Daily Comment (July 30, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning, all! U.S. equities appear to be headed for a lower open this morning. Equities have fallen due to concerns over the tech sector as investors fear disappointing earnings reports and a continued tech crackdown by China. Our report begins with a discussion on the debt ceiling followed by international news, where Russia fines a U.S. tech company and Peru has a new prime minister. U.S. economics and policy news are up next, including details about the infrastructure bill and a possible replacement for LIBOR. China news follows, and we end with our pandemic coverage.

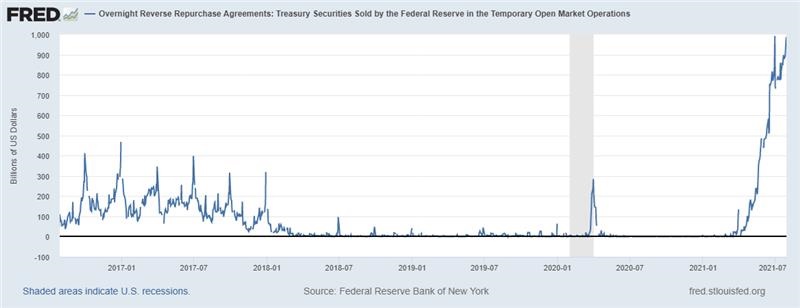

Debt ceiling: On Saturday, the agreement that allowed for the temporary suspension of the debt ceiling will be lifted and the new ceiling will be set at the debt level as of tomorrow. The reimposition of the debt limit means that the Treasury will be limited in its capacity to issue new debt. As part of the suspension agreement, the Treasury is required to reduce its cash balance to $450 billion; it is currently around $700 billion. This element of the agreement was designed to prevent the administration from piling up cash in advance of the deadline, which would have reduced the leverage that comes from the debt ceiling. To reach that level, the Treasury has been curtailing the size of its T-bill auctions. We are already seeing the effects of the deadline as short-term interest rates have continued to drop and the Fed’s reverse repo facility has been unusually active.

This chart shows the borrowing made in the Fed’s reverse repo window. Borrowing is currently at $1.0 trillion. Institutions are lending at this facility due to the lack of opportunities elsewhere. Current rates on short-term instruments are running around 5 bps; the interest paid on reserve balances, which is the rate at which the Fed conducts its reverse repo facility, is 15 bps. Although the returns are minuscule, the 10-bp margin is attractive to other alternatives.

As noted above, to reach the $450 billion level, the Treasury has been issuing fewer T-bills than what is expiring, which means available collateral has declined. Although short-term interest rates are falling, paradoxically, it may lead to even less lending. T-bills are used as collateral for shadow bank activities and the lack of supply means less collateral is available for lending. The financial plumbing of the short-term interest rate markets is complicated and the likelihood of a financial accident under these conditions is elevated.

International news:

- Google (GOOGL, $2,715.55) was fined by the Russian government for not keeping personal data belonging to Russian users on servers in Russia. Google will have to pay $41,000 to the Russian government and could face additional penalties going forward.

- Newly elected Peruvian President Pedro Castillo named a far-left party member as his prime minister. Guido Bellido, who is also recently elected, has never held public office and has shown support for communist governments. Castillo’s decision to pick Bellido reinforces concerns that he may implement more leftist policies to the dismay of international investors.

- Tunisia is in turmoil following the president’s decision to suspend parliament and seize executive power earlier this week. Tunisian President Kais Saied’s power grab has sparked concern that democracy in the country is in jeopardy. The president’s takeover comes after weeks of anti-government protests due to a weak economy and a surge of coronavirus infections.

- Natural gas prices in Europe are expected to increase as a slowdown in European production and Russia’s refusal to send additional supply have led to shortages throughout the continent.

Economics and policy:

- In preparation for the financial system’s move away from LIBOR, the Alternative Reference Rates Committee (ARRC) has endorsed the usage of Secured Overnight Financing Rate (SOFR) as the new benchmark interest rate. ARRC was created in 2014 by the Federal Reserve to oversee the transition away from LIBOR.

- President Biden has asked Congress to extend the federal eviction moratorium, which is set to expire on Saturday.

- Food and beverage makers have warned that they will keep raising prices in response to shortages in materials and labor. So far, the firms have only been able to raise prices abroad in places like Latin America, Russia, and Turkey. Prices in North America and Europe have remained low due to these companies’ contract commitments with major retailers. That being said, as the older contracts run out they will likely be replaced with ones using the updated pricing scheme.

- The Committee for a Responsible Federal Budget found that the pay-fors in the infrastructure budget deal may be overstating the level of funding. Their report concludes that much of the savings the bill relies on to fund the spending has already taken place.

- The infrastructure bill is expected to increase the IRS’s ability to surveille crypto investors. The bill will require crypto investors and brokers to report all transactions for trades above $10,000.

China:

- Regulators from China held talks with global investors to alleviate concerns of a regulatory crackdown on Chinese tech companies listed abroad. The call led to a temporary rise in Chinese shares due to officials not offering any reassurances that the crackdown will not expand to other companies.

- A militant group that is affiliated with Al-Qaeda has sought to establish a state within Xinjiang. The group remains present in Afghanistan and is viewed as a threat to Chinese interests. China has warned its citizens to leave Afghanistan, citing concerns over the security situation.

- China insisted that it will not allow EU diplomats to visit Xinjiang if they continue to insist on visiting jailed the Uyghur scholar, Ilham Tohti. European leaders have demanded to speak with Tohti as they seek to get a better understanding of the treatment of Muslim minorities in Xinjiang. China has characterized the EU’s insistence on talking with the jailed activist as disrespect for its sovereignty.

COVID-19: The number of reported cases is 196,741,728 with 4,201,788 fatalities. In the U.S., there are 34,754,668 confirmed cases with 612,129 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 397,464,625 doses of the vaccine have been distributed with 344,071,595 doses injected. The number receiving at least one dose is 189,945,907, while the number of second doses, which would grant the highest level of immunity, is 163,739,916. The FT has a page on global vaccine distribution.

- An internal presentation from the Center for Disease Control and Prevention acknowledged that “the war” against the coronavirus has changed. The presentation states that the delta variant can spread as easily as chickenpox, causes more severe illness, and the vaccinated can transmit the strain as easily as those who are unvaccinated.

- President Biden announced on Thursday that all federal employees either need to be vaccinated or submit to regular testing and practice social distancing. New York Governor Andrew Cuomo issued a similar order. In addition, President Biden has requested state and local governments to make $100 payments to every newly vaccinated American.

- The European Union has outpaced the U.S. in vaccine doses per 100 people according to Our World in Data. The rise in vaccinations highlights the growing struggle the U.S. has had in recent months to get more people vaccinated as well as the EU’s improvement. Spain, one of the countries most affected by the coronavirus, has now reached 56.9% of full vaccinations, which is among the highest in the world.

- Israel will offer a third shot of the Pfizer vaccine to people over 60 in an attempt to halt the surge in infections from the delta variant.

- Washington, D.C., will require all people regardless of vaccination status to start wearing a mask indoors.

- Local government offices in Florida have decided to reimpose mask mandates as the delta variant continues to spread throughout the state.

- India has seen an uptick in COVID-19 cases on Friday as the country continues to struggle to contain another wave of infections.

- In Australia, the army has been sent out to neighborhoods to ensure that people who have tested positive for the virus remain isolated.

- Japan has expanded its state of emergency to include four more areas as the country continues to struggle to slow the spread of the delta variant.