Daily Comment (July 21, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment begins with an explanation of why today could be a rocky day for markets. Next, we will discuss two major developments that may reshape international finance. Finally, we will share our thoughts on the Spanish elections occurring on Sunday.

Triple the Effect: A trifecta of events will weigh on market activity on Friday: a reshuffling of a popular tech index, the expiration of option contracts, and the release of corporate earnings.

- The tech-heavy Nasdaq 100 index is undergoing a special rebalance today to address concerns about the weighting of mega tech companies. The index is typically rebalanced quarterly, but an exception was made earlier this month due to the growing dominance of these companies. Boosted by the excitement of artificial intelligence, the top five tech companies now account for over 50% of the index, significantly higher than the 40% cap typically preferred by the providers. The special rebalance will reduce the weightings of these companies and increase the influence of smaller companies. This will likely lead to increased volatility in the market as investors adjust their portfolios accordingly.

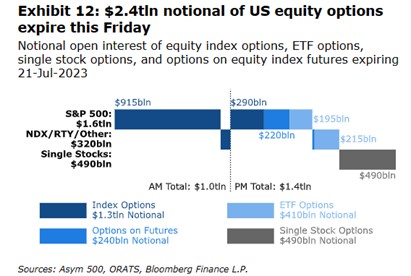

- In addition to the Nasdaq 100 rebalance, an estimated $2.4 trillion worth of options tied to stocks and indexes are set to mature. The expiration of these contracts will likely impact trading activity as investors decide whether they would like to roll over existing positions or start new ones. July has been the slowest month of trading in two years, and there is speculation that investors may be sitting on the sidelines until there is more clarity about the future direction of monetary policy. If investors do decide to roll over their options, it could lead to a surge in trading volume and volatility. However, if investors decide to start new positions, it could lead to more sustained performance.

- Finally, the day is likely to be heavily influenced by corporate earnings releases. Several companies are expected to report their results, including regional lenders Comerica (CMA, $52.93) and Regions (RF, $20.35), as well as credit card company American Express (AXP, $177.11). Comerica and Regions are expected to give insights into the deposit market, important information given the fears of disintermediation. At the same time, American Express’s earnings will provide information on the discretionary spending habits of consumers. The results could have a significant impact on the direction of the market in the coming weeks as it may give investors a better sense of the state of the economy.

Institutional Shifts: The World Bank and the Federal Reserve have made major announcements that suggest both organizations are looking to modernize.

- The Chinese-backed Asian Infrastructure Investment Bank (AIIB) has joined forces with the World Bank. The deal with the AIIB will help alleviate the World Bank’s financial constraints. However, this new partnership is likely to raise eyebrows, as it comes weeks after reports that members of the Chinese Communist Party infiltrated the bank. Suspicions of Chinese involvement in the World Bank led Canada to withdraw its membership from the multilateral organization. The move also comes as the two supranational financial institutions look to restructure the debt of emerging market companies.

