Daily Comment (June 18, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning, all! U.S. equities appear to be headed for a lower open this morning. Today’s report begins with a discussion on the surge in reverse repos. International news follows, with reports on the Iranian presidential election and Nicholas Maduro hinting at a possible truce with the U.S. We review economics and policy news next, including a new federal holiday and the House’s withdrawal of authorization for the Iraq war. China news follows, and we close with our pandemic coverage.

Reverse Repos: The Federal Reserve’s reverse repos rose to a record $756 billion following the central bank’s rate increase in the interest it pays banks for its excess reserves (IOER) and overnight reverse repo facility. The attractiveness of reverse repos may be due to a collateral shortage caused by a lack of Treasury bills. Recently, the Treasury Department has been reluctant to issue new bills in fear of surpassing the debt ceiling before its deadline in July. This has forced financial institutions to obtain Treasury bills through the reverse repo facility. Although these financial institutions could have gone to money market funds, the yields on those funds, in some cases, were approaching zero. Hence, the rise in rates made reverse repos relatively more attractive when compared to the alternative.

The surge in reverse repos is likely a signal of the growing imbalances within the financial system. Over the last year, financial institutions have been flush with cash due to both fiscal and monetary expansionary policy. These institutions now have excess cash and, as a result, have struggled to find places to store it. Ironically, it was the opposite problem in September 2019, when the lack of cash caused repo rates to skyrocket. The issue illustrates the growing complexity of the financial system and the Fed’s inability to foresee problems before they occur. The problem also highlights the Fed’s need to pay closer attention to how its decisions may impact financial markets.

International news: Nigeria forces dealers to get rid of dollar holdings, Iran votes for a new president, and Maduro seeks a deal.

- The U.S. and the EU have joined forces to develop technology to counter Russia and China. Both groups are boosting their investment spending in order to reduce their dependence on tech imports. Additionally, it appears that the two sides will work together in improving their technology related to artificial intelligence.

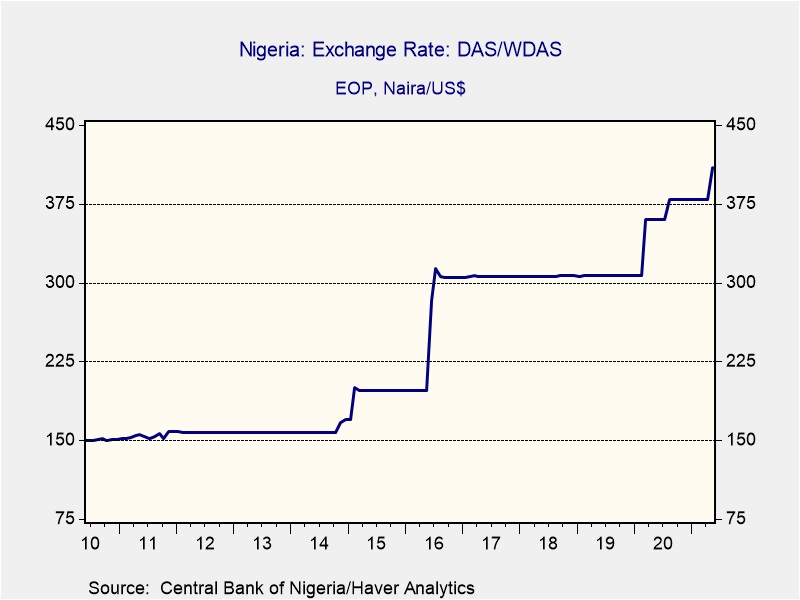

- Nigeria’s forex trading body has asked dealers to sell their stock of dollars in an attempt to narrow the spread between spot price and illegal market price. The country has struggled to maintain its peg with the U.S. dollar in recent months.

- In the U.K., the Conservative Party lost a party seat in one of its strongholds. On Friday, a Liberal Democrat – a centrist, pro-EU group – was able to win a by-election in the constituency of Chesham and Amersham. The region is a few miles away from West London, where PM Boris Johnson holds a parliamentary seat. The Liberal Democrat victory in the region highlights a growing fracture within the Conservative Party.

