Daily Comment (June 17, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with the latest developments in the Israel-Iran conflict. We next review several other international and US developments with the potential to affect the financial markets today, including new forecasts of excess supply in the world oil market despite the conflict in the Middle East and new details on US fiscal policy as envisioned by Republicans in the Senate in their proposed version of President Trump’s “big, beautiful” tax-and-spending bill.

Israel-Iran Conflict: After reports surfaced that President Trump vetoed an Israeli plan to kill Iranian Supreme Leader Ayatollah Ali Khamenei in recent days, Prime Minister Netanyahu yesterday insisted that killing Khamenei would end the current conflict. Other Israeli officials have echoed Netanyahu’s stance. That raises the possibility that Israel will ultimately decide to ignore Trump, kill Khamenei, and pursue regime change in Iran, leaving the country and region even more politically unstable and potentially upending global financial markets.

- Many Iran critics who support regime change reportedly believe that Khamenei and his top officials could be replaced by former Crown Prince Reza Pahlavi, the eldest son of the former shah. Pahlavi reportedly has high name recognition among Iranians and has called for the country to transition to a secular democracy. However, it isn’t clear whether Iranians would rally around him if Khamenei were to be assassinated.

- In any case, President Trump spooked the markets late yesterday when he said he would leave early from the Group of 7 summit in Alberta, Canada, first warning that Tehran should be evacuated but then hinting that he should be back in Washington for talks about a ceasefire.

- Separately, as Israel and Iran continued to strike each other overnight, global investors worry that Israel could attack Iran’s oil export hubs or Iran could make a full-throated effort to close the Strait of Hormuz, through which much of the world’s oil exports pass. In either scenario, a key victim could be China, which currently takes more than 90% of all Iranian crude oil exports.

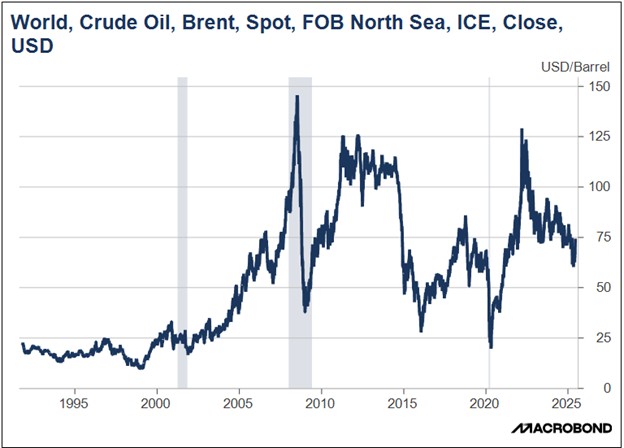

Global Oil Market: In its annual report, the International Energy Agency today forecast that global oil supplies will substantially outstrip demand in 2025, despite escalating conflict in the Middle East. The agency predicts that world oil production this year will rise by 1.8 million barrels per day to 104.9 million bpd, while demand rises by just 720,000 bpd to 103.8 million bpd, largely reflecting weakness in the US and China. As a result, the agency expects rising inventories and weaker pricing.

Global Gold Market: In a new survey of world central bankers, the World Gold Council found that a record 95% of respondents expect their institution’s gold holdings to rise over the next 12 months. As we have argued before, central banks are likely to continue being avid gold buyers amid today’s geopolitical tensions, sanction risks, and growing concern about the value of the US dollar. We therefore believe that gold prices will continue to march upward in at least the near term.

Japan: The Bank of Japan today held its benchmark short-term interest rate unchanged at 0.50%, as widely expected. Perhaps more important, BOJ Governor Ueda announced that the central bank will move more slowly on cutting back its purchases of Japanese government bonds starting next April. The move follows recent volatility in the market for JGBs, which has pushed longer-term bond yields higher, boosted the value of the yen, and created economic headwinds.

- The BOJ is currently buying 4.1 trillion JPY ($28.3 billion) of Japanese government bonds each month, with the purchases being reduced by 400 billion JPY ($2.7 billion) every three months.

- Under Ueda’s plan, the BOJ will start tapering its purchases by just 200 billion JPY ($1.3 billion) every three months starting next April, with the aim of reaching a monthly purchase level of 2.1 trillion JPY ($14.5 billion) by March 2027.

US Monetary Policy: The Fed starts its latest policy meeting today, with its decision due on Wednesday at 2:00 PM ET. Based on futures trading, investors widely expect the policymakers to hold their benchmark fed funds interest rate at its current range of 4.25% to 4.50%. Investors expect the next rate cut to come only in September, with perhaps one more cut by the end of the year. We agree with that assessment, but we’ll also be looking for more clues on the direction of rate cuts at Chair Powell’s Wednesday press conference.

US Fiscal Policy: Republicans in the Senate yesterday released details on their version of President Trump’s “big, beautiful” tax-and-spending bill. The basic contours of the bill duplicate what the House passed in May, but the proposal also includes significant differences that will be tough to reconcile with the delicate compromises agreed by Republicans in the lower chamber. That suggests that US fiscal policy will probably remain up in the air for at least a few more weeks, and passage of the final bill may not meet Trump’s preferred July 4 deadline.

- For example, the Senate bill includes more permanent business tax breaks, deeper cuts to Medicaid, slower phaseouts for clean-energy tax credits, and a much lower cap on the state and local tax deduction.

- The Wall Street Journal provides a handy summary of the main policy differences between the Senate and House bills here.

US Tariff Policy: President Trump’s decision to make an early departure from the G7 summit in Canada, mentioned above, has precluded most of his bilateral meetings with other leaders that many investors thought would lead to trade deals and reduced trade tensions. He did meet with Canadian Prime Minister Carney, but that meeting ended only with an agreement to work toward a deal in the next 30 days. The lack of any meetings or deals with other leaders is likely one reason for the weakness in US stock prices so far this morning.

US Immigration Policy: Following reports that US Immigration and Customs Enforcement leaders had directed agents to ease up on immigration raids at farms, meatpacking plants, restaurants, and hotels, as we noted in our Comment yesterday, reports yesterday revealed that Department of Homeland Security Secretary Kristi Noem has overridden the decision and ordered that “[W]e must dramatically intensify arrest and removal operations nationwide.”

- The reversal highlights growing disagreement within the Trump administration on whether to go full-bore on the president’s immigration raids even if they disrupt economic activity.

- Some top Trump officials are reportedly more sensitive to business concerns and argue for taking a softer, slower approach to removing illegal migrants.

US Commercial Real Estate Industry: New data from CBRE shows that the supply of office space is now on track to fall for the first time in 25 years, as developers hold off on building new work space and office-to-residential conversions accelerate. Conversions have been especially encouraged by rapid price declines for obsolete office buildings, changes to zoning rules that allow for more residential construction, and government incentives that help bring down costs.

- According to CBRE, conversions and other losses will reduce available US office space by about 23.2 million square feet in 2025, while developers are only expected to build about 12.7 million square feet of new offices.

- At the same time, corporate return-to-work policies are boosting the demand for office space.

- The result will likely help support office rents and the value of office buildings going forward.