Daily Comment (July 26, 2018)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT]

A deal…sort of: President Trump and EU Commission President Juncker announced a trade deal has been reached.[1] Equities rose, interest rates moved higher and the dollar eased as investors took the news as a “risk-off” event. We were surprised by the outcome. And, on its face, it looks like the EU “blinked.” However, it should be noted that the “deal” is really nothing more than an opening for negotiations. Trade negotiations usually have excruciating detail and that isn’t what this meeting was about. Still, the outcome suggests the Europeans have concluded that the costs of a trade war are too high and they must accept some concessions. The problem will be that all member states of the EU have to agree on any changes and it is very hard to get an agreement passed. The recent free trade deal with Canada and the EU took years to finalize and Italy continues to threaten to scuttle the agreement. But, for now, this is good news.

Here are the “sort of” issues: Existing tariffs are apparently excluded from negotiations. Thus, the tariff on imported light trucks will remain in place as will steel and aluminum tariffs. Nothing will change on agricultural trade except for soybeans, which is the only part of this trade that Juncker has any authority. It should be noted that Europe was poised to buy more soybeans anyway because China’s trade restrictions will essentially shift global oilseed trade. South America will become the primary supplier to China but the oilseeds that would have been sold to Europe and elsewhere will now be supplied by the U.S. The EU already doesn’t have tariffs on U.S. LNG. However, the U.S. can’t sell LNG to any nation where it doesn’t have a trade agreement in place. As a result, there is an incentive for some sort of agreement on this issue alone. The EU is already building regasification facilities so any concession made by Juncker on this issue really isn’t a concession. We note that LNG isn’t competitive with piped gas from Russia; Juncker has been a proponent of building LNG import facilities to diversify supply sources but the idea that the U.S. will send lots of LNG to Europe is probably misplaced.

In other words, the deal announced yesterday is much less than meets the eye. We do note that Peter Navarro was nowhere to be seen in these negotiations but Larry Kudlow was involved. We (and others) have noted the divide in the administration between the anti-trade wing (Navarro and Lighthizer) and the pro-trade wing (Kudlow and Mnuchin). The two sides seem to rise and fall in influence. It is quite possible that rising criticism from GOP congressmen toward the administration’s trade policy led to a return of the pro-trade wing. But, there is no guarantee that this will last.

Another item we are watching comes from what we would characterize as ill-advised post-meeting comments from Juncker. The president of the EU Commission touted a “major concession” from the U.S. on autos.[2] It is rarely productive to suggest a “win” over President Trump because he seems to view the world as a zero-sum game. Thus, a Juncker “win” means a Trump “loss.” We would not be surprised to see a pushback on Juncker’s comments.

ECB: The ECB held its regular meeting. There was no change in policy. Interest rates were held steady. The central bank will stop buying bonds in December but will continue to reinvest maturing bonds, meaning the balance sheet will remain steady. The ECB plans to consider raising rates by the summer of 2019. The only item of note in the press conference was that President Draghi suggested there are no signs of accelerating inflation. The EUR weakened modestly on the news; the currency rallied on yesterday’s trade news so some of the “give back” may simply be due to a more sober view of the aforementioned trade agreement and less about the ECB meeting.

Pakistan elections: We haven’t spent a lot of time on this election but Imran Khan is likely to become the new prime minister. As is common in emerging nations, there were widespread accusations of voting irregularities. Khan is a former professional cricket player; in general, civilian leaders in Pakistan are constrained by the powerful military, so we have doubts that a new leader will foster significant changes in policy.

Energy recap: U.S. crude oil inventories fell 6.1 mb compared to market expectations of a 3.1 mb draw.

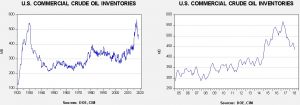

This chart shows current crude oil inventories, both over the long term and the last decade. We have added the estimated level of lease stocks to maintain the consistency of the data. As the chart shows, inventories remain historically high but have declined significantly since March 2017. We would consider the overhang closed if stocks fall under 400 mb. This week’s decline occurred because of a decline in imports which offset another unexpected drop in refinery operations. The slower refining activity led to a drop in gasoline stocks. We would expect a rebound in refining activity next week which will probably bring a drop in oil inventories.

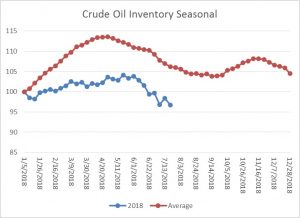

As the seasonal chart below shows, inventories are well into the seasonal withdrawal period. This week’s drop in stocks was consistent with seasonal patterns. If the usual seasonal pattern plays out, mid-September inventories will be 399 mb.

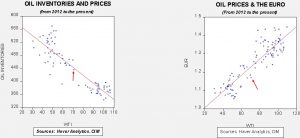

Based on inventories alone, oil prices are near the fair value price of $72.65. Meanwhile, the EUR/WTI model generates a fair value of $61.05. Together (which is a more sound methodology), fair value is $64.69, meaning that current prices are above fair value. Currently, the oil market is dealing with divergent fundamental factors. Falling oil inventories are fundamentally bullish but the stronger dollar is a bearish factor. It should be noted that a 399 mb number by September would put the oil inventory/WTI model in the high $80s per barrel. Although dollar strength could dampen that price action, oil prices should remain elevated.

Saudi suspension: Saudi Arabia has temporarily suspended oil shipments through the Bab-el-Mandeb Strait in the southern part of the Red Sea. According to reports,[3] two tankers owned by the Saudi National Shipping Company were attacked by Houthi forces. The tankers suffered minor damage. The Bab-el-Mandeb Strait is one of the global oil chokepoints. About 4.8 mbpd of oil and product flow move through this strait daily, which makes it the fourth most trafficked of the listed chokepoints. Thus, this action is important but it is probably (a) temporary, and (b) likely offset by other flows. We note that Brent crude oil prices rose this morning but there was little effect on WTI.

[1] https://www.washingtonpost.com/business/economy/trump-pushes-25-percent-auto-tariff-as-top-advisers-scramble-to-stop-him/2018/07/25/f7b9af04-8f8a-11e8-8322-b5482bf5e0f5_story.html?utm_term=.b9940dc840bf&wpisrc=nl_todayworld&wpmm=1

[2] https://www.politico.com/story/2018/07/25/trump-juncker-trade-concession-tariffs-1661543

[3] https://www.ft.com/content/f0858962-9005-11e8-b639-7680cedcc421