- The Iranian elections are taking place on Friday and it is expected that ultra-conservative candidate Ebrahim Raisi will win. The election appears to be a formality as other serious contenders were barred from the race. Raisi is a close ally of the Supreme Leader Ayatollah Ali Khamenei and his election could signal a more isolationist Iran. Although Raisi is known to be skeptical of the West, he has come out in favor of the nuclear deal.

- In an interview with Bloomberg Television, Venezuelan President Nicolas Maduro hinted that he is ready to make a deal with the U.S. to remove sanctions. Venezuela is in desperate need of foreign investment as economic conditions continue to deteriorate. The gesture by Maduro highlights the crippling effects of the sanctions and could be a sign that he may be losing influence within the country. In 2018, the U.S., along with other countries in South America and Europe, recognized a member of his opposition, Juan Guaido, as the rightful leader of the country. The move came after Maduro’s 2018 re-election victory was declared fraudulent. As a result, it will be difficult for President Biden to make a deal that will allow Maduro to stay in power. At this point, it is unclear whether Maduro will consider stepping down, but it is obvious that he doesn’t have much leverage.

Economics and policy: Juneteenth becomes a federal holiday, the house revokes authorization of the Iraq invasion, and the Affordable Care Act survives.

- The Supreme Court rejected a challenge to the Affordable Care Act. The ruling, however, left the door open for another lawsuit.

- The House voted to revoke authorization of the 2002 Iraq invasion. The authorization was used in the fight against Islamic State in Iraq as well as the killing of Iranian general Qassim Soleimani. The vote symbolizes the growing withdrawal of the U.S. from the superpower role.

- The Federal Communications Commission voted unanimously to study the effect of banning U.S. companies from purchasing telecommunications equipment from Chinese companies. Additionally, it voted to consider revoking previous authorization of equipment from five Chinese companies that were deemed to be a national security threat.

- On Thursday, President Biden signed legislation that officially made Juneteenth a federal holiday. So far, government agencies and financial institutions have struggled to determine whether their offices should be closed on Friday in acknowledgment of the holiday.

China:

- Chinese astronauts have made their way to the Tiangong space station. They will be in the space station for three months.

- Bitcoin miners are now leaving China and coming to the U.S. China has begun to crack down on the industry due to the amount of energy it consumes, and the shift to the U.S. comes as investment firms are becoming more accepting of the digital commodity.

- A pro-democracy tabloid Apple Daily was raided by Hong Kong police officers on Thursday. Authorities cited potential violations of its national security law.

- China is hoping that the higher than expected inflation will encourage the U.S. to remove tariffs.

- Officials in China are discussing the possibility of lifting birth restrictions completely by 2025 as the country continues to struggle with low birth rates.

COVID-19: The number of reported cases is 177,201,586 with 3,836,092 fatalities. In the U.S., there are 33,505,563 confirmed cases with 600,880 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 377,215,060 doses of the vaccine have been distributed with 314,969,386 doses injected. The number receiving at least one dose is 175,867,860 while the number of second doses, which would grant the highest level of immunity, is 147,758,585. The FT has a page on global vaccine distribution.

- The U.K. reported its highest number of cases since February of this year. The rise in cases highlights the dilemma as to whether the country should reduce its restrictions. There are growing concerns that if the virus isn’t contained, the U.K. could see another surge in cases in the winter.

- The U.S. plans to invest more than $3 billion into developing an antiviral pill to treat COVID-19. The money will come from the coronavirus relief package that was passed in March. Although the vaccine will remain the centerpiece to ending the pandemic, the pill will be looked at as a way to treat those who may have contracted the virus.

- The Japanese government has stated that it is considering relaxing some of the lockdown restrictions as it prepares to host the Olympic Games. Although the country has seen a decline in cases, it hasn’t been successful in convincing people to get vaccinated.

- A new coronavirus variant has made its way to Moscow and it appears to be more aggressive and infectious than previous variants.