Daily Comment (June 16, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment begins with a discussion on how the expiration of options contracts may place downward pressure on equities. Next, we explain why equity investors are still not convinced that central banks will not cut rates this year. Lastly, we give our thoughts on the latest Bank of Japan policy decision.

Triple Witching: Markets are expected to be down today, but there is evidence that investor optimism could still lift equities higher.

- After six consecutive days of gains in the S&P 500, the simultaneous expiration of stock options, index futures, and index futures derivative contracts, also known as triple witching, threatens to end the streak. Today, $4.2 billion of U.S. and European futures are set to expire, along with the quarterly expiration of index futures and the rebalancing of benchmark indexes. Although the combination of these events does not necessarily lead to a bad day for equities, it does suggest that the day will likely be faced with increased trading volume as well as heightened volatility, particularly in the final hours as investors decide whether to chase recent gains or hedge against potential losses.

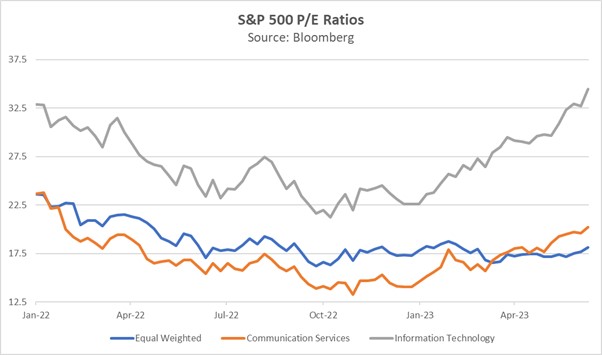

- An imminent recession combined with continued optimism regarding generative artificial intelligence (AI) technology may impact investor behavior today. The craze over the machine-learning algorithms has pushed the P/E ratio for the S&P 500 Communication Services and Information Technology sectors to their highest level since the start of 2022. In contrast, the P/E ratio for the Equal-Weight Index has remained relatively stable within that same period. The divergence in performance reflects investors’ expectations that the technology will allow firms to add different sources of revenue. On the flip side, economic fears are elevated as forecasters are still predicting a recession for the second half of the year.

- The decision to hedge or pursue gains may come down to each investor’s recession call. If they believe that a major downturn is imminent, they may be tempted to play it safe and protect gains made for the year. If true, this could sap momentum from the current market rally. On the other hand, if market participants assume that a recession will likely be mild or averted altogether, they may be persuaded to take on additional risk in order to maximize profits. As of right now, we believe that as long as the economic conditions remain positive, equities may offer attractive opportunities for risk-tolerant investors.

Peak Rates: Investors are already looking for the exit to the tightening cycle, even as central banks signal that their job is not done.

- On Thursday, the S&P 500 index rose above 4,400 for the first time since April 2022, a surprise move given that the Federal Reserve is still expected to raise interest rates by another 50 basis points and the economy may be headed for a recession. Although some of the rally can be attributed to the recent surge in generative AI technology, all sectors of the index managed to close higher. The broad performance was likely due to investor optimism that the Fed is nearing the end of its rate-hiking cycle, as it is assumed that recent data showing that consumption is slowing and jobless claims are rising may force policymakers to rethink their current strategy.

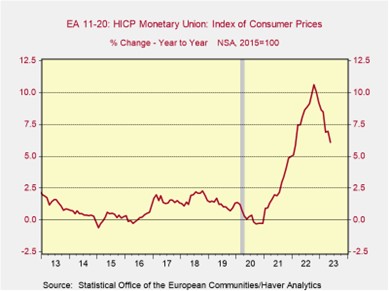

- The STOXX Europe 600 Index is hovering near a monthly high, despite falling to an intraday low following hawkish comments from ECB President Christine Lagarde. Media and retail related stocks helped fuel a recovery toward the end of the trading period resulting in the index closing slightly below the previous day’s close. The rally was related to doubts that the central bank will be able to raise interest rates significantly while the economy is in recession. Last month, consumer prices rose 6.1% from the prior year, well above the central bank’s inflation target of 2%.

