Daily Comment (June 17, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

We begin this morning in the wake of the Fed surprise. As we discuss in detail below, the Fed made a hawkish turn, and we are getting the expected reaction—equities are lower, the dollar is up, and precious metals and commodities are lower. We are seeing a rally in bonds this morning after they sold off yesterday. Following our recap of the Fed meeting, our coverage continues with China news and the international roundup. Economics and policy follow, and we close with the pandemic update.

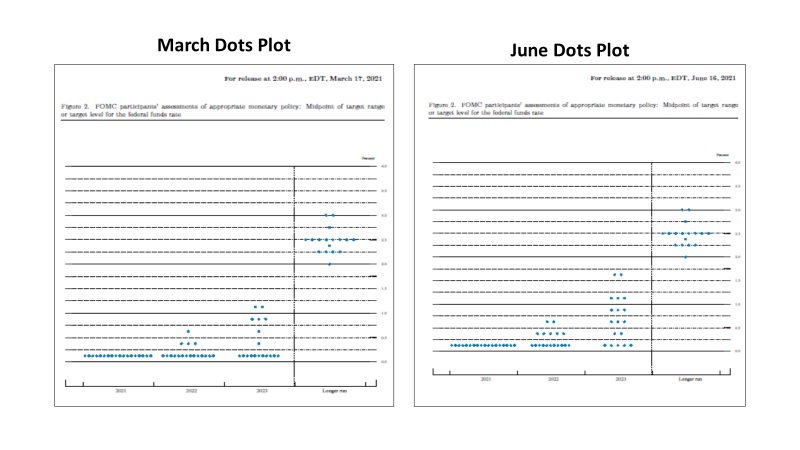

The Fed: The actual statement held no surprises; rates didn’t change, and neither did QE levels. But, the dots plot, as we show below, signaled a profound shift. Market reaction was swift and negative. If there was any doubt that the recent strength in financial markets was dependent on accommodative monetary policy, yesterday’s FOMC meeting should dispel such notions. Interestingly enough, changes to growth forecasts were rather modest, and expectations about inflation still show a drop in the growth rate over the next two years. Even without expectations of stronger growth or higher inflation, the dots plot signals that rate hikes will commence in 2023 and may occur sooner.

(Source: The Federal Reserve)

This chart shows the dots plots from March and June. In March, only four members signaled a rate hike in 2022 and seven in 2023. Yesterday, the Fed said that seven members are looking for a hike next year, and a clear majority looks to raise rates in 2023. In fact, the weighted average fed funds rate for 2023 is 0.86% which is three rate hikes.

What happened here? It appears that the FOMC has become spooked about higher inflation risks, even though the base forecasts suggest the committee doesn’t think inflation will persist in the future. The clue is in the uncertainty polls.

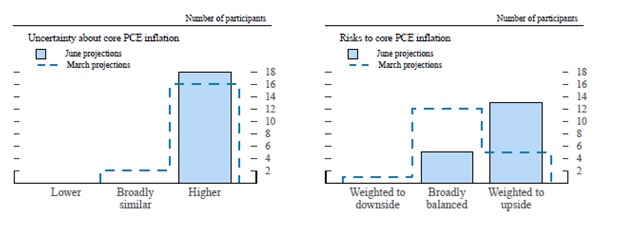

(Source: The Federal Reserve)

In March, the committee had high uncertainty surrounding core PCE but thought the risks were mostly balanced between rising or falling. In June, the clear majority was worried about higher inflation.

Although Chair Powell has moved to change the Fed’s focus to the labor markets and intends to no longer engage in policy pre-emption, this position doesn’t appear to have been fully accepted by the rest of the committee. This signal of rate hikes suggests to us that the Fed still seems to be focused on quelling inflation expectations. Yes, it’s true that the Fed didn’t raise rates, which would be true pre-emption (in fact, it is arguable the hikes should have already occurred). However, the committee does want to signal the market participants that they are (a) worried about inflation and (b) are indicating they intend to do something about it.

Market reaction was swift; equities fell, longer duration rates rose, commodities declined, the dollar rose, and bitcoin and gold fell. In trying to assign who is on each dot, one clue is that there were no dissenters in the statement. That probably means that the two highest dots are George (KC) and Mester (CL), who are not current voters. We would not be surprised if Brainard, Evans (CHI), and Rosengren (BOS) lifted their forecasts. They are worried about overheating asset markets and thus would probably join the hawks in wanting to express concern. Most of the remaining members are still likely holding to the Phillips curve view of the world and thus are uncomfortable with never-ending accommodation.

