Daily Comment (June 21, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment begins with our thoughts on investor concerns regarding Federal Reserve Chair Jerome Powell’s testimony to Congress later today. Next, we discuss how China may jump start its economy without relying solely on policy stimulus. Lastly, we explain why India’s growing prominence makes it an attractive investment target.

Powell Speaks: Investors’ fears of a more hawkish Federal Reserve have weighed on equity performance.

- Fed Chair Jerome Powell is slated to testify before Congress this week about the state of the economy and monetary policy. He is expected to provide clarity on the future path of interest rate hikes after markets were previously left confused following his comments at the Federal Open Market Committee’s meeting on June 13-14. Powell will also update lawmakers on the state of the banking system following the turmoil that took place in March.

- The S&P 500 closed down 0.4% on Tuesday as strong economic data reinforced fears that Powell will deliver a hawkish message during his testimony to Congress. Despite concerns that the U.S. economy could fall into recession sometime this year, new government data showed that the economy remains resilient. Housing starts, a leading economic indicator, rose to their highest level in 14 months. The Atlanta Fed’s GDPNow model also estimates that real GDP growth rose 1.9% in the second quarter, slightly higher than the previous quarter’s reading of 1.3%.

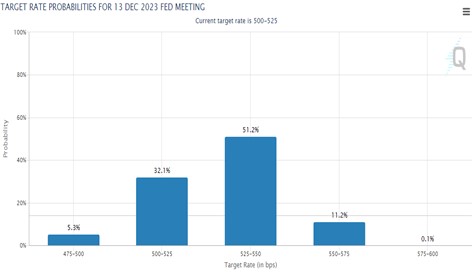

- The current CME FedWatch Tool shows that there is now only a 5% chance that the FOMC will hold rates below 5% before the end of the year, much lower than the 90% chance it predicted a month ago.

(Source: CME)

- It is unclear whether the Federal Reserve will ease off its inflation-fighting efforts as the economy heads into recession. Recent speeches from Fed officials suggest that they are more likely to hold interest rates stable in order to contain inflation, even if it means causing economic pain. This outcome would help accelerate the decline of inflation, but it would come at a cost. Therefore, any comments from Powell about the economy being resilient should be interpreted as evidence that the Fed is still committed to its hawkish monetary policy.

Emerging Markets: While the lack of stimulus in China may be a cause for concern, investors should not completely turn their backs on other emerging market countries.

- China’s reluctance to provide sufficient stimulus to its economy has weighed on investor sentiment. Despite hints that the government would offer support after the country ended its Zero-COVID restrictions, it has yet to do so. Additionally, Chinese banks have not lowered lending rates as sharply as investors had expected following a series of rate cuts by the People’s Bank of China. Concerns about the country’s economy have pushed the offshore yuan (CNY) to 7.2 against the dollar, its lowest level since November. The currency has declined 4% since the start of the year and is the second worst-performing currency behind the yen (JPY).

- The drop in the CNY has been so fast that it has been speculated that the country may be looking to grow through exports. On Wednesday, the PBOC set the CNY’s reference rate to 7.1795 per dollar, weaker than the previous fix of 7.1596. This decrease in the country’s currency comes after government data showed Chinese exports slowed more than expected in May. As a result, the country may receive a boost through trade, especially if meetings with U.S. Secretary of State Antony Blinken go well.

- While China is a significant emerging market, investors should not overlook the opportunities offered by other individual countries. For example, Argentine stocks have risen 6.0% over the last seven days, highlighting the upside of looking abroad. The recent surge in stock prices in developing countries is likely due to a number of factors, including investors’ desire to hedge against currency depreciation. However, it is important to remember that financial assets in developing countries are more volatile than those in developed countries. This means there is a greater risk of losing money on these types of investments. Therefore, investors should always do their due diligence before making investment decisions.

Is India a New Power? Rising geopolitical tensions have led countries to become more assertive as they look to have more global influence.

- On Wednesday, U.S. President Joe Biden and Indian Prime Minister Narendra Modi are set to meet in Washington to discuss ways to deepen their countries’ strategic partnership. The meeting comes as the growing friction between the U.S. and rivals China and Russia is rising. Prior to his first official visit to the White House in nine years, Prime Minister Modi stressed that the relationship between the United States and India was “tighter than ever.” Meanwhile, Washington views India as a crucial partner in its attempt to prevent China from expanding its influence throughout the Indo-Pacific region.

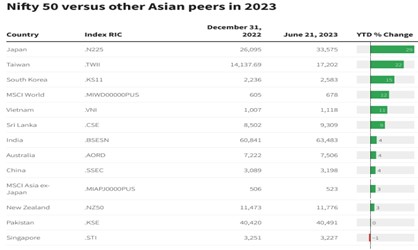

- Despite not having the best performance so far this year, India has a lot of potential. India’s blue-chip stock index, the Nifty 50, is up 3.62% on the year, and even though this is not a bad performance, it does lag many of its Asian counterparts (as the chart below shows). That said, the country is a major target for foreign direct investment as firms look for supply chain diversification. Companies such as Apple (AAPL,$185.01), Tesla (TSLA, $274.45 ), and Google (GOOGL, $123.10) have announced a desire to set up factories in India.

(Source: Reuters)

- India has been a major beneficiary of the conflict between the United States and China, particularly following Russia’s invasion of Ukraine. New Delhi has been able to leverage the conflict to its advantage by playing the two sides against each other. On the one hand, India has received weapons and oil from Russia, while on the other hand, it has maintained trade ties with the United States. India’s ability to remain neutral in the conflict has also boosted its global clout, as the country has ambitions to become a significant player on the world stage. As a result, India is well-positioned for long-term growth.