Daily Comment (June 11, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning, all! U.S. equities appear to be headed for a higher open this morning. Today’s report begins with an update on the infrastructure spending negotiations and an in-depth analysis of the CPI report. International news follows, with reports of sanctions being lifted on Iran and the EU ramping up its crackdown on U.S. tech firms. Economics and policy news are up next, including the meeting between President Joe Biden and U.K. Prime Minister Boris Johnson. China news follows, and we close with our pandemic coverage.

Infrastructure plan developments: A bipartisan group of 10 Senate Democrats and Republicans agreed to a $1.2 trillion infrastructure package over eight years. The package offers $579 billion in net new spending over that period, up from the more than $300 billion proposed by Senate Republicans in the previous week. The plan does not explicitly call for an increase in taxes; however, the proposal does allow for gas taxes to be indexed to inflation. The proposal appears to be a take-it-or-leave-it type of offer as it is unclear whether Senator Kyrsten Sinema (D-AZ) and Senator Joe Manchin (D-WV) will support an infrastructure package that isn’t bipartisan. At this time, it is unclear whether President Biden will agree to move forward with the proposal. Representatives from the White House seem to suggest that the president will likely push for additional changes to the bill. The gas tax provision is believed to be the president’s biggest source of tension as it would likely violate a pledge he made to not raise taxes on those making less than $400,000 annually.

Along came inflation: According to the Bureau of Labor Statistics, consumer prices rose to a 13-year high in May, surpassing the forecasts of most economists. The 5% year-over-year rise in the Consumer Price Index (CPI) has elevated concerns that inflation could be a sign of trouble within the economy. Here are a few takeaways we believe went unnoticed in the report:

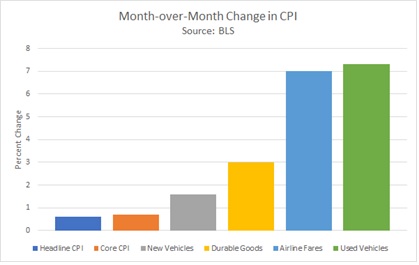

- The monthly change in the report suggests that the rise in prices is being distorted by increases in durable goods and travel services. The chart below compares the monthly change in headline CPI, core CPI, new vehicles, durable goods, airline fares, and used vehicles. These distortions appear to be pandemic-related. The price of airline fares is likely the result of increased tourism, while the increase in prices of durable goods can be attributed to rental car services restocking inventory after depleting their fleets during the pandemic.

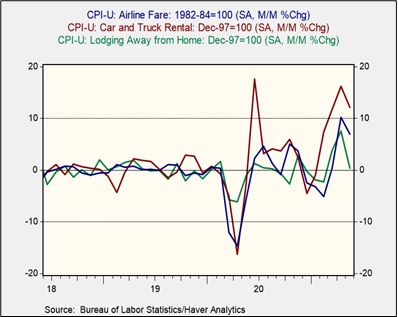

- Additionally, there are already signs of moderation in price pressures as several travel services have slowed down price increases.

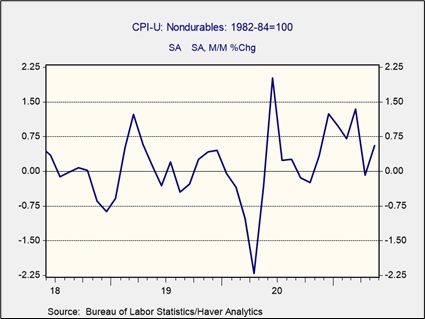

- The rise in prices of perishable goods remains relatively modest, suggesting that consumer day-to-day goods may have avoided much of these pandemic-related inflationary pressures.

All that being said, we are still monitoring inflation very closely. We have noticed that certain regions have been impacted by inflation more than others. However, we still maintain that these inflationary pressures will likely be temporary. If we are wrong, we suspect it will likely be related to ongoing supply chain issues from firms that outsource some of their goods abroad. Additionally, if the labor shortage persists, it could also have an impact on inflation.

