Daily Comment (July 25, 2017)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] It’s another quiet summer trading day. Here are the items making news:

The FOMC meeting begins later today: The Fed has created a problem for itself. The U.S. central bank meets every six weeks (or eight times per year), but because it makes four meetings out of each year more important by issuing dots, economic forecasts and holding a press conference, the markets mostly ignore the meetings that don’t have those events. This is one of those meetings. Although the Chair and other FOMC members continue to warn us that all meetings are “live,” that perception isn’t going to change until they actually take significant policy action outside of the meetings with press conferences. So, the Fed finds itself in a situation where it really only meets four times a year. That probably isn’t enough for a major central bank. The solution? Either end the dots and press conferences altogether, add them to all meetings, or make a major policy change at a meeting without a press conference. How does this affect markets? The financial markets are mostly ignoring this week’s meeting and so we could see some volatility if the FOMC actually does something. However, we view the likelihood that anything happens as very low.

German business—I’m so happy! The German IFO index (see below) unexpectedly hit a new record high, with the July number reaching 116.0. The monthly survey of some 7k firms operating in Germany is reaching “euphoria,” according to IFO Chief Clemens Fuest. According to interviews with German firms, the recent rise in the EUR is being managed successfully which probably means further gains in the exchange rate are possible. European equities lifted on the news.

Is shale drilling starting to slow? One feature of the oil market has been the relentless rise in U.S. production. Bloomberg[1] is reporting that Halliburton (HAL, 42.51) warned that exploration companies are “tapping the brakes.”[2] Anadarko (APC, 44.21) fell sharply overnight after reporting a larger Q2 loss than expected. The company announced a cut in its capital budget and its production forecast for next year. If this becomes a trend among other companies, the price pressure coming from shale could ease. This would be good for oil prices in the short run, even though it may not be helpful for oil equities, at least initially.

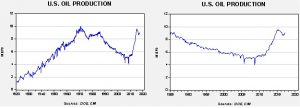

These charts show U.S. oil production with a long-term view on the left chart and production over the past 32 years on the right. Note the lift in production since November 2016. If that production begins to stall, we could see oil prices move higher. We note that oil prices are higher this morning.

China prepares for war? The WSJ[3] is reporting that China is increasing its military presence along its border with North Korea. In some respects, this is merely an update to reports we have been hearing for some time about troop movement on the North Korean frontier. However, the article did note some policy signals from Beijing. China wants to avoid a flood of refugees and doesn’t want a hostile power aligned with the U.S. directly on its border. Thus, the article hints that the People’s Liberation Army (PLA) is likely drawing up plans to invade North Korea to set up a safe zone so that refugees will move there instead of into China, and it also may be taking steps to secure the nuclear facilities. Essentially, if the U.S. attacks, China wants to remove the Kim regime and establish another buffer government, one that can more easily be controlled by the U.S. and China. The danger is that China is making it clear that if the U.S. intervenes militarily in North Korea, the Chinese will as well. This could lead to a bigger war if both sides are not careful in their actions.

China and Russia hold joint naval exercises: The FT reports[4] that Russian and Chinese warships are holding exercises in Baltiysk, the home port of Russia’s Baltic fleet in the Russian enclave of Kaliningrad. China is slowly expanding its naval “footprint” and joining up with Russia clearly gets the attention of the West. The NATO frontier nations, especially the Baltic States, will be watching these exercises closely.

[1] https://www.bloombergquint.com/business/2017/07/24/anadarko-cuts-drilling-plan-as-oil-explorers-bow-to-price-slump

[2] https://www.bloomberg.com/news/articles/2017-07-24/frack-giant-halliburton-adds-1-billion-in-sales-during-recovery

[3] https://www.wsj.com/article_email/china-prepares-for-a-crisis-along-north-korea-border-1500928838-lMyQjAxMTE3ODI4NDkyMDQ0Wj/ (paywall)

[4] https://www.ft.com/content/1dfabf08-7076-11e7-93ff-99f383b09ff9?segmentId=a7371401-027d-d8bf-8a7f-2a746e767d56 (paywall)