Daily Comment (June 10, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning! It’s ECB day as the Eurozone’s central bank holds its regular meeting. It’s also CPI day; we cover the data below, but consumer inflation came in higher than expected. Overnight, U.S. equity futures were mostly steady in front of the data. In its wake, equities came under pressure. And, here’s a fact of the day—National Geographic has named another ocean, calling it the Southern Ocean, and it encircles Antarctica. We begin today with short comments about the ECB. The press conference was underway while we were writing. Economics and policy are next, followed by the international news roundup. China news follows, and we close with the pandemic update.

ECB: The central bank, as expected, made no changes to policy. In the press conference, President Lagarde suggested that risks in the economy were mostly balanced, which could be taken as hawkish. These words, however, were not backed up by tightening. Market reaction, so far, has been modest, although we are seeing long-duration yields rise. That reaction may have more to do with U.S. CPI.

Economics and policy: Crypto is continuing to dominate the news, and payment for order flow is coming under review.

- We continue to closely monitor developments in the cryptocurrency market, especially as regulators start to recognize that much of the crypto world is looking like regulatory arbitrage. In other words, a coin that essentially gives one lending or cash transfer powers must have the same level of regulatory protections as those in the existing financial system. Much of distributed finance creates unregulated derivatives that may be illegal to operate in that fashion. We note the Basel Committee, which is sort of a global bank regulator, is calling for much tougher capital rules for cryptocurrencies. If regulation creeps in, we would expect the current prices of various crypto coins to become more volatile.

- Crypto for your 401k? Coinbase (COIN, USD, 224.32) is working with 401k managers to offer various crypto coins for retirement plans.

- China continues to crack down on bitcoin miners. Qinghai province recently closed a mining project.

- The U.S. custody bank State Street (STT, USD, 84.57) is creating a cryptocurrency division. As cryptocurrencies steadily become embedded in the financial infrastructure, they will likely continue but face much higher regulatory scrutiny.

- Although bitcoin was thought to be untraceable, the recent seizure of coins in the wake of the Colonial Pipeline hack shows that such secrecy may be overestimated.

- Globalization is a major benefit for the talented and powerful. That’s because it creates a broader platform allowing such people to leverage their talents on a wider scale. Mike Bloomberg is looking to create an alternative to the World Economic Forum with the aim of fostering continued globalization.

- Although China remains behind in its Phase One trade deal obligations, we are seeing continued aggressive Chinese purchases of American grain. Current prices reflect China’s buying.

- On the G-7 corporate tax harmonization plan, we already notice broader reactions. First, the U.K. wants an exception for the City of London. Second, Ireland, a notorious tax haven, has suggested it might be ok with a 15% rate.

- At the same time, getting this deal through the Senate, given that it is a treaty, looks like a long shot. The Senate requires two-thirds approval for a treaty, which may be close to impossible. The GOP is becoming increasingly hard-wired against tax increases. As the party becomes populist, it may inadvertently become the party most likely to adopt MMT-type policies.

- There is a timeless economic adage that says “nothing cures high prices like high prices.” There are reports that the global logistics industry is ordering container ships, and shipyards are looking to invest in increasing loading capacity in response to high demand.

- Payment for order flow is a way to essentially execute a form of regulatory arbitrage. Exchanges set the standard for bid/ask spreads on equities. These spreads reflect the risk that concentrated institutional positions could pressure the spread because they tend not to be dispersed. On the other hand, retail flow tends to be mostly balanced between buys and sells. So, order flow firms accumulate retail trades and execute the trades inside the exchange spread. When you make a retail trade, and you see a line called “price improvement,” it reflects the price you received inside of the exchange spread. Payment for order flow means these firms split the price improvement between the customer and their broker/dealer. The firm sells the flow, and the broker/dealer, the retail customer, and the order flow firm share the benefit. The SEC says it intends to review this arrangement. As trade commission rates fall to zero, it is the payment for order flow that compensates the broker/dealers. For the most part, it appears that institutional investors, who get the exchange spread, are the losers in this arrangement. We doubt the SEC will end the practice, but we wouldn’t be shocked to see rules put into place that give the greatest benefit to the retail customer. If that is the outcome, we might see retail-focused broker/dealer equities come under pressure.

