Daily Comment (June 1, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

In today’s Comment, we open with significant demographic policy changes in China, followed by various signs of increased inflation and potentially tighter monetary policy in both Europe and the United States. Next, we review a range of international and U.S. news from the holiday weekend. We end with the latest coronavirus pandemic news.

China: Just weeks after the country’s latest census report showed China’s population is on the cusp of a prolonged decline, the government unexpectedly announced that it will allow all married couples to have as many as three children. That’s an increase from the previous two-child policy, in place since 2015, and the one-child policy enforced for decades before that. As a further incentive to childbearing, the government also said it would boost family financial support for education and childcare.

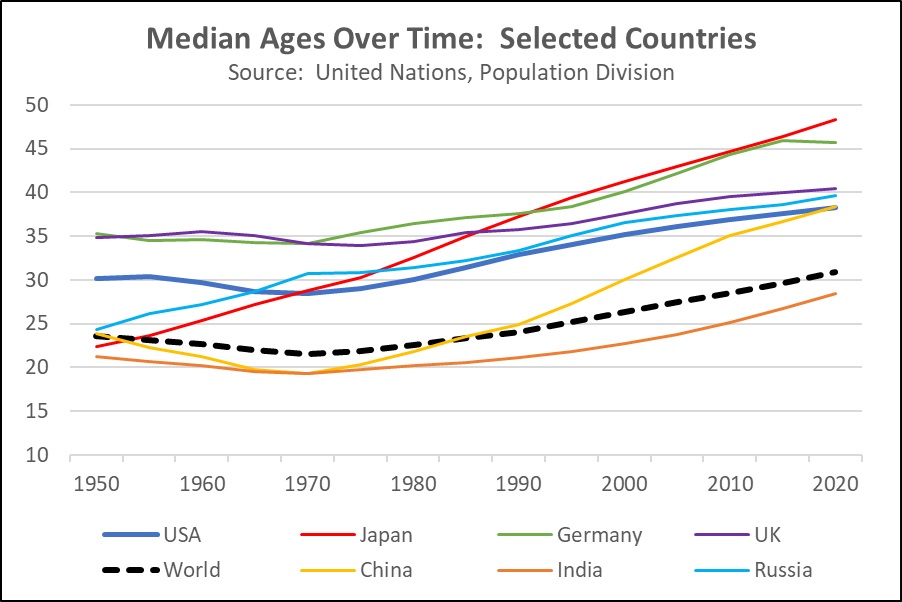

- At this point, it isn’t at all clear that the new policies will significantly boost China’s birth rate and help arrest its population aging. The move to a two-child policy in the middle of the last decade had little discernible impact on births. Other countries facing a similar shortage of births, such as Japan and South Korea, have found that increased support to families and other such policies don’t necessarily lead to a lot of new babies. China will still have one of the largest populations in the world for some time to come, but it probably can’t avoid being overtaken by India’s population in the next few years. It will gradually lose its preponderant population advantage in geopolitics as its population shrinks and ages dramatically, while the U.S. population, supplemented by immigration, keeps growing and remains relatively younger (see chart below).

- It appears that these dynamics have not only caught the attention of President Xi but have sparked some sense of panic. Major changes to China’s population policy have typically been made by the Communist Party conferences held late in the year. The new three-child policy was decided yesterday at a meeting of the Politburo, chaired by President Xi himself.

- As China’s population shrinks and ages, it is also facing major economic and financial issues. For example, a shrinking population will tend to slow overall economic growth. Population aging will also worsen the country’s underfunded pension system. The Politburo on Monday also said it would gradually raise the national retirement age. That unpopular move could even spark political unrest in the coming months and years.

