Daily Comment (July 9, 2019)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] Good morning! It’s an “everything down day” this morning, with both risk-on and risk-off asset values lower. Most likely this is position-squaring in front of Powell’s testimony. Here is what we are watching today:

Powell: There isn’t too much more to add that we didn’t discuss yesterday in terms of the testimony. If the FOMC wants to disabuse the markets of their expectations of a rate cut later this month, this is the best opportunity. However, we seriously doubt Powell wants to do that; the actions in the financial markets alone are enough to warrant a rate cut.

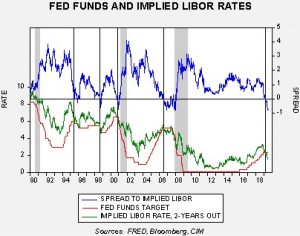

This chart shows the implied three-month LIBOR rate from the two-year deferred Eurodollar futures contract and the fed funds target. We have placed vertical lines at the points of inflection. The upper line shows the spread. The genius of Greenspan was to cut rates as soon as the spread broke zero. By doing so, he was able to engineer the longest expansion in history up to that point. In this expansion, the Fed hasn’t faced a similar threat…until now. The last time the FOMC ignored this signal we had the 2007-09 recession. With inflation dormant, the Fed would be reckless not to cut rates.

Art Laffer, who recently was granted the Presidential Medal of Freedom, told CNBC that the case for central bank independence isn’t logical. This is the position most economists held after WWII; the idea was that policy would be more effective if fiscal policy and monetary policy were coordinated. It was a real surprise that William M. Martin was able to convince President Truman to give the Fed independence from the Treasury. The reason for central bank independence is that politicians can’t be trusted to contain inflation. The political class is always worried about the next recession and will always tend to lean toward stimulus now, austerity later. It does stand to reason that in a world where inflation has been low for a long time, the rationale for central bank independence is being forgotten. We don’t view this development as an anomaly but a trend; the lessons of high inflation are steadily being lost as the generations that suffered from it pass this earthly plane. Simply put, the attack on independence isn’t just a Trump issue. We will be watching to see how Europe handles this issue. The fact that a German didn’t get the ECB presidency is a potential sign that hard money policies are falling from favor everywhere.

The dollar scare: Currency markets tend to be difficult for most investors; as an asset, it has no generally accepted valuation metric and, under floating rates, can only be valued in relation to other currencies. Thus, a nation cannot always unilaterally weaken its currency if other nations match the actions of that country. In the 1970s, when dollar and pound weakness was endemic, the Germans, but especially the Swiss, maintained relatively hard money policies and their currencies appreciated strongly. It has become clear that President Trump wants to bring a weaker dollar.

There is an old trilemma in international economics sometimes called the “impossible trinity.” Assume there are three goals:

- A fixed exchange rate;

- Independent monetary policy;

- Free capital flows.

The impossible trinity states that a nation can have two of the three, but not all. So, if a nation wants free capital flows and a fixed exchange rate, then its monetary policy must adjust to maintain the exchange rate and is no longer independent. If a nation wants a fixed exchange rate and independent monetary policy, then it needs to restrict foreign flows. With independent monetary policy and free capital flows, policymakers must accept floating exchange rates.

The U.S. currently operates with the latter combination; we have independent monetary policy and free capital flows with a floating exchange rate. President Trump seems to be leaning toward a different set of objectives—free capital flows and a fixed exchange rate, forcing the Fed to give up its independence. In other words, the president wants a weaker dollar and he can’t have that without gaining control of monetary policy, too. The president has tools to weaken the dollar. He could openly intervene in the currency markets, using dollars to buy yen, euro, etc. However, if the Fed offsets intervention with tighter policy (sometimes called “sterilization”), then the action will be for naught.

What is potentially unsettling for financial markets is that we could see a widespread move by nations to simultaneously and unilaterally attempt to weaken their currencies. The last time we saw something similar was in the 1930s under conditions of fixed exchange rates and devaluations against gold. The outcome was economic nationalism and dramatically reduced global trade. The potential for a return to 1930s currency policy is probably underappreciated by the financial markets because it is so difficult to sort out the outcomes. One could argue that we faced a similar situation in the mid-1980s; at that time, the monetary austerity policies of the Volcker Fed led to a very strong dollar that seriously undermined U.S. competitiveness. The U.S. convened a meeting at the Plaza Hotel in New York and the outcome was a coordinated effort to weaken the dollar. An interesting sidelight to that meeting is that Chinese leaders believe it was the beginning of the end of Japan’s economic rise and they fear that the U.S. wants to do the same thing to China. The U.S. was able to essentially force cooperation because all the parties to the agreement were dependent on the U.S. for security. The conditions for a “Plaza Accord II” are less optimal; the Chinese have no interest in participating in a program they believe is designed to contain their economy and the shadow of the Soviets no longer forces Asian and European cooperation.

We don’t know exactly how it would play out if the U.S. decides to make a unilateral and concerted effort to weaken the dollar. The likelihood of foreign cooperation is low. The Fed would probably have to be coerced to participate. But, if the administration is successful, we could potentially see extreme volatility in foreign exchange rates that would make trade and investing difficult and could, paradoxically, foster dollar strength as foreigners move to accumulate dollars as a store of value. One thing is for sure—gold would do well. We note that the PBOC added gold to its reserves for the sixth consecutive month.

U.S.-China trade talks: According to a U.S. official, senior U.S. and Chinese trade negotiators are due to speak by telephone this week in an effort to get the trade talks on track again and set up a series of face-to-face meetings in the near future, likely in Beijing. However, most observers seem to see little evidence that either side is ready to significantly change its demands. Little near-term progress is expected. In fact, China expert Derek Scissors, who works at the American Enterprise Institute and has served as a consultant to the Trump administration, was quoted by Reuters today as saying, “I expect this to drag out for months.”

Taiwan: The U.S. government has approved a $2.2 billion arms sale to Taiwan, consisting of 108 Abrams tanks, 250 Stinger missiles and related equipment. The sale is the biggest to Taiwan since President Trump took office, and news of it came just days before Taiwanese president Tsai Ing-wen is due to make an unusual two-day visit to New York. The sale and visit are the latest in a series of moves the Trump administration has made in support of Taiwan. The Chinese government sees the new sale and visit as provocative, and it has already demanded that the sale be canceled, although it’s not clear whether it will have a direct impact on the U.S.-China trade tensions.

Hong Kong: Chief Executive Lam today said her controversial bill to legalize extradition to China is “dead,” but the declaration was seen as far short of the formal withdrawal demanded by the mass protests of recent weeks. Protestors continue to push for Lam’s resignation, an independent inquiry into police conduct during the demonstrations and the dropping of charges against arrested protestors. We believe Lam’s statement has done nothing to diffuse Hong Kong’s political protests, so the risk of a crackdown by Beijing remains alive.

Other China news: Protests against a trash incinerator continue in Wuhan. Under normal circumstances, this protest would not cause concern. Local protests in China are not all that unusual. However, with the issues in Hong Kong, there are fears among policymakers that these protests could evolve into something more ominous. African Swine Fever continues to be a huge issue for China; a report by Caixin confirms other reports we have noted recently, which suggest the problem is much more widespread than officially reported and ranchers are taking steps to protect their own economic interests at the expense of containing the disease.

A diplomatic dust-up: A leak of diplomatic cables has led to a row between the U.S. and U.K. Cables tend to be candid; the dump a few years ago from Wikileaks revealed what diplomats thought of the leaders in various nations. This most recent event has some interesting twists. First, if one supports Brexit, this leak was fortuitous as it showed what the current government really thinks of the sitting U.S. president. A Johnson administration would likely replace Sir Kim Darroch and the issue would be laid to rest. Second, this event shows the tensions that develop between a professional diplomatic service and the political leaders they serve. Often, the goals of the two diverge. PM May would likely prefer to not have to deal with this issue in the waning days of her government.

Meanwhile, ballots have reportedly now been mailed to the Conservative Party’s rank-and-file members who will decide whether Boris Johnson or Jeremy Hunt will take over as party leader and prime minister. As the campaign nears its conclusion, both candidates have been ramping up their rhetoric regarding their willingness to pull the U.K. from the European Union without a Brexit deal.

Iranian enrichment: There is not too much new to add on this issue from yesterday. In an effort to persuade Iran to refrain from further breaches of its 2015 nuclear agreement, French President Macron will send diplomatic advisor Emmanuel Bonne to Tehran today for talks with the Iranian government. Iran is continuing to threaten further violations of the nuclear deal but hasn’t set any path to negotiations.

India: Finance Minister Sitharaman has released her proposed budget for the coming fiscal year, including a surprise cut in the deficit to 3.3% of gross domestic product (GDP) from a previous goal of 3.4%. Stimulus measures in the proposal include expanding an existing pension program and increasing the number of companies eligible for a reduced 25% tax rate. However, the proposal was widely seen as lacking sufficient revenue-generating measures to pay for those initiatives. Even worse, the proposal would require listed companies to float at least 35% of their stock to the public, up from 25% currently. Skepticism over the fiscal target and fear of significant new stock issues have weighed on Indian stocks in recent days.

Venezuela: There is a growing side effect of fuel shortages in Venezuela. The shortages are hampering efforts to plant and maintain crops and, when they mature, the lack of fuel is preventing shipping. Just when it seems impossible for conditions to get worse in the country, they do.

Debt ceiling issues: Although we still think a last-minute deal will be struck, it is becoming clear the solution will be made at the last minute. There have been so many of these events that financial markets are mostly ignoring them. However, this one has enough imbedded issues that the potential for sequester is probably higher than the financial markets have discounted.