Daily Comment (July 5, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with news of more trade frictions between China and the West. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including reports of a new breakthrough in electric vehicle batteries out of Japan and further evidence that the U.S. economy may finally be sliding into recession.

China: The Ministry of Commerce on Monday imposed a license requirement on exports of gallium, germanium, and dozens of other related minerals and metals that are produced and refined mostly in China and are critical for manufacturing semiconductors, modern missile systems, and solar cells. According to the ministry, the licensing requirement, which will take effect on August 1, aims to protect national security and interests.

- The license requirement is widely seen as an effort to retaliate for the West’s clampdown on sending advanced semiconductor technology to China. It also likely aims to put U.S. Treasury Secretary Yellen on the back foot when she visits Beijing later this week.

- At this point, China will likely issue the required licenses, so exports of the minerals may not be immediately impacted. However, there would be a continuing threat to withhold the licenses and cut the flow of exports. The licensing regime is therefore a bargaining chip for China as it faces the U.S. technology bans.

- In any case, the move could backfire on China by further highlighting the risk of depending on it for any important good or resource. It will therefore incentivize more “de-risking” by the West. At the risk of sounding like a broken record, we continue to believe that the unending escalation of tit-for-tat restrictions on trade, technology, and capital flows between the West and China will likely put investors at risk.

- In one new example of how Western firms are de-risking and building supply chains outside of China, the Indian minister of electronics and information technology said U.S. chip firm Micron Technology (MU, $63.90) will break ground on its first semiconductor assembly plant next month and begin producing the country’s first domestically manufactured microchips by the end of 2024.

- India is likely to be an important beneficiary of the new, de-risked supply chains, and investors have already begun to bid up Indian assets in response.

China-Russia-Ukraine-European Union: The Financial Times cites unnamed sources as saying that Chinese President Xi in March privately warned Russian President Putin against using nuclear weapons in his faltering invasion of Ukraine. The sources say Chinese diplomats are now taking credit for holding back Putin from a nuclear war to curry favor with European leaders and split them off from the U.S.’s strong anti-China policies.

- We believe there is still substantially less than a 50% chance that Putin would use a nuclear weapon or start a dangerous escalation toward it.

- Nevertheless, the Chinese diplomatic messaging probably resonates more in Europe than it would in the U.S. That highlights the ongoing challenge the U.S. will face in keeping the Europeans on board with a tougher approach to China’s geopolitical aggressiveness.

Japan: Auto giant Toyota (TM, $160.47) announced it has made a technological breakthrough that will allow it to halve the size, cost, and weight of solid-state batteries for its electric vehicles by 2027 or 2028. The company said electric vehicles with its new batteries could have a range of over 600 miles and be able to re-charge in 10 minutes or less.

- The announcement serves as a reminder that electric vehicle technology remains in flux.

- As we’ve been writing, China appears to be in the driver’s seat with electric vehicles at the moment. However, its leadership is not necessarily guaranteed for the long term.

- That’s especially true if Western governments restrict Chinese vehicle imports and new, more competitive technologies are developed in the West.

South Korea: The government today announced it will allow new entrants into the country’s banking market for the first time in three decades. The new policy will allow more online banks, permit commercial bank licenses for existing financial firms, and ease the loan-to-deposit rules for local branches of foreign banks. The government said the aim is to spur competition after President Yoon Suk Yeol criticized existing banks for enjoying a “feast of bonuses” and “easy” profits as interest rates rise.

South Korea-North Korea: A joint U.S.-South Korean analysis of debris from North Korea’s failed spy satellite launch in May indicated the craft’s surveillance capabilities weren’t military grade in any case. Although North Korea garners a lot of headlines with its high-profile weapons advances, the findings are a reminder that Pyongyang’s actual capabilities may be less than meets the eye.

Guatemala: After a center-left candidate and an anti-corruption reformer appeared to win the first-round presidential election in June, the country’s top court has ordered a suspension of the official results. The move has raised suspicions that Guatemala’s political and business elites may be trying to ensure a place for the governing party’s candidate, Manuel Conde, in the two-person run-off election next month. A victory by Conde would likely preclude any meaningful improvement in the country’s corruption, crime, and political polarization, which have prompted large numbers of Guatemalans to try to emigrate to the U.S.

U.S. Re-Industrialization: In data released on Monday, overall construction spending in May was up a healthy 2.4% from the same month one year earlier. Private residential spending was down 10.8% on the year, but public works spending was up 13.3%. Even more impressive, private nonresidential construction spending, a proxy for commercial construction, was up 19.6%, marking the fifth straight month of year-over-year increases at that level or above.

- As we discussed in our most recent Bi-Weekly Asset Allocation Report, the recent jump in commercial construction comes in large part from booming factory construction. To be more precise, much of that increase is being driven by new manufacturing facilities for electrical and information-processing goods like electric vehicles, electric vehicle batteries, and semiconductors.

- We continue to believe the jump in factory construction is early statistical confirmation that the U.S. is in a period of re-industrialization as companies shift much of their production back home from Asia or other foreign locales. We think re-industrialization will create equity opportunities in the broad industrial sector, in construction firms and the service companies that support them, in providers of manufacturing materials and equipment, and potentially even in industrial real estate firms.

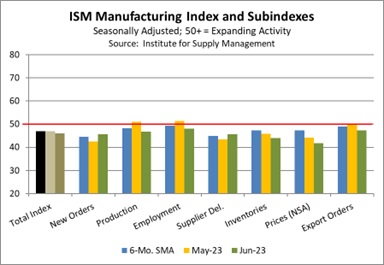

U.S. Manufacturing Sector: Despite the burst in factory construction, actual manufacturing activity continues to weaken. The Institute for Supply Management on Monday said its June ISM manufacturing index fell to a seasonally adjusted 46.0, short of expectations and down from 46.9 in May and 47.1 in April. As with all major purchasing managers’ indexes, the ISM index is designed so that readings below 50 point to contracting activity. All the key subindexes are now below that standard, but the real drivers of the overall decline in June came from deepening contractions in production, employment, and inventories. We believe that confirms a sharp slowdown in factory activity, consistent with the overall economy edging toward recession.

Global Fund Management: The Financial Stability Board and the International Organization of Securities Commissioners have issued guidance saying that funds investing in hard-to-sell assets such as property should charge clients for withdrawing their cash to discourage a rush for the exit in times of stress. The recommendation is especially pertinent as investors today worry about the value of office buildings amid rising interest rates and work-from-home challenges. Some major fund managers have already implemented such policies.

LIBOR’s Demise: For one final time, we also want to remind investors that use of the London Interbank Offering Rate, or LIBOR, ended on Friday. We provided a detailed analysis of LIBOR’s demise and its implications in our Comment on Friday, but to reiterate the main points:

- The Federal Reserve and other regulators moved to end LIBOR and shifted to the Secured Overnight Financing Rate (SOFR) as of Friday.

- One important implication is that the market therefore loses the “TED Spread,” or the spread of Eurodollar yields versus T-bill yields. For years, the TED Spread was one of the key indicators of market stress. The SOFR/T-bill spread will not likely exhibit the same characteristics as the TED spread.

- Bank loans will also lose a buffer. Bank loans are often tied to LIBOR as a base rate. A typical floating loan is LIBOR plus a spread. Since LIBOR rates would rise during periods of financial stress, banks were provided a modicum of protection from such events. Since SOFR is collateralized, the rate relative to the risk-free rate shouldn’t rise when credit conditions deteriorate, so we would expect loan pricing to eventually change to reflect the shift.

- Credit lines could be utilized more frequently during periods of stress. Banks routinely issue credit lines to corporate borrowers, assuming few will use them. Tying the credit line to a LIBOR rate tended to discourage credit line use because (as noted above) the LIBOR rate would rise when credit conditions weakened. Since SOFR is secured, the rate probably won’t rise when stress emerges, which may encourage the use of credit lines just at the moment when banks would rather see them lay dormant.