- The economy is grappling with reopening. This is revealed in the JOLTS data, which shows a disconnect between hiring and job openings. It has also become evident in the inflation data. However, the key point to watch isn’t this short-term logistics issue but the longer-term reaction. There is great fear that the current situation will trigger lasting inflation problems. There is also a good chance that it will foster a productivity boom as firms begin to adapt to higher wages with increased investment and productivity. Low-interest rates could foster this outcome.

- Although we are, like everyone else, watching the 10-year T-note yield dip under 1.50%, we are not sure why it’s occurring. If lasting inflation fears were rising, this drop probably wouldn’t occur.

- One of our concerns about the current political divide is that it will lead to regulatory “swings” that will make investment decisions increasingly risky. Case in point—the Biden administration is looking to change clean water regulations to make them more stringent.

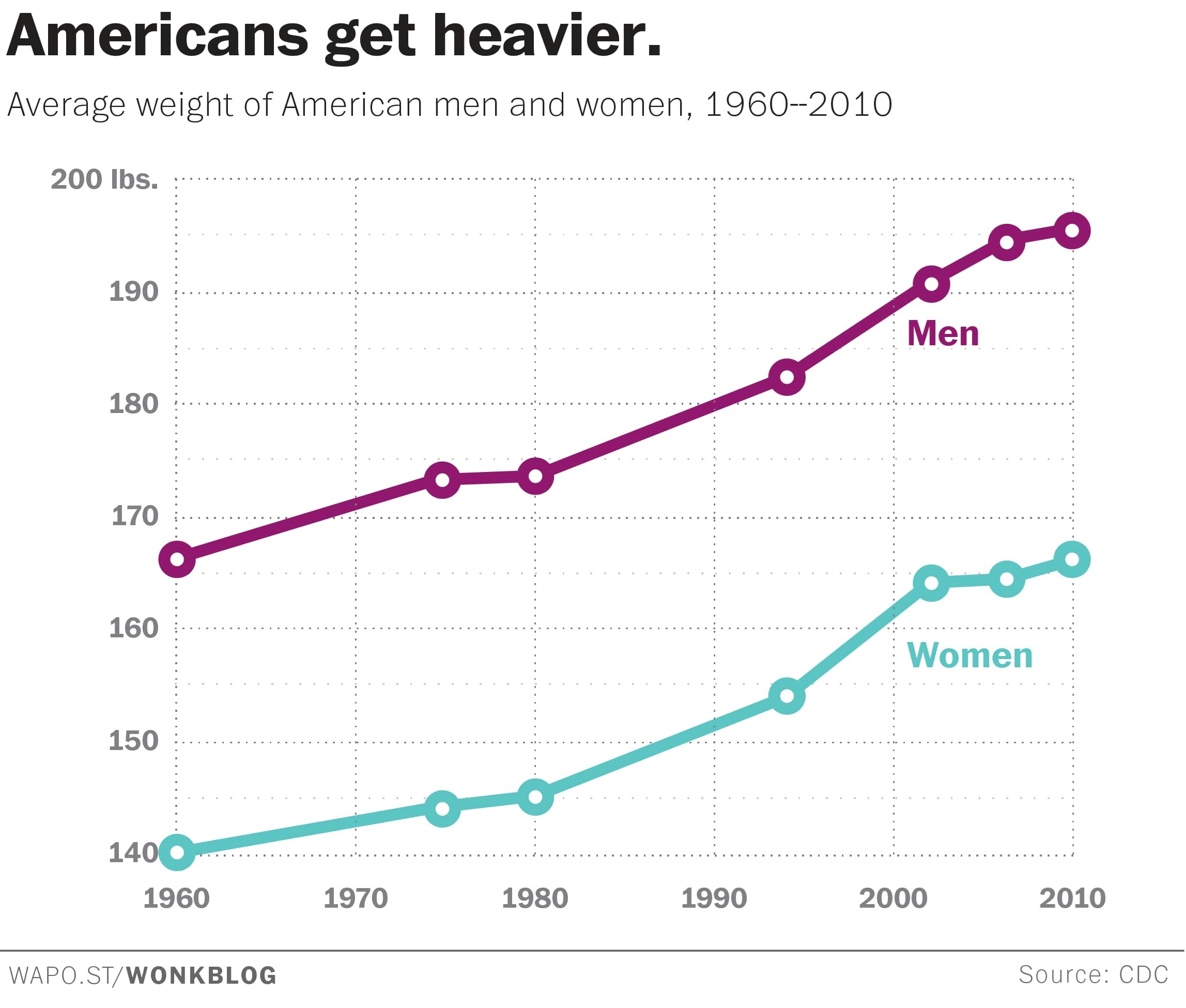

- It’s a known fact that Americans have become increasingly heavier.

The FAA is requiring airlines to take this fact into account, which may lead to more stringent rules on luggage or more passengers being bumped from full flights. What we haven’t seen yet is seat pricing by passenger weight.

- There is new research that suggests that up to half of unemployment insurance support may have been fraudulent.

- The Fed’s reverse repo has hit a new record of $500 billion, suggesting that financial institutions are overwhelmed with liquidity.

International roundup: President Biden’s European trip kicks off today.

- President Biden and PM Johnson are set to meet today. Although we expect talks to appear agreeable, the issues surrounding Northern Ireland will likely be a sticking point.

- It’s not just the U.S. that is troubled by the situation in Northern Ireland. The EU is considering retaliation for border trade violations.

- At the same time, the U.K. is quietly working to improve trade with the EU in the post-Brexit environment.

