Daily Comment (June 10, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with the latest in the high-level, high-stakes trade talks going on in London between the US and China. We next review several other international and US developments with the potential to affect the financial markets today, including unrequited efforts by Beijing to curry favor with the European Union by offering trade concessions and news that the Trump administration’s immigration crackdowns could be costing it the political support of union workers and Hispanics.

United States-China: High-level officials from the US and China continue their trade talks in London today, with initial reports suggesting that the two sides aren’t coming to agreements easily. US Commerce Secretary Lutnick today said the talks are “going well,” but President Trump has suggested that the Chinese are taking a tough stance. If incoming reports point to further hurdles, global stock markets could falter later today or in the coming days.

- Separately, the Chinese government said it will extend its antidumping probe into European Union pork exports for another six months, until mid-December. The probe into EU pork was launched in June to retaliate for the EU slapping antidumping tariffs on Chinese electric vehicles.

- As with Beijing’s hint yesterday that it will favor the EU as it relaxes its embargo on rare-earth exports, the extension of the pork probe likely aims to discourage the EU from coordinating with the US on its tough trade policies against China.

European Union-China: Despite Beijing’s effort to curry favor with the EU and preclude any further US-style barriers, the European Commission today said it will impose anti-dumping tariffs of up to 62.4% against Chinese plywood imports. According to the Commission, the new duties are in response to a three-year surge in hardwood plywood imports that has damaged domestic producers. Brussels is also reportedly monitoring imports of Chinese softwood plywood for further antidumping duties.

Germany: Lawmakers in Chancellor Merz’s center-right CDU party said Germany may need to re-institute conscription to raise the troops needed to counter Russian aggression. According to the lawmakers, Germany’s current measures to incentivize voluntary enlistment are falling short. The possibility of a renewed draft in Germany underscores the urgency with which some European countries are trying to rebuild their armed forces amid the threat from Russia and the Trump administration’s desire to cut the US commitment to Europe’s defense.

Italy: A referendum aimed at granting faster citizenship to immigrants failed yesterday due to low turnout, apparently as voters heeded right-wing Prime Minister Giorgia Meloni’s call to boycott the ballot. On its face, the result seems to reflect the growing nationalist populism and anti-immigrant sentiment in Europe, but the details were contradictory. Of those who voted, more than 65% cast their ballot to cut the residency requirement to five years from 10. However, total turnout was only 30% of registered voters, far below the 50% required to be valid.

Syria: In an interview with the Financial Times, central bank chief Abdulkader Husrieh said the country will be re-connected to the SWIFT international payments system in the coming weeks. The move would come after 14 years of war and Western sanctions cut Syria off from the world economy as a pariah state under former President al-Assad. The move could portend a return to foreign investment in Syria (but it’s probably way too soon to start thinking about buying Syrian stocks!).

Australia: The Australian Securities and Investments Commission today said it will take steps to ease initial public offerings of stock, after new listings slumped to their lowest level in more than a decade. The Australian market has also suffered a number of big de-listings in response to merger activity. All the same, it’s too early to know whether the steps will be enough to increase activity on the Australian stock exchange and maintain investor interest in the market.

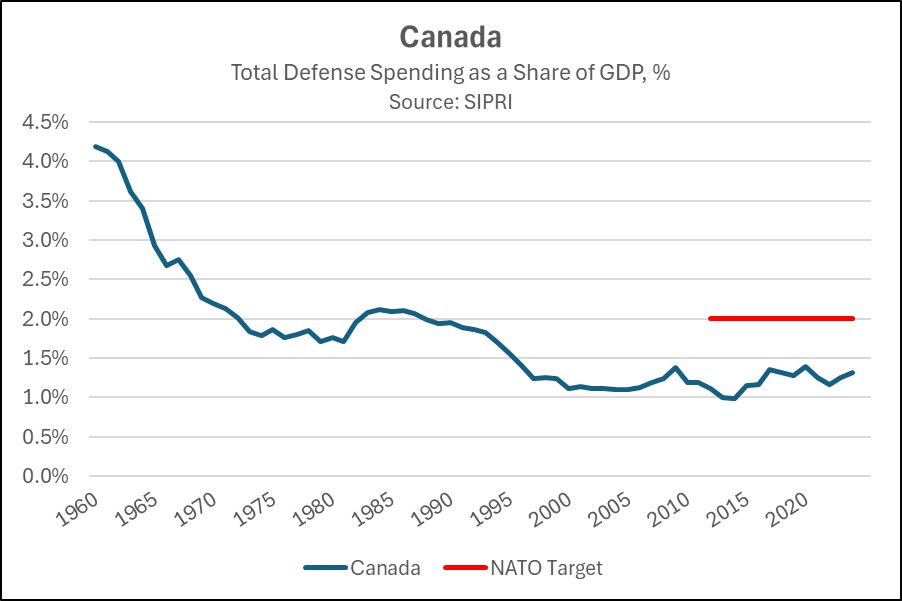

Canada: Prime Minister Carney yesterday said his government will boost Canadian defense spending to 2% of gross domestic product in the current fiscal year, finally lifting the country’s defense burden to the agreed target for members of the North Atlantic Treaty Organization. Former Prime Minister Trudeau had also pledged that Canada would meet the NATO target, but only in 2032. Carney’s move could potentially help ease US-Canadian tensions over trade and other issues.

US Immigration Policy: As protests continue to flare up in Los Angeles against the Trump administration’s immigration crackdown, press reports suggest that local branches of top unions are increasingly siding with the protestors. In recent days, authorities arrested David Huerta, president of the state branch of the Service Employees International Union, for allegedly obstructing federal agents conducting an immigration raid. As of yesterday, local units of the Teamsters and the United Auto Workers have expressed their support for the SEIU.

- More union workers are also reportedly joining in the protests.

- The development may present a political problem for Trump and the Republicans, who until now have been unexpectedly successful in garnering support among union workers and Hispanics.

US Solar Energy Industry: Sunnova Energy International, once one of the US’s top installers of rooftop-solar systems, filed for bankruptcy yesterday and said it plans to sell or wind down all its assets. The bankruptcy follows Friday’s bankruptcy of Solar Mosaic, which makes loans to homeowners for solar installations.

- Several other residential solar firms have recently gone out of business because of weak demand and rising interest rates. The latest wave of bankruptcies reportedly stems largely from the Trump administration’s plan to remove clean-energy subsidies and reduce prices for fossil-fuel energy.

- According to the bankruptcy filings of Sunnova and Solar Mosaic, uncertainty around the future of solar-related tax credits hurt their ability to refinance debt or attract new investment.