Daily Comment (July 25, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with China news, including signals of economic support from a meeting of the Communist Party’s Politburo. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including a discussion of the U.K.’s high interest burden and a new survey on the attitudes of U.S. retirement investors.

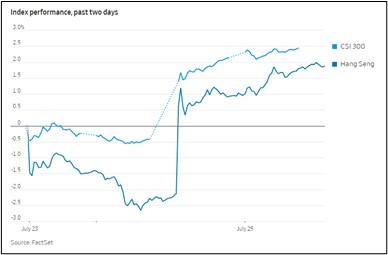

China: At its monthly meeting yesterday, the Communist Party’s powerful Politburo took a number of key decisions that could have sweeping impacts on the Chinese economy and foreign relations. Most important for investors, the Politburo acknowledged the headwinds holding back economic growth, announced its intent to address them, and signaled several measures related to key sectors. The measures did not include the major fiscal stimulus that many investors have come to expect in China, but they did include promises to increase the number of affordable housing units built and signaled that the government will loosen its restrictions on buying homes for investment purposes. Even though the announced measures were modest, the positive tone of the announcement has given a strong boost to stocks in China and Hong Kong so far today.

- Separately, Pan Gongsheng was named as the new chief of the People’s Bank of China, less than a month after being named as the central bank’s Communist Party chief. The appointment of Pan, who was previously the head of the State Administration for Foreign Exchange, will further solidify President Xi’s control over the institution.

- Finally, Chinese state media said top party foreign affairs official Wang Yi would reclaim his prior job as foreign minister, replacing Qin Gang, the fast-rising protégé of President Xi who was China’s ambassador to the U.S. until he was named foreign minister this spring. Qin hasn’t been seen in public for about a month, so speculation has been high that he might be in trouble. The announcement merely said that he had been replaced for “health reasons.”

China-United States: After CIA Director Bill Burns said in a speech last week that his agency was making progress in rebuilding its spy network in China, the Chinese foreign ministry yesterday issued an angry statement denying that China spies on the U.S. and vowed to protect itself from the CIA’s efforts. The Burns statement referred to a catastrophic loss of CIA agents in China between 2010 and 2012 due to a mole at the agency.

China-India: The Indian government has rejected a bid by leading Chinese electric-vehicle maker BYD (BYDDY, $68.55) to build a car and battery factory in Hyderabad, citing security concerns. The rejection reflects India’s tough stance on trade with China following the two countries’ Himalayan border skirmishes three years ago. The rejection also throws a wrench in BYD’s effort to rapidly build up its foreign sales under Beijing’s “Made in China 2025” industrial plan. In response, Chinese Foreign Minister Wang criticized New Delhi and called for the two countries to “enhance strategic mutual trust.”

Pakistan: The national election commission issued a new, non-bailable arrest warrant for Former Prime Minister Imran Khan, who was ousted last April and arrested on corruption charges in May before being bailed. The new warrant suggests the country will continue to face political instability and mass demonstrations for the foreseeable future.

Israel: As we flagged in our Comment yesterday, Prime Minister Netanyahu and his right-wing coalition pushed a key plank of their judicial reform through the Knesset yesterday. The law, which limits the grounds on which the supreme court can nullify acts of parliament, has sparked mass protests, strikes, and warnings that key businesses will relocate out of the country. In recent years, Israel and Israeli stocks have become investor darlings, but the new political instability and concerns about Israeli democracy threaten to undermine the country’s asset values in the near term.

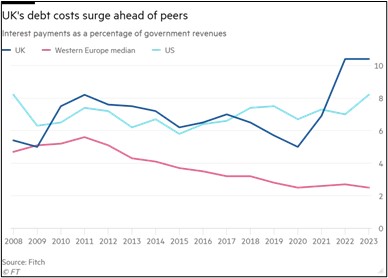

United Kingdom: In a report on government debt burdens around the world, bond rater Fitch said the U.K. will face the highest debt interest burden among major developed countries this year. Because of the central bank’s interest-rate hikes to bring down inflation, high debt levels, and a large proportion of that debt in inflation-protected bonds, the U.K. government will spend an estimated 110 billion GBP on interest in 2023, equal to 10.4% of government revenue.

United States-Russia: The Defense Department said a Russian fighter jet deliberately released flares close to a U.S. drone flying over Syria, causing damage to the U.S. craft. The incident is the latest in a series of moves that suggest Russia is trying to pressure the U.S. into reducing its activity in Syria. In any case, the incidents are further raising U.S.-Russia tensions.

U.S. Monetary Policy: Officials at the Federal Reserve today begin their latest two-day policy meeting, with their decision due to be released at 2:00 PM EDT on Wednesday. Along with most other analysts, we suspect that continued strong wage gains and price pressures will prompt the officials to hike their benchmark fed funds interest rate further after pausing last month. All the same, some other analysts think recent signs of modest economic slowing could convince them to hold rates steady again and simply signal the potential for more rate hikes later.

U.S. Investment Markets: A new survey by BlackRock (BLK, $756.58) found that the share of U.S. retirement savers who feel they are “on track” has fallen to 56%, down from 69% in 2021. The share of savers who feel they are “off track” has more than doubled to 24% in the same period. The changing attitudes reportedly reflect concerns about high inflation and volatile markets. In response, almost 30% of survey respondents said they now plan to work longer than they previously expected to.