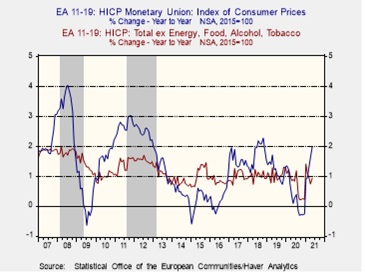

European Union: May consumer prices in the Eurozone were up 2.0% year-over-year, marking the first time in more than two years that the bloc’s annual inflation rate beat the European Central Bank’s target of just below 2.0%. Inflation in April had stood at just 1.6%. Of course, much of the jump in European inflation last month came from fast-rising prices for key commodities like food and energy. Stripping out those categories, May consumer prices in the Eurozone were up a more muted 0.9% for the year, versus a rise of 0.7% in the year through April. All the same, the increased price pressures will likely keep some investors jittery about inflation and could keep alive concerns that the key central banks will be forced to tighten monetary policy more quickly than currently planned. Those concerns are now prompting some investors to adjust their strategies to prepare for greater market volatility.

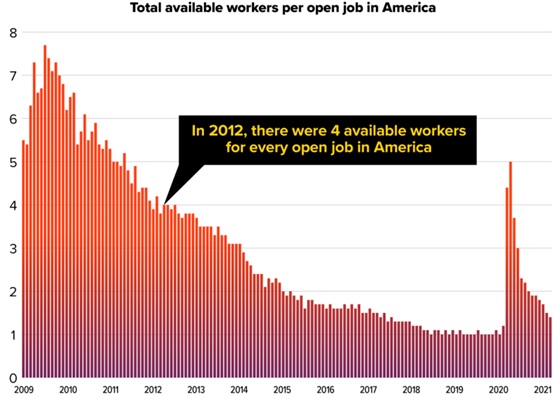

U.S. Monetary Policy: In an interview with the Financial Times, St. Louis FRB President Bullard said the U.S. labor market is tighter than it looks, which could accelerate the central bank’s timeframe for removing some monetary stimulus from the economy. According to Bullard, investors shouldn’t focus only on the nonfarm payroll data, which shows jobs are still down by about eight million compared with pre-pandemic levels. He noted that other indicators are far closer to normal, matching anecdotal evidence of worker shortages.

- Bullard said he was “starting to advocate” for the Fed to look at other measures of job market tightness, particularly the unemployment to job opening ratio. That ratio was at a low of 0.8 in February 2020, spiked to 5.0 during the first lockdowns, and was then back down to 1.2 in March 2021 (see chart below, from the U.S. Chamber of Commerce).

- Bullard’s statement could help reignite concerns about inflation and tighter monetary policy, despite those concerns calming down a bit recently. If so, the result would likely be renewed upward pressure on bond yields and perhaps increased volatility for stocks.

(Source: U.S. Chamber of Commerce)

U.S. Cryptocurrency Regulation: Acting Comptroller of the Currency Hsu said he and other top regulators are developing ideas about reining in the $1.5 trillion cryptocurrency market to stop it from being used for criminal finance and prevent harm to investors and savers. Coupled with other recent moves to control the development of cryptocurrencies, such as China’s recent prohibition against financial firms dealing in them, the budding U.S. regulatory move is likely to further weigh on the market and stoke additional volatility in the currencies.

United States-Denmark-European Union: Over the weekend, multiple reports indicated that Denmark’s secret services helped the U.S. National Security Agency spy on European officials, including German Chancellor Merkel, during the Obama administration. The NSA’s spying on U.S. allies first came to light in 2013 via disclosures by whistleblower Edward Snowden, but this is the first time Denmark’s role in the scandal has been made public. According to the reports, the spying involved the NSA and Denmark jointly tapping under-sea internet cables.

- Based on a statement by Danish Defense Minister Bramsen that “systematic interception of close allies is unacceptable,” there is probably some possibility that the spying on European officials was a residual benefit of a system built to track terrorists or other U.S. enemies.

- All the same, the news is likely to hurt President Biden’s relationship with key EU leaders, given that he was Obama’s vice president. That could spoil Biden’s reception at the upcoming G7, EU, and NATO summits in mid-June.

