Daily Comment (July 20, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment begins with our concerns about the banking sector. We then discuss how the war in Ukraine and El Niño could impact Fed policy. Finally, we explain why the recent improvement in U.S.-China relations may be short-lived.

Deposit Flight: While banks have mostly recovered from the March fiasco, disintermediation remains a challenge.

- Three of the country’s biggest banks by assets were able to beat expectations in the second quarter. JP Morgan (JPM, $154.25), Citigroup (C, $47.52), and Wells Fargo (WFC, $46.26) made a combined profit of $22.3 billion going into the year’s second half, thanks in part to hawkish Fed policy. The surge in interest rates have benefited banks in two ways. First, they were able to charge more for loans, which increased their net interest income. Second, the banking crisis in March led to an increase in deposits at major banks as savers fled regional banks. This surge in new clients made it easier for banks to lend out capital. However, it is unclear whether this trend will continue into the third quarter.

- Several major headwinds are expected to plague banks over the next few months. First, as interest rates rise, customers are pushing for more compensation for their deposits. In fact, institutional depositors are already moving their savings to higher-yielding accounts. Second, the prospect of new regulations and loan losses from commercial real estate is forcing banks to shore up their balance sheets. For example, U.S. Bancorp (USB, $38.68) announced that it has increased its Common Equity Tier 1 (CET1) by 60 basis points, offloaded assets, and securitized auto loans in order to reduce its balance sheet exposure. On top of that, banks have noticed that households are holding back on spending, and credit card losses are increasing.

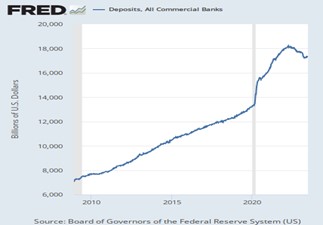

- The good news is that deposits at commercial banks have stabilized since the fall of Silicon Valley Bank. However, these holdings will be under threat as long as the Fed keeps raising rates. Regional lenders are the most sensitive to interest rate changes, as evidenced by the deposit outflows reported by U.S. Bancorp, Citizens (CFG, $31.06), M&T Bank (MTB, $138.08), and Charles Schwab (SCHW, $66.00) in the second quarter. Even Bank of America (BAC, $31.40), the second-largest bank by assets, saw a deposit flight. If bankers are forced to pay more on deposits, it could lead to even higher borrowing costs and further weigh on consumer spending. As a result, we are still paying close attention to the banking system.

It’s Hot in Here: Adverse weather conditions and the war in Ukraine could complicate Fed efforts to ease monetary policy.

- Temperatures in the United States, Europe, and Asia have reached record highs this year, driven by relatively strong El Niño conditions. Global ocean temperatures have exceeded the 20th-century average by 1.89 F, according to the National Oceanic and Atmospheric Administration. The unusually hot weather has pushed up energy consumption in the United States, with power demand in Texas and Arizona expected to set records. The unprecedented heatwave has also led to wildfires in Greece and Canada. