Daily Comment (July 6, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment begins with a discussion about friction between policymakers in the U.S. and Europe over the pace and direction of interest rate changes. We will then discuss why households are not as confident in the economy as the data suggests. Finally, we will explain why China may be able to make a comeback later in the year.

Less United: Central bankers in Europe and the United States are still undecided about when to end the ongoing hiking cycle.

- The Federal Open Market Committee was divided on whether to pause rates in June, according to the latest meeting minutes. Despite the lack of any dissents to last month’s pause, some policymakers argued for an increase of 25 basis points in the central bank’s benchmark policy rate. Members who favored a rate hike pointed to recent data showing that the labor market remains tight and inflation remains elevated. Despite the disagreement, Fed officials have left the door open for future hikes, with the market pricing in another quarter-point hike toward the end of the month.

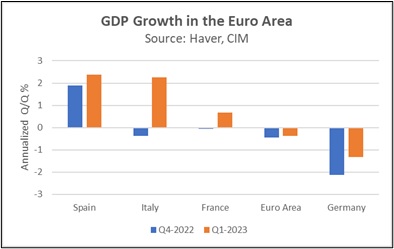

- Despite the economic contraction in the Euro area, members of the European Central Bank are still divided as to whether to increase rates again this year. Earlier this week, Joachim Nagel, a member of the ECB’s Governing Council, advocated for additional rate hikes due to elevated inflation. In contrast, Italian governor Ignazio Visco has cautioned against additional increases in the policy rate as the region continues to assess the damage from previous tightening. The tensions between members of the ECB Governing Council reflect growing anxiety about the state of the Eurozone economies. Most countries in the bloc are showing signs of slowing, which raises the political and economic costs of higher interest rates.

- It will be difficult for central banks to justify their hawkish stance as price pressures continue to ease. Producer prices in the U.S. fell well below 2% in June, a sign that producers are feeling less need to pass on costs to consumers. Similarly, Spain has also seen inflation fall well below 2%, making it the first major Eurozone country to do so. This progress suggests that central bankers are getting closer to achieving price stability. However, it is still unlikely that either the ECB or the Fed will cut rates this year as both central banks fear the return of inflation.

Not Sure: Although the government data shows that the economy remains resilient, households are still worried about a potential downturn.

- Middle-class people are becoming more concerned about an imminent recession. Americans making between $45,000 and $180,000 annually and wealth between $100,000 and $1 million reported higher levels of anxiety regarding the economy, according to polls conducted by Bloomberg. The findings showed that only 39% of survey respondents expect their economic situation to improve within the next year. This report comes amidst a series of positive economic surprises showing that the country is stronger than most analysts believed at the start of the year. The rising anxiety among middle-class Americans is a reminder that the economy is not always as it seems.

- Although consumer spending has reverted to pre-pandemic levels, households are still expressing concerns about their present situation. This reality reflects the growing angst that households are feeling in an economy with rising interest rates and elevated inflation. That said, it does appear the data may be catching up to household perceptions of the state of the business cycle. Average weekly hours have fallen in three out of the last four months, meanwhile initial claims data has been trending higher over that same period. These trends generally serve as a precursor to a weakening labor market. As a result, we still believe that it is too early to say whether or not the economy has averted a downturn as some analysts believe.

- The Fed’s reliance on government data could be its Achilles heel, as it may be limiting its perspective. Initiation rates, which measure the percentage of respondents who agree to participate in a survey, have fallen well below pre-pandemic levels. For example, Fed officials have often cited strong payroll data as a reason to keep monetary policy tight. However, initiation rates for establishment surveys have dropped from 67.0% in February 2020 to 38.5% as of April 2023. This decline in initiation rates raises doubts about the accuracy of the Fed’s data-driven decision-making as it shows that policymakers may not have a complete picture of the economy as it sets interest rate policy. Therefore, the likelihood of a Fed mistake is still somewhat elevated.

- During the last Fed meeting, policymakers also raised doubts as to whether the payroll data accurately reflects the strength of the labor market.

New Day, New Way: Despite its weak start to the year, China still may be able to finish the year strong.

- Top leaders are expected to hold off from making major economic reforms at the July Politburo meeting. The meeting of the 24 most influential Communist Party leaders is likely to set the stage for economic policy in the second half of the year. Investors will be keen to see how the Chinese government plans to respond to the disappointing economic recovery following the end of pandemic restrictions. Additionally, onlookers will be paying close attention to a potential thaw in tensions with the U.S. as well as the outlook for the Chinese property market.

- Despite the recent misses, there is still optimism that China will be able to turn things around in the second half of the year. The People’s Bank of China (PBoC) has reassured markets that it has ample tools to prevent a severe depreciation of the yuan (CNY) against the U.S. dollar (USD). At the same time, there is hope that U.S. Treasury Secretary Janet Yellen’s visit to Beijing may improve diplomatic ties between the two largest economies in the world. This possible change in trajectory is also reflected in the data. According to the OECD leading economic indicator, the Chinese economy is currently gaining momentum and is outperforming the U.S.

- The changing geopolitical landscape has made it more difficult to predict China’s long-term trajectory. However, there is still a reasonable chance of a market recovery over the next 6-12 months. There are a few factors that suggest this could be the case. First, the government does not appear to be in a rush to sever ties with the West. In fact, it is trying to maintain relations with Europe. Additionally, China may be reluctant to completely isolate itself from the U.S. as it seeks to restore confidence in its economy. Second, it is still possible that the government will implement large-scale stimulus later in the year, as it has in previous major downturns. These factors suggest that China may be better positioned than it was at the start of the year.