- As might be expected, China is also jumping on the news to criticize the U.S. Today, China has accused the U.S. of being “the world’s top hacking empire.” We would note, however, that China’s sensitivity to the issue may well reflect the fact that it is probably subjected to many more offensive U.S. cyberattacks than the public realizes.

Global Oil Market: The OPEC+ group of oil producers will meet today to decide whether or not to proceed with their plans to gradually increase oil production as the global economy recovers from the coronavirus pandemic and demand rebounds. The delegates are expected to continue with their plans despite the prospect of more Iranian oil being released onto the market later this year. Still, the rise in demand, constrained inventories, and transportation bottlenecks continue to buoy prices, with Brent rising some 2% to more than $70 this morning.

Israel: Right-wing politician Naftali Bennett, centrist Yair Lapid, and other opponents of Prime Minister Netanyahu are reportedly closing in on a coalition agreement that would give them a razor-thin majority in the Knesset, allowing them to topple the prime minister. Under the deal, Bennett and Lapid would serve alternately in the role of prime minister. Lapid has a deadline of Wednesday to form a government.

COVID-19: Official data show confirmed cases have risen to 170,771,941 worldwide, with 3,551,306 deaths. In the United States, confirmed cases rose to 33,264,595 with 594,568 deaths. Vaccine doses delivered in the U.S. now total 366,316,945, while the number of people who have received at least their first shot totals 167,733,972. Finally, here is the interactive chart from the Financial Times that allows you to compare cases and deaths among countries, scaled by population.

Virology

- Newly confirmed U.S infections totaled just 5,602 yesterday. Of course, the low number probably reflects the Memorial Day holiday, yet, it was well below the seven-day moving average of 17,189. The seven-day moving average of deaths related to the virus has now fallen to just 392. The dramatic declines in infections, hospitalizations, and deaths can be attributed largely to the nation’s continuing mass vaccination campaign. Data from the CDC show 50.5% of the U.S. population has now received at least one vaccine dose, and 40.7% of the population is fully vaccinated.

- New data show that the disinfecting and hand-washing that became common during the pandemic served not only to dramatically reduce influenza cases last season but also reduced childhood illnesses such as chickenpox, stomach viruses, and strep throat. For example, U.S. chickenpox cases this year are down about two-thirds from their levels before the pandemic.

- In Britain, the government still plans to lift its pandemic lockdown on June 21, subject to a data assessment next week, but reports over the weekend indicate government scientists expect the “Step 4” restriction easing will be delayed because of a rebound in infections related to the Indian mutation of the virus.

Economic and Financial Market Impacts

- The OECD boosted its forecast of global economic growth this year to 5.8%, up from its December forecast of just 4.2%. Along with its revised forecast for growth of 4.4% in the following year, that would imply the global economy will reach its pre-pandemic level in 2022. According to the organization, the brightening outlook will give governments leeway to switch from blanket emergency support to more targeted measures, with a focus on investing.

- Even though leisure travel is already bouncing back nicely, there are growing signs that business travel will soon start to normalize as well. The chief customer officer at American Airlines (AAL, $24.24) said 47 of her airline’s top 50 corporate customers plan to resume flying by the end of the year.

- After facing a big resurgence in infections while waiting for its first vaccine shipments early this year, the Canadian government is providing hundreds of millions of dollars in funding to expand and build domestic vaccine-manufacturing plants. It also plans to set aside more than two billion Canadian dollars, equivalent to US$1.66 billion, over the next seven years to attract new investment in the life-sciences sector. If successful, the effort could eventually help balance out the sectoral makeup of the Canadian stock market. Currently, the Health Care sector makes up only about 1.1% of the MSCI Canada Index, versus 11.0% for the Materials sector, 13.8% for the Energy sector, and a whopping 37.4% for the Financials sector.