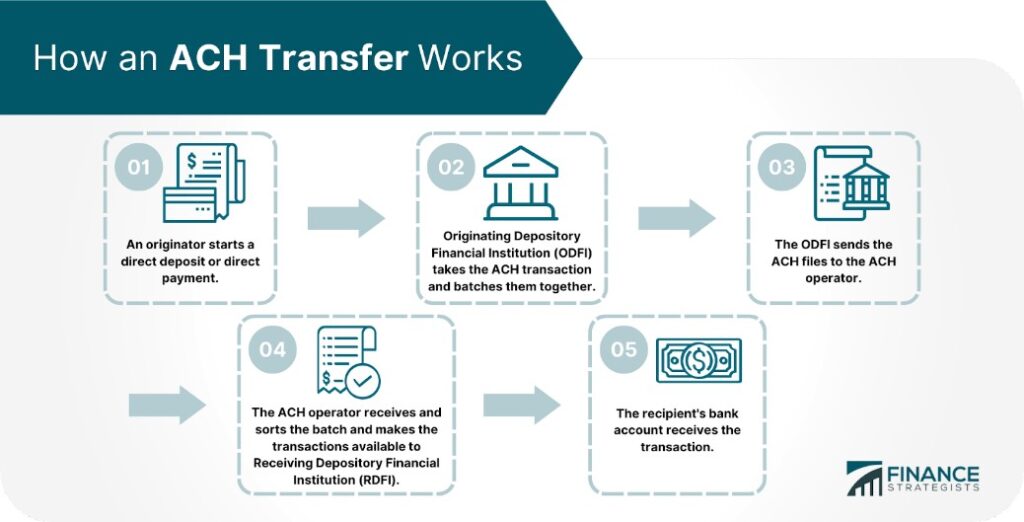

- The Federal Reserve in the United States has upgraded its payment system to make it easier for Americans to transfer money. FedNow is a much-needed shift in a banking system where people still rely on paper checks and cash to send payments through Automated Clearing House (ACH) transfers, which can take several days to process. Although banks still need to sign up for the new system, its implementation is expected to lead to some disruption. The real-time payment system network should increase competition among credit card companies and offer new opportunities for fintech companies.

- These two developments show how the world is slowly adapting to a new normal. China is one of the world’s largest creditors, and its partnership with the World Bank makes sense given its influence in developing countries. Meanwhile, the U.S.’s current payment system is antiquated and needed to be improved to keep up with the demands of a world that is increasingly dominated by digital transactions. Taken together, these reports reflect how difficult it is for the financial system to keep up with changing trends as one could argue that both events should have happened much earlier.

¿A La Derecha? The upcoming Spanish election is widely expected to result in a rightward shift in the country’s political landscape.

- Recent polls suggest that the Popular Party (PP), led by Alberto Núñez Feijóo, is poised to win the most votes in the upcoming Spanish election taking place on Sunday. This would put the PP in a strong position to form a government. However, there is speculation that Feijóo may seek to form a coalition with the controversial Vox party. The far-right group has been accused of racism, xenophobia, and Islamophobia. If Feijóo were to form a coalition with Vox, it would be a significant shift in Spanish politics, as it would give a far-right party a seat in parliament for the first time since the end of Francisco Franco’s rule in 1975.

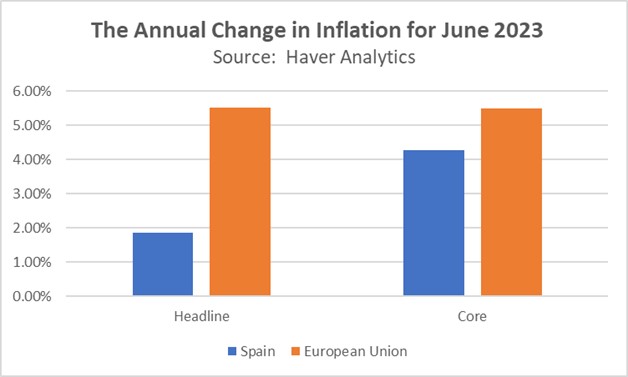

- The rise of populist parties in the European Union is linked to the bloc’s encouragement of unpopular reforms. In Spain, for example, the government barely passed a labor reform in order to unlock pandemic funds last year. Similarly, pressure to push through reforms in Italy helped lead to the ouster of Mario Draghi from the premiership. Meanwhile, French President Emmanuel Macron’s controversial pension reforms have boosted support for his political rival, Marine Le Pen. This situation will likely worsen as the European Central Bank plows ahead with rate increases despite signs that inflation is slowing, and the region narrowly avoided a technical recession in Q2 of 2023.

- The European Union’s inability to adapt to each country’s individual needs is a major weakness that could undermine the bloc’s ability to function in the future. This is evident in the fact that Spain will be subject to tighter monetary policy despite the fact that it is making better progress in its inflation fight than other countries. This lack of flexibility could lead to more populist leaders being elected in the EU, who would likely look to protect their countries’ interests, even if it means going against the bloc. As a result, if this trend continues, it could lead to a much weaker euro in the future.