The Chair tried to downplay the dots as his predecessors have done[1] when they get an outcome that they probably disagreed with. To quote Powell in full:

These are of course individual projections, they’re not a committee forecast, they’re not a plan, and we did not actually have a discussion of whether lift off is appropriate at any particular year. Because discussing lift off now would be highly premature, it wouldn’t make any sense . . . the dots are not a great forecaster of future rate moves and that’s because it’s so highly uncertain, there is no great forecaster of future rates, so [the] dots have to be taken with a big grain of salt.

Such statements beg the question…if the dots are so immaterial, why have them at all? Despite this sentiment, the dots should be taken seriously. The Chair has lost control of the narrative. The members of the FOMC have become unnerved by the rise in inflation and are signaling that rate hikes are likely coming unless uncertainty about inflation eases. In 2026, the Fed will release the full transcript of this meeting. If we are still north of the dirt when it comes out, it will be at the top of our reading list.

What now? The key we will be watching in the coming days is the reaction from the financial markets and the political class. Occasionally, the FOMC and Fed Chairs float an idea to gauge the reaction of both. What comes to mind is Greenspan’s “irrational exuberance” speech which was widely panned. The political class wants an accommodative Fed forever; a tenant of MMT is a non-independent central bank that is in the service of the Treasury. It will be interesting to see how political leaders react. We fully expect the left-wing populists to lash out. On the other hand, the establishment of all stripes will quietly cheer the FOMC for being responsible.

The other item to watch carefully is that if inflation does prove to be transitory, we could see the dots take a dovish turn in the future. That idea is tempered by the fact that financial conditions have become remarkably easy.

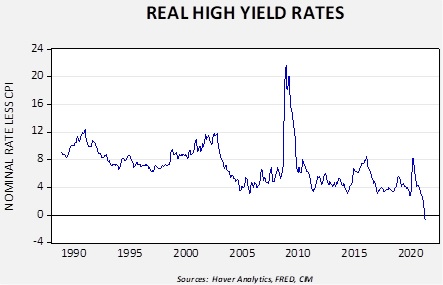

For example, for the first time ever, as this chart indicates, real high yield levels are negative. The FOMC members who are sensitive to financial market froth will likely continue to press for policy tightening.

This potential shift in policy will lead to some degree of recalibration for financial markets. Generally speaking, higher short-term rates are dollar bullish, equity bearish, commodity bearish. Part of the recalibration will be further information that comes in the next few weeks. FOMC members will fan out in the next few days and be questioned about this meeting. The tenor of comments will be weighed carefully. So, there is still more to come. But a warning shot has been made and will be taken seriously.

China: Beijing reacts to the Biden trip, and tensions between the U.S. and China remain elevated.

- As President Biden’s meetings wind down, we now begin the process of seeing what will follow from his visits.

- There are increased concerns about China’s closer links to Russia. Although the two nations have traditionally been enemies (nearly going to war on several occasions in the 1960s and 1970s), shared hostility toward the U.S. has led to increased cooperation between Moscow and Beijing.

- The Europeans are not as willing to confront China as the U.S. is; the G-7 is, thus, divided on this issue. Still, we note the Germans, who are probably the most reluctant to criticize China, did come out against Beijing’s new sanctions law. Despite these divisions, Beijing is angry about being a topic of discussion for NATO.

- China’s foreign direct investment into Europe is declining.

- The Pentagon is considering assigning a permanent naval task force to China. This action would be a clear signal that the U.S. sees China as a serious threat. Meanwhile, China has been adding ships at a furious pace; the PLA Navy usually names vessels after large cities but is running out of names.

- General Secretary Xi is increasingly rewriting China’s history, especially of historical CPC figures.

- Any casual look at a map around China can see a chain of islands, called the “first island chain,” that is key to containing Beijing’s aspirations. A key nation in that chain is the Philippines. The Biden administration is trying to improve relations with the former U.S. colony, but overall, the relationship is far from cordial.

- Earlier this week, we noted there was a reported nuclear leak at a Chinese nuclear power plant. China denies it occurred but did admit fuel rods were damaged. State media is indicating “nothing to see here.”

- Alibaba (BABA, USD, 209.32) was hit with a data leak where a hacker pulled over a billion pieces of user data.