- The strong performance of both indexes shows that investors are not confident that policymakers will be able to maintain their inflation fight during a downturn. This bias is the most prevalent in the United States where traders appear to be looking past the Fed commenting that they are serious about continuing to increase interest rates. The CME FedWatch Tool shows that some traders expect a rate cut this year. At the same time, eurozone overnight index swaps suggest that the European Central Bank will cut rates in December. This confidence could lead to sorrow if the US economy remains resilient and the eurozone economy rebounds in subsequent quarters since inflation would then be unlikely to fall to 2% before the end of the year, which could possibly lead to additional hikes.

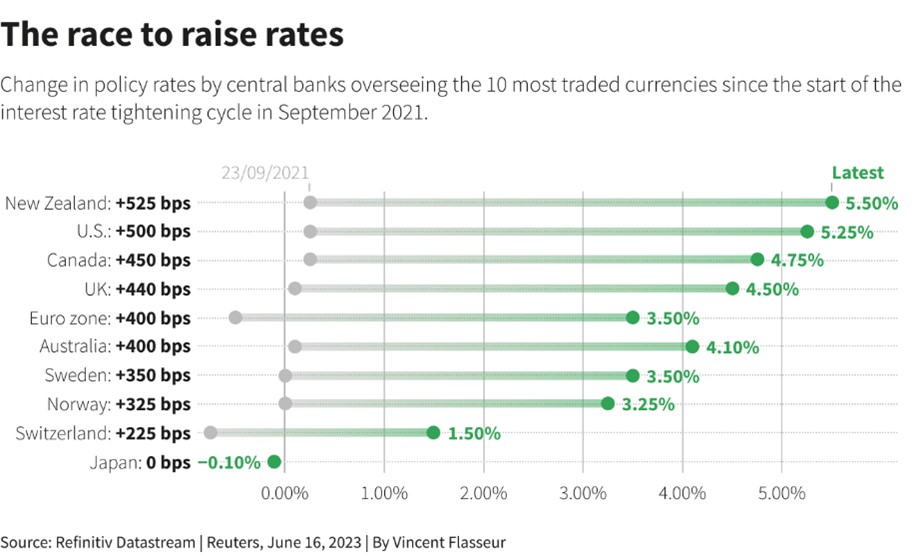

Bank of Japan: The Bank of Japan (BOJ) continues to be the only central bank in the G10 not to tighten policy in response to elevated inflation.

- The Bank of Japan has decided to keep its negative interest rates and yield-curve-control policy in place following its two-day meeting on June 14-15, 2023. Governor Kazuo Ueda remained relatively ambiguous as to when the BOJ may alter its policy, but he maintained that officials believe inflationary pressures will moderate as cost-push factors dissipate. He also noted that the group noticed a change in corporate price-setting behavior. In April 2023, Japanese headline inflation rose 4.6% from the previous year, while core inflation rose 4.1%. These figures are well above the BOJ’s target of 2%. However, Ueda said that the central bank is confident that inflation will eventually fall back to its target as the economy adjusts to higher energy prices and other cost-push factors.

- The suspense over when the Bank of Japan will finally decide to remove policy stimulus has started to weigh on the Japanese yen (JPY). The currency sank to a 15-year low against the euro after the central bank announced its policy decision on Thursday. Meanwhile, the JPY traded further above 140 against the dollar, adding to concerns that the BOJ may need to intervene to protect the currency. Going into 2023, investors had speculated that the BOJ would signal an end to the ultra-accommodative monetary policy that has kept interest rates at near zero for years. However, the BOJ has so far resisted calls to tighten policy, even as other central banks have begun to raise rates in an effort to combat inflation.

- Despite elevated inflation, Japanese equities have performed remarkably well to begin the year. The Nikkei 225 is up 31% for the year, drastically outpacing the S&P 500, which is only up 15%. Much has been made about the country’s corporate reforms restoring the confidence of foreign investors. However, we believe some of this performance is related to expectations that the BOJ will end its yield-curve-control policy. In our view, the BOJ will be unlikely to quickly remove this policy, but it could take small steps, such as tweaking the band on its cap on ten-year yields. As a result, we believe that a hawkish BOJ could offer support for dollar-based investors looking for foreign exposure.