Daily Comment (July 3, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with energy news, including further oil output cuts by Saudi Arabia and Russia, as well as a spate of negative prices for wholesale electricity in Europe. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including further EU support for “de-risking” its supply chains with China and yet another significant strike in the U.S. labor market.

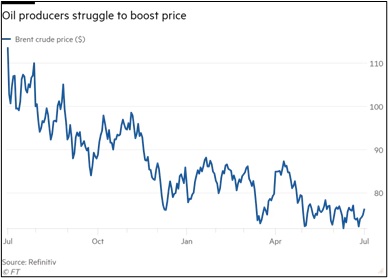

Global Oil Market: The governments of Saudi Arabia and Russia today announced they will further cut their oil production in August to boost prices as global demand slows. Russia alone will cut its output by an additional 500,000 barrels per day. Nevertheless, slowing economic growth and expectations of a recession in the U.S. continue to weigh on prices for oil and some other commodities. So far this morning, nearby Brent crude futures are trading at $76.03 per barrel, up just 0.8% on the day.

European Union: Another commodity with weak pricing these days is wholesale electricity in the EU. Prices were negative for much of the weekend and for an entire day in Germany, reflecting ample natural gas supplies and a surge of new solar and other green energy sources amid sunny weather. The negative prices can complicate finances for utility firms and will likely spur more interest in batteries and other storage mechanisms.

European Union-China: At their summit on Friday, the EU’s 27 national leaders formally supported European Commission President Von der Leyen’s call to “de-risk” supply chains with China. Although the leaders also stressed that they don’t want to completely “de-couple” from China, the statement illustrates how EU leaders continue to shift toward the U.S. position of taking a stronger stance toward China’s political, economic, and military aggressiveness. As we have noted many times before, these de-risking policies and China’s reaction to them are growing risks for investors.

- On a related note, the Dutch government has tightened its restrictions on selling advanced semiconductor manufacturing equipment to China, as requested by the U.S. Starting September 1, top equipment maker ASML (ASML, $724.75), which is headquartered in the Netherlands, will be required to get a license before selling its most advanced immersion deep ultraviolet (DUV) lithography systems to customers in China.

- On China’s side, the country’s new anti-espionage law went into effect on Sunday. The law potentially criminalizes the release of even basic economic and corporate financial information. It also could compel locally employed Chinese nationals of Western companies to assist in Chinese intelligence efforts.

China: The Communist Party has named Pan Gongsheng, head of the State Administration of Foreign Exchange, to be its new party chief at the People’s Bank of China. Not only does the appointment highlight how President Xi has pushed for stronger party representation in public and private organizations, but it has also raised speculation that the central bank could be preparing to defend the renminbi, which has recently weakened to a seven-month low against the dollar.

Brazil: The country’s top electoral court on Friday convicted right-wing Former President Bolsonaro of abusing his political power and misusing the media ahead of last year’s election. The decision bans Bolsonaro from running again for any political office until 2030, which would likely end his political career, but the former president is likely to appeal to the Supreme Court. In sum, the electoral court’s decision and ongoing criminal investigations against Bolsonaro suggest the Brazilian investment environment will remain unstable in the near term.

U.S. Labor Market: Thousands of hotel workers in Los Angeles went on strike for higher pay and better benefits yesterday. Along with the many other strikes we’ve reported on recently, the hotel workers’ strike reflects the increased cost of living and workers’ realization that they have greater bargaining power amidst today’s labor shortages.

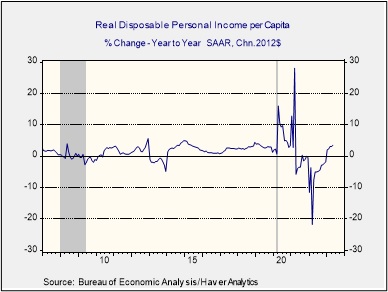

- Over much of the last two years, galloping price inflation was more than enough to offset the jump in wage rates. The resulting drop in inflation-adjusted compensation or “real” purchasing power goes far toward explaining today’s worker activism, low consumer sentiment, and the Biden administration’s low approval ratings.

- We would note, however, that the modest cooling in inflation in recent months has started to boost real income. This chart shows that disposable personal income (i.e., income after taxes) is now up about 3.5% year-over-year even after stripping out taxes. That could potentially cool worker dissatisfaction and help Biden politically going forward.

U.S. Travel Market: AAA estimates that 43.2 million people will travel by automobile for the Independence Day holiday this year, which is 4% higher than the previous all-time high of 41.5 million in 2019. The organization’s analysis suggests the jump in travel will come largely from the fact that gasoline prices this year are about 30% lower than their peak early last summer, at a national average of $3.49 per gallon.

U.S. Student Loan Market: Despite the slowdown in inflation and the jump in consumer purchasing power at the present, we’re increasingly focused on the risk that consumption demand could suddenly slow in October, when the pandemic-era pause on student loan repayments ends and 27 million people have to start writing those checks again. In addition, the Supreme Court on Friday invalidated President Biden’s student loan forgiveness plan, which would have cancelled up to $20,000 of debt for some particularly low-income borrowers. Even though the administration is reportedly working on rules to ease the transition back to normal, the shock of sudden new debt service payments could well undermine consumption spending and finally bring about the recession that we’ve been expecting for some time.

LIBOR’s Demise: Finally, we think it’s important to remind investors that use of the London Interbank Offering Rate, or LIBOR, ended on Friday. We provided a detailed analysis of LIBOR’s demise and its implications in our Comment on Friday, but to reiterate the main points:

- During the Great Financial Crisis, it was discovered that banks were manipulating their reported interest rates to help their respective institutions and, in the most egregious cases, encouraging other banks to do the same as “a favor.” Because LIBOR was the rate tied to the Eurodollar futures market, this manipulation ran afoul of U.S. commodity trading regulations. In the wake of the scandal, the Federal Reserve and other regulators moved to end LIBOR and shifted to the Secured Overnight Financing Rate (SOFR) as of Friday.

- One important implication is that the market therefore loses a key data point. For years, one of the key indicators of market stress was the T-bill over Eurodollar spread, commonly called the “TED spread.” Since LIBOR represented non-government guaranteed dollar deposits, there was credit risk embedded in the rate. Market participants began to notice that when credit stress developed in the financial markets, the TED spread would widen, with LIBOR rates rising above T-bill rates. The SOFR/T-bill spread will not likely exhibit the same characteristics as the TED spread, meaning that traders and investors will lose the TED spread as a market indicator.

- Bank loans will also lose a buffer. Bank loans are often tied to LIBOR as a base rate. A typical floating loan is LIBOR plus a spread. Since LIBOR rates would rise during periods of financial stress, banks were provided a modicum of protection from such events. In other words, the rate on LIBOR-based loans would rise as stress levels rose. Assuming the borrower remains current, the rise in the loan’s rate would exceed the level of the risk-free rate by a wider margin. This protection would allow banks to offer more competitive rates to borrowers, knowing that the lender had some protection from financial stress events. Since SOFR is collateralized, the rate relative to the risk-free rate shouldn’t rise when credit conditions deteriorate. Eventually, we would expect loan pricing to change to reflect the shift.

- Credit lines could be utilized during periods of stress. Banks routinely issue credit lines to corporate borrowers, assuming few will use them. Tying the credit line to a LIBOR rate tended to discourage credit line use because (as noted above) the LIBOR rate would rise when credit conditions weakened. Since SOFR is secured, the rate probably won’t rise when stress emerges, which may encourage the use of credit lines just at the moment when banks would rather see them lay dormant.