Daily Comment (June 15, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment begins with a discussion on the Federal Reserve’s latest interest rate decision. Next, we review the latest central bank policies in the eurozone and China. Lastly, we end with why recent developments in the Middle East and Europe have caught our attention.

Skip or Pause? Fed Chair Jerome Powell is uncertain whether the central bank will pause or hike, but he is adamant that a cut is not being considered.

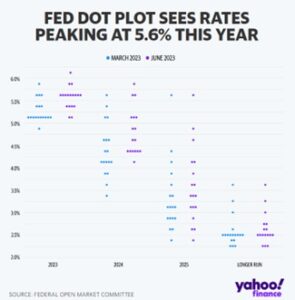

- The Federal Reserve left rates unchanged for the first time since February 2022. On Wednesday, policymakers announced that they would hold rates at their current levels to give the group time to observe the state of the economy. In its dot plots, Fed officials signaled that they still plan to lift rates an additional 50 bps before the end of the year. Meanwhile, the summary of economic projections showed that members had revised their expectations for real GDP growth and inflation upwards but decreased their estimates of the unemployment rate. In short, the Fed officials have become more hawkish since the February meeting despite their decision to pause.

- During the press conference, Fed Chair Jerome Powell downplayed the importance of the dot plots, which show the individual projections of the Federal Open Market Committee (FOMC) members for the future path of interest rates. Powell insisted that there were no discussions held about rate hikes for the July FOMC meeting. His comments led to a strong recovery in risk assets, which had dipped following the release of the hawkish dot plots. The Nasdaq 100 fell 0.8% within 20 minutes of the Fed announcement but closed the day higher by 0.7% from the previous day. The extreme swings in equities reflect investor confidence that the central bank is finished with its hiking cycle. Fixed-income securities also rallied as bondholders believed that the Fed would trigger a recession in its attempt to fight inflation.

- The opposing reactions from the bond and equity markets suggest that there is still much uncertainty regarding the Fed’s future policy path. Bondholders are confident that policymakers will continue to hike rates until inflation is under control, while equity traders believe that the Fed is leaning toward holding rates at their current levels. The diverging viewpoints suggest that one of the markets may be headed for a correction. It is too early to say which market is wrong, but we are confident that recession will likely be the arbiter.

Other Central Bank News: As the European Central Bank prepares to end its hiking cycle, the People’s Bank of China eases its monetary policy.

- The ECB decided to raise its deposit rate by 25 bps to 3.50%, its highest level in 22 years. During the press conference, ECB president Christine Lagarde insisted that it has no plan to end its hiking cycle anytime soon. The decision to push rates higher comes amidst concerns that inflation is still stubbornly high. The Euro Stoxx 50 index sank following the ECB’s rate decisions as investors worried that the policy would weigh on the regional bloc’s economy, which fell into recession last quarter. However, the hawkish stance did provide a bump in the euro.

- In a contrasting tactic, the People’s Bank of China cut its medium-term lending facility (MLF) rate to 2.65% from 2.75%. The decrease in rates will lower borrowing costs on 237 billion CNY ($33 billion) worth of one-year loans. This move is designed to stimulate the economy as the central bank looks to encourage growth. Earlier this week, the central bank cut interest rates on the standing lending rates by 10 bps, thus pushing down overnight rates to 2.75%, the seven-day reverse repurchase rate to 1.9%, and the one-month rate to 3.75%. The announcement will likely encourage banks to reduce their lending rates over the coming weeks, which may lead to an increase in consumption.

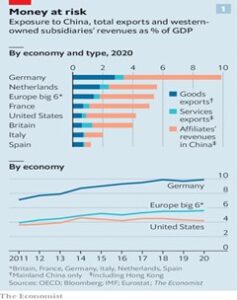

- Despite hawkish comments from the ECB, European assets may be able to benefit from a revitalized Chinese economy. As the chart above shows, European countries are becoming increasingly integrated with the Chinese economy. Germany, in particular, may be uniquely positioned to benefit from a Chinese economic recovery since China is a significant market for Germany, accounting for nearly 10% of its GDP. The majority of these sales come from German subsidiaries in China, such as Volkswagen (VWAPY, $14.14) and BASF (BASFY, $12.63). As a result, the PBOC stimulus for the Chinese economy may provide support to European equities.

Rising Uncertainty: Geopolitical risks are increasing as tensions escalate over Iran’s nuclear program, and Europe’s access to LNG is more vulnerable than originally thought.

- The U.S. has been holding talks with Iran over an agreement to limit Tehran’s nuclear program. An agreement has not been reached, but it appears Washington is prepared to release billions of dollars of frozen Iranian funds and conduct a prisoner exchange. The discussions come amidst rumors that Iran has been able to enrich uranium to 60% purity, a level at which experts say has no civilian use. Israel, also considered to have nuclear capabilities, has vowed to prevent Iran from becoming a nuclear power. If the United States and Iran are unable to reach an agreement, it is possible that Israel will take military action against Iran. This would be a major escalation of tensions in the region and could lead to a broader conflict.

- Meanwhile, benchmark futures for European natural gas prices spiked as high as 24% on Thursday. The price surge was in response to an announcement that the Dutch government plans to permanently shut down Europe’s biggest gas field later this year. Gas price volatility was already elevated following forecasts of hotter weather coupled with a possible pickup in Asian demand which threaten to strain global stockpiles. Uncertainty over supply and demand for natural gas raises concerns over energy availability for the winter. Consequently, this may make it harder for countries to reduce their dependency on Russian supplies due to the conflict in Ukraine.

- Geopolitical risks remain one of the biggest threats to the global economy. As the chart above shows, the Economic Policy Uncertainty (EPU) index remains well above its long-term average of 100. The EPU index tracks the relative frequency at which local newspapers use words associated with economic policy uncertainty. The index has been elevated since Russia began its invasion of Ukraine and has remained high. Although the EPU index does not suggest that the financial markets will suffer, it does signal that the chances of a fat-tail event are elevated meaning investors should continue to pay close attention to ongoing geopolitical conflict.