International news: U.S. lifts sanctions on Iran, EU proposes a fine, and Russia looks to help Iran.

- The U.S. lifted some sanctions targeting Iran’s energy sector on Thursday. The move highlights the easing of tensions between the two sides as the U.S. looks to reenter the nuclear pact. Although it isn’t clear whether there will be a new agreement, as nuclear talks have stalled, lessening tensions will make a deal more likely.

- Russia is looking to provide Iran with its advanced satellite system. The new system will allow Iran to surveil its military targets from space.

- Russia fined Facebook (FB, $332.46) and Telegram for not taking down content that it believed to be unlawful.

- Amazon (AMZN, $3349.65) could face a $425 million fine from the European Union. The fine is in response to the company’s data collection practices.

- French President Emmanuel Macron stated that the Northern Ireland Protocol is non-negotiable. The protocol has sparked protests within Northern Ireland as critics claim the protocol pushes the region closer to the European Union and away from the U.K.

Economics and policy: U.S. not ready for another pandemic, leaders of the U.K. and U.S. meet, Puerto Rico is without power.

- A top official at the Centers for Disease Control and Prevention warned that the U.S. may not be ready for the next pandemic. CDC Principal Deputy Director Anne Schuchat stated that the agency needs additional funding to prevent a future crisis from taking place.

- Congress is still working on a bill to bolster the semiconductor industry and send the China competitiveness bill to the White House.

- Thousands of people in Puerto Rico are without power following a fire at an energy facility.

- Three members of the panel of advisors resigned from the Food and Drug Administration on Thursday. The resignations follow the approval of a controversial Alzheimer’s treatment that went against the panel’s advice. The efficacy of the treatment has been a source of debate as critics argue there is not enough evidence to support the claim that it is effective in treating Alzheimer’s.

- President Biden and U.K. Prime Minister Johnson met for the first time on Thursday. During the 90-minute meeting, the two discussed Northern Ireland, democracy, human rights, and trade. Afterwards, the two renewed the Atlantic Charter, in which the leaders pledged to counter influences of autocratic states.

China:

- China’s parliament pushed through a bill that would make it illegal for Chinese companies to comply with sanctions imposed by foreign governments. If made into law, it would allow Beijing to punish individuals and companies implementing these sanctions. The move will likely heighten tensions between China and the West and could accelerate the decoupling of the two sides.

- China is gearing up to send its first crew to the country’s new space station.

COVID-19: The number of reported cases is 174,729,478 with 3,768,560 fatalities. In the U.S., there are 33,426,302 confirmed cases with 598,716 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 372,830,865 doses of the vaccine have been distributed with 305,687,618 doses injected. The number receiving at least one dose is 172,423,605, while the number of second doses, which would grant the highest level of immunity, is 141,583,252. The FT has a page on global vaccine distribution.

- Leaders of the G7 countries are expected to announce a plan to vaccinate the world by the end of 2022. The countries plan to donate 100 million surplus doses over the next 12 months. Additionally, the group is also looking to allocate $100 billion to developing nations in order to aid their recovery from the pandemic.

- The Food and Drug Administration announced that it is going to authorize a six-week extension on the Johnson & Johnson (JNJ,$167.08) COVID-19 vaccine expiration date. The extension will give states additional time to figure out what to do with their surplus inventory.

- The World Health Organization stated that it does not believe that African countries will be able to meet the 10% vaccination goal established by the agency. Failure to reach this goal could complicate efforts to end the pandemic.

- Vaccination rates have slowed dramatically over the last few weeks as officials have struggled to convert shot skeptics. Many of the holdouts now attribute the receding pandemic as a reason to not get vaccinated. The slowing of vaccinations could make it harder for the country to achieve herd immunity.

- The global death toll from the coronavirus this year is already higher than it was in 2020. The surge in COVID-19 deaths has primarily come from South America, Asia, and Africa. If not contained soon, this could mean that the virus will be a problem in developing countries for the foreseeable future.