- Among the tech firms, work life is based on “9-9-6,” or nine in the morning until nine at night, six days a week. This grueling schedule has been increasingly criticized. Now we are seeing a backlash against surveillance software that is used to monitor workers. Another development, noted at the bottom of this linked report, is a development among the youth of China to engage in “lying flat” or to simply turn inward and stop striving. There are reports that Xi is cracking down on the private test prep industry in a bid to ease pressure on families. As China’s growth slows, the opportunities for advancement will contract, and this outcome will be a major threat to the CPC rule.

- We continuously monitor the Chinese financial system for signs of stress.

- The Chinese retailer Suning (002024, CNY, 5.59) has seen its share trading suspended due to concerns over its debt.

- Regulators are increasing scrutiny of bank-issued cash management products; new rules require higher-rated debt to be held in these products, meaning that about $390 billion of these products will soon be out of compliance.

International roundup: Biden and Putin meet; North Korea is facing crop failure.

- The Biden trip ended with a meeting in Geneva with Russian President Putin. Recent presidents have vacillated on Russian relations. Bush looked into Putin’s eyes, Obama called for a “reset,” Trump tried personal relations. None of these worked particularly well. It looks like Biden and Putin have set low expectations and met them. The U.S. wants Russia to stop harboring cybercriminals. Moscow wants NATO expansion to stop. Both are interested in some form of nuclear weapons control. The fact that the diplomats are returning is a good sign. We don’t expect much improvement, but it also looks like both sides are taking a realistic view of relations.

- North Korea admitted it is facing a major crop problem, blaming flooding for falling output. Kim Jong Un has described the food situation as “tense.”

- The U.K. has signed its first major trade deal since Brexit with Australia. British farmers are likely going to see their market share decline.

- The World Bank won’t assist El Salvador in its transition to bitcoin.

Economics and policy: The EU has begun issuing Eurobonds, the FTC is taking a new look at antitrust, and bottlenecks are lifting prices.

- The EU has begun to issue the Eurobond, backed by the full faith and credit of the entire Eurozone. Brussels admitted it really can’t track how the money is spent.

- Lina Kahn has been appointed to the chair of the FTC. She is a 32-year-old law professor from Columbia Law School who became famous after publishing a paper essentially critical of the Bork standard for antitrust. That standard argued that as long as consumers were not harmed, industry concentration was irrelevant. Kahn suggested otherwise in her paper. Her appointment signals are more critical view toward technology, which has seen significant concentration in the past two decades.

- One issue causing inflation concerns is logistical bottlenecks. Container rates are rising as there are more containers to be shipped than space on vessels and in ports.[2] Critical infrastructure is in need of repair.

- At the same time, we are seeing some high-flying commodities pull back. Metals are under pressure on reports that China may try to contain prices by releasing inventory from strategic stockpiles. Homebuyers are reportedly balking at soaring home prices, and this news has started to bring down lumber prices as well.

- Although we have seen a jump in used car prices, that hasn’t stopped Americans from holding on to their current vehicles. The average age of an American vehicle is 12 years.

- During the pandemic, retail landlords began charging rent based on the store’s revenue. This practice may continue into the future.

- The ECB is holding a retreat to discuss policy goals.

- Brazil’s central bank has lifted rates for the third time this year.

COVID-19: The number of reported cases is 177,105,723 with 3,834,719 fatalities. In the U.S., there are 33,499,190 confirmed cases with 600,656 deaths For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high frequency data on various factors. The CDC reports that 375,186,675 doses of the vaccine have been distributed, with 312,915,170 doses injected. The number receiving at least one dose is 175,053,401, while the number of second doses, which would grant the highest level of immunity, is 146,456,124. The FT has a page on global vaccine distribution.

- There is some evidence to suggest that COVID-19 might have been circulating as early as December 2019. There is no evidence that transmission was widespread.

- Curevac’s (CVAC, USD, 94.79) vaccine failed to meet effectiveness criteria in clinical trials, which probably means it won’t be used. The EU had invested heavily in the firm, so this is a blow to European hopes.

- The U.K. will delay reopening due to the delta variant of COVID-19.

- China continues to deliver vaccines to the emerging world, boosting Beijing’s status.

- One of the better explanations of the lab leak hypothesis is discussed in this podcast.

[1] “I think that one should not look to the dot plot, so to speak, as the primary way in which the Committee wants to or is speaking about policy.” – Janet Yellen, March 19, 2014

“I think you could also retitle this conference “Why We Don’t Like the Dot Plot.” I think the dot plot is like the advanced level of the video game. If you haven’t been to the first 12 levels, forget about the dot plot.” – Ben Bernanke, November 30, 2016