclear facilities is likely to heighten international concerns. That said, the attacks appear to have significantly degraded Iran’s nuclear enrichment capabilities, reducing the immediate threat level. Barring a renewed escalation, we expect minimal disruption to financial markets in the short term.

July Rate Cut: Nearly a week after the Federal Reserve concluded its two-day meeting, there are signs that Fed officials may now be favoring a rate cut.

- On Monday, Fed Vice Chair for Supervision Michelle Bowman said she would support easing monetary policy if inflation demonstrates sustained progress toward the 2% target and labor market conditions deteriorate meaningfully. Her comments align with recent remarks from Fed Governor Christopher Waller, who emphasized that future rate decisions should be based on incoming data rather than speculation. Waller also noted the likely temporary nature of tariff-related inflationary pressures.

- Their comments on future monetary policy follow the latest Summary of Economic Projections (SEP), which revealed growing divergence among policymakers regarding the path of policy rates. While the median federal funds target rate for year-end remained unchanged from the March meeting at 3.9%, projections for the next two years showed one fewer rate cut anticipated for both years. This suggests that despite dovish rhetoric from some Fed officials, the FOMC’s overall stance has turned slightly more hawkish.

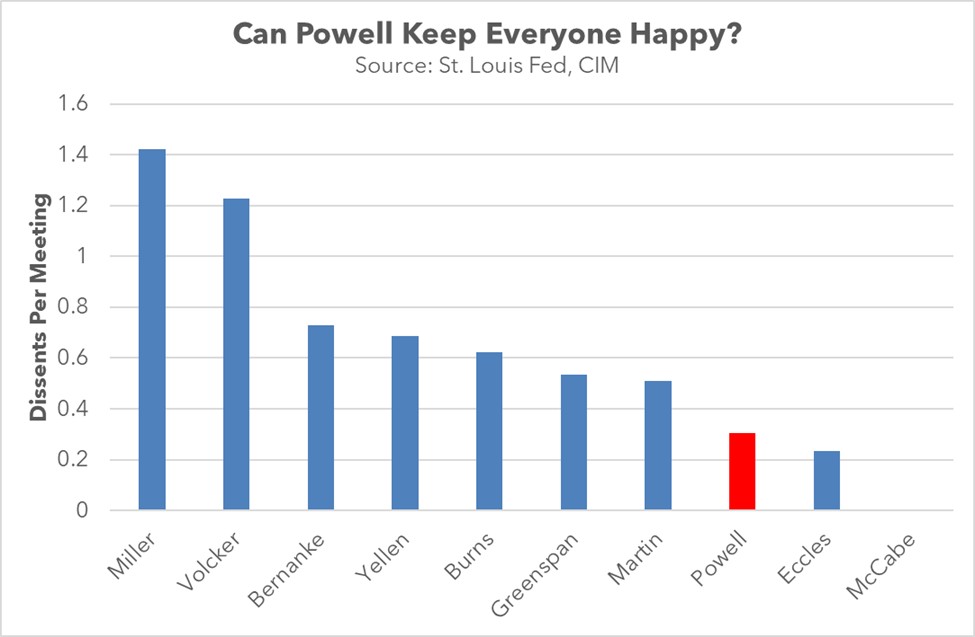

- That said, despite diverse views among FOMC members, the committee has maintained remarkable unity in actual policy rate decisions. Fed Chair Jerome Powell has presided over one of the lowest dissent rates in modern Fed history compared to his predecessors. We believe this reflects Powell’s leadership approach — allowing members to voice differing opinions publicly while maintaining consensus in formal policy votes.

- Moreover, this consensus may come under increasing pressure as the president continues to urge the central bank to lower interest rates, both to mitigate the economic impact of tariffs and reduce government debt servicing costs. We expect these pressures could prompt the Fed to deliver roughly 50 basis points of rate cuts this year if economic conditions remain stable. However, a material deterioration in labor market conditions might necessitate more aggressive easing.

NATO Defense Spending: At its two-day summit, the Western military alliance is set to address key issues, including Iran and defense spending.

- The central topic of the summit will be Europe’s plan to raise defense spending to 5% of GDP by 2035. While most member states broadly agree on this target, Spain has emerged as a key dissenter. Prime Minister Pedro Sánchez has called the goal disproportionate, arguing that Spain can fulfill all its NATO commitments, in terms of personnel and equipment, by spending just 2.1% of GDP. Its decision to hold out has called into question whether or not all countries will be able to meet spending obligations.

- That said, the larger European countries appear to be on track to ramp up spending and meet the ambitious target. The UK has pledged to increase defense spending to 5% of GDP, allocating 3.5% to core defense and an additional 1.5% to other defense-related expenditures. France’s President Emmanuel Macron has long advocated for the bloc to boost its military spending. Meanwhile, Germany has accelerated its military buildup, with plans to increase defense spending by two-thirds by 2029.

- Beyond defense spending, divisions are emerging among European allies over US involvement in the Iran and Ukraine conflicts. While Germany and NATO’s leadership have backed President Trump’s decision to strike Iranian nuclear facilities, France and others have denounced the move as a violation of international law. Separately, discussions are expected on bolstering Ukraine’s defense against Russia, with the bloc pushing for Kyiv’s potential NATO membership, a prospect Trump continues to resist.

- While tensions over defense spending and foreign policy priorities will dominate the summit, financial markets remain acutely attuned to any signs of alliance fragmentation. A deepening rift between European members and the US has become increasingly apparent, driven by Washington’s desire to shift away from providing Europe with security towards countering China in the Indo-Pacific. This shift has sparked concerns about a premature reduction of US forces in Europe before continental allies are ready.

- Although no immediate withdrawal announcement is expected, even subtle indications of such a move could exacerbate geopolitical anxieties. Market reactions would likely manifest through a rotation out of European sovereign bonds and into defense-sector equities, as investors anticipate accelerated military spending. Such a shift would pressure government balance sheets through increased borrowing while boosting revenues for aerospace and defense contractors.