- As President Biden travels to meet with EU leaders, his message is the U.S. is “back” and that America and Europe need a united front against China.

- An international sting operation that created an encrypted communications platform, secretly run by the FBI, has resulted in over 800 arrests Cash and illegal drugs were seized from Asian crime syndicates, Albanian organized crime, the Italian mafia, and motorcycle gangs. The sting operation lasted three years.

- The leader of Boko Haram, a Nigerian Islamic terrorist group, has allegedly committed suicide.

- It looks like Pedro Castillo has eked out a narrow victory in Peru. An avowed left-winger, his election has put pressure on Peruvian equities. However, we would note this party has little power in the legislature, so his win might not be all that bad for the Peruvian capital in the long run.

This chart shows the Peru ETF. When it appeared the right-wing Fujimori was set to win, the price rallied, but it has tumbled on Castillo’s win.

- Nicaragua’s President Ortega has hit upon a new way to improve his chances of winning reelection. He is systematically arresting his opponents.

- Russia has outlawed Alexei Navalny’s related organizations.

- The EU and Germany are debating if EU courts overrule German ones. Our money is on Berlin.

China: The gains against poverty have probably been overstated, and tech firms are seeing tighter regulation. Credit conditions are tightening.

- One of General Secretary Xi’s purported accomplishments is the eradication of poverty in China. It is part of Xi’s “Chinese Dream” concept. Bill Bikales, a former U.N. economist, disputes the claim in a recent report, suggesting the “accomplishment” is more definitional than actual. So far, we haven’t seen a reaction from Beijing, but we would expect a rejection of Bikales’s claim at some point.

- When Canada held Meng Wanzhou, the CFO of Huawei (002502, CNY, 4.43), for extradition to the U.S. on charges she violated sanctions against Iran, China arrested two Canadians on what appeared to be trumped-up charges. There are reports that there is a deal in the works for the release of these Canadians, Michael Kovrig and Michael Spavor. It is not clear if that outcome would also mean that Meng would return to China.

