Daily Comment (June 18, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is focused on the Federal Reserve’s pivotal policy rate decision. In today’s Comment, we’ll provide the latest updates on the escalating Israel-Iran conflict, analyze what to expect from the Fed’s rate announcement, and highlight other key market-moving developments. As always, we’ll include a summary of recent domestic and international economic data releases.

Iran on the Brink? The US is considering escalating its role in the Israel-Iran conflict as part of a strategy to push Tehran back to the negotiating table.

- The White House is reportedly evaluating various policy options toward Iran, including a potential regime change. In a recent social media post, President Trump suggested US intelligence had located Ayatollah Khamenei and implied that an assassination could be considered unless Iran accepts unconditional surrender. These remarks follow failed diplomatic efforts to restart nuclear negotiations, as Iran maintains it will only return to talks after Israel stops its airstrikes.

- Despite sustained Israeli airstrikes targeting critical infrastructure near Iran’s nuclear sites, the attacks have failed to achieve their primary objective of fully destroying the facilities. US military involvement could prove decisive, as American forces possess specialized bunker-busting munitions capable of penetrating the fortified mountain locations where Iran’s nuclear program is believed to operate.

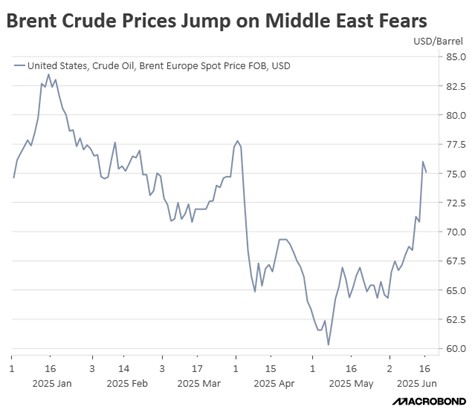

- Heightened fears of an expanding conflict have sent tremors through global markets. Brent crude surged to a six-month high Thursday, driven by anxieties over potential disruptions to oil shipments. Meanwhile, the S&P 500 dropped 0.8% as investors nervously assessed the ripple effects of increased US involvement or the implications of a potential Iranian collapse.

- Iran appears increasingly isolated as key allies offer only limited support. Russia (which has depended on Iranian-made drones for its war in Ukraine) and China have provided nothing beyond verbal backing. Even Lebanon-based Hezbollah — typically a staunch Iranian ally — has remained on the sidelines, still recovering from recent confrontations with Israel and the US.

- The conflict’s ultimate resolution will likely hinge on whether the US pursues regime change in Iran. While the White House has indicated an openness to this option, it remains unclear whether such rhetoric represents genuine intent or merely strategic posturing to pressure Tehran into negotiations, particularly given simultaneous signals favoring diplomatic solutions. In the interim, we anticipate market volatility, with risk assets likely facing downward pressure until investors gain clarity on the conflict’s trajectory.

Fed Meeting Preview: Fed officials are likely to perform a delicate balancing act, aiming to convince markets that they are weighing both economic growth concerns and inflation risks.

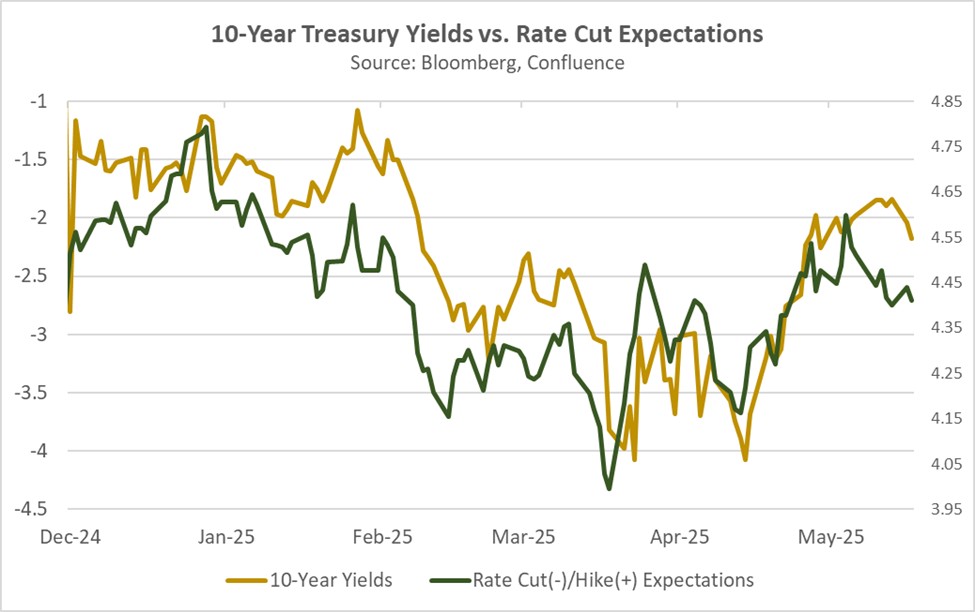

- Fed officials are expected to keep policy rates steady at the target range of 4.25%-4.50% when their two-day meeting concludes today. Several central bank members have signaled that patience remains the preferred approach, as they continue to monitor inflation risks, including those posed by tariffs. Investors will likely scrutinize the updated economic projections, searching for clues on what data the Fed needs to see before considering rate cuts this year.

- Although inflation shows signs of moderation, Fed officials remain unconvinced that the trend will sustain. Richard Clarida, former Federal Reserve Vice Chair now at PIMCO, noted inflation has improved more than expected since January but cautioned that tariff effects may be temporarily hidden by preemptive inventory accumulation. He has argued that the inflation fight may not be over as new shipments from abroad will reflect the new tariff rates.

- A rate hold by the Fed will likely provoke immediate White House criticism, as the president has repeatedly attacked the central bank for maintaining restrictive policy despite easing inflation. His recent social media posts have emphasized that rate cuts could ease the government’s debt burden, which is a growing concern following the CBO’s revised dynamic scoring model that is now projecting the 10-year deficit at $2.8 trillion, up $400 billion from previous estimates.

- We anticipate that the Fed will maintain current interest rates at this meeting, with market attention squarely focused on future policy signals. Should the Fed indicate an openness to rate cuts, we expect a bond market rally. Conversely, any suggestion that cuts may be postponed could drive yields higher. The current market pricing already reflects expectations for two cuts for the year. Whether or not this remains will hinge on today’s meeting.

Stablecoin Progresses: Legislation governing the digital asset has passed the Senate, moving it closer to becoming law.

- The Senate has approved landmark bipartisan legislation establishing the first federal regulatory framework for dollar-pegged cryptocurrencies. The bill, aptly named the Genius Act, passed with strong support (68-30) and now moves to the House where it may undergo revisions before potential presidential approval. This represents the most significant step yet toward mainstream crypto integration into US financial markets.

- A stablecoin is a cryptocurrency that must maintain dollar-for-dollar reserves in short-term government securities or other approved assets under state or federal oversight. These digital assets have gained traction by: (1) providing liquidity to Treasury markets, (2) facilitating merchant payments, and (3) serving as a potential dollar proxy for users seeking USD exposure without currency conversion.

- However, mass adoption introduces systemic risks. Like money market funds, stablecoins remain vulnerable to bank runs and rapid capital flight during market stress — a danger starkly revealed in 2022 when China’s property crisis sparked catastrophic redemptions. One major issuer ultimately “broke the buck,” falling below its $1 peg due to reserve failures before collapsing entirely.

- We are closely monitoring stablecoin adoption, particularly given the well-documented historical pattern — articulated by economist Hyman Minsky — linking financial innovation to banking crises. While current risks appear contained, the systemic implications of widespread stablecoin adoption by households, businesses, and financial institutions warrant market attention of a potential threat to financial stability.

AI Job Displacement: Mounting evidence suggests AI adoption may significantly reduce demand for white-collar occupations.

- Amazon, the nation’s second-largest private employer, has announced plans to use AI technology to replace some of its corporate workforce. This reflects a broader corporate trend of leveraging artificial intelligence to drive productivity gains and operational efficiencies. Such technological integration may render certain job functions obsolete, particularly roles involving repetitive tasks that AI can automate.

- The growing adoption of AI aligns with the Trump administration’s strategy to fight inflation while keeping tariffs in place — a plan that relies heavily on productivity gains. This creates strong incentives for companies to absorb tariff costs by automating more operations and reducing headcount. Walmart’s recent elimination of 1,500 corporate jobs, coming just after its warnings about tariff-related price increases, shows this dynamic may already be playing out in the real world.

- Additionally, creating a larger pool of workers could motivate the Trump administration’s push to bring manufacturing jobs back to the US. Conservatives have long argued that a strong manufacturing base boosts national security, and they have supported shifting focus from college-educated roles to skilled trades. As JD Vance once quipped, “We have a lot of financial engineers and a lot of diversity consultants, we don’t have a lot of people making things.”

- Manufacturing currently accounts for just 10% of US employment, but AI-driven productivity gains could help revitalize the sector as the nation shifts toward domestic production. This transformation may attract both recent college graduates struggling in a tight job market and displaced workers seeking new opportunities. However, the inherently cyclical nature of manufacturing work could introduce greater volatility in the labor market.

Note: There will not be a Comment tomorrow due to the holiday.