- Beijing is aggressively moving to regulate China’s tech industry, which has, for the most part, operated in a favorable regulatory environment. Regulators are now moving beyond the large firms to investigate smaller firms. The actions are affecting the overall tech sector.

- If there was any hope in Beijing that the new administration in Washington would have a lighter touch, it is becoming increasingly clear that opposition to China is more about circumstance than personalities. The Biden administration released the list of blacklisted firms, and although there are some differences, overall, it shows that accommodation to China is no longer the direction of policy.

- In the late 1990s, China established four firms that were effectively “bad banks.” They accepted bad debt from the Chinese financial system to eventually liquidate the loans. Such bad banks are standard practice in finance to address a widespread bad loan problem. By taking the bad loans off bank balance sheets, the banks can begin lending again (sometimes after recapitalization), and the bad banks can try to recover whatever value remains. Usually, once the bad loans are either written off or sold, the bad bank itself winds down. That was not the case in China. Huarong (2799, HKD, 1.02) issued bonds against the “assets” it held, and default fears have led to (a) the value of these bonds falling to around 70 cents/dollar, and (b) led to the execution of its ex-chairman, Lai Xiaomin. Now, China Great Wall, another one of these companies, has seen its chairman come under investigation. Although fears of China’s corporate debt have been around for a long time, so far, the country has avoided a major debt crisis. Yet, each scandal raises fears that one might develop.

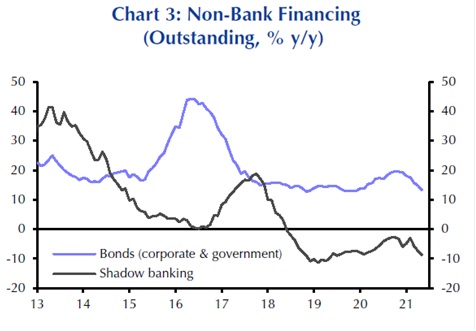

- Meanwhile, the PBOC is steadily tightening lending, leading to slower loan growth. Weaker loan growth will tend to depress the economy and may lead to higher exports.

(Source: Capital Economics)

- The U.S. Senate has passed $250 billion of spending to counter China’s rise. The bill had wide, but not universal, bipartisan support. China was not pleased.

- Chinese social media firms have been given a reprieve from being closed in the U.S. However, the administration is conducting a review, which may lead to future restrictions.

- The SoD has issued a directive to accelerate efforts to counter China’s rise.

COVID-19: The number of reported cases is 174,468,792 with 3,759,188 fatalities. In the U.S., there are 33,414,769 confirmed cases with 598,766 deaths For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 372,495,525 doses of the vaccine have been distributed, with 304,753,476 doses injected. The number receiving at least one dose is 172,054,276, while the number of second doses, which would grant the highest level of immunity, is 140,980,110. The FT has a page on global vaccine distribution.

- Millions of doses of Johnson & Johnson (JNJ, USD, 165.36) COVID-19 vaccines may expire. When concerns developed about the safety of the vaccine earlier this year, inoculations were halted. Although the halt was lifted, doses exceeded injections.

- The U.K. is dealing with the “delta” variant of the virus; the bad news is that it appears to be more contagious. The good news is that current vaccines appear to offer good protection against serious illness.

- The U.S. is purchasing 500 million doses of the Pfizer (PFE, USD, 39.81) vaccine for global distribution.

- Taiwan is dealing with a serious outbreak of COVID-19. We discussed the U.S. vaccine donation earlier this week. The outbreak is starting to affect the critical chipmakers on the island.

- The state of Washington is offering a free joint for accepting a COVID-19 shot.

- China is aggressively inoculating its citizens. Despite the jabs, new lockdowns are occurring as outbreaks develop.

- The king of Thailand owns the company that is distributing vaccines; due to strict lèse majesté laws, it has become difficult to complain about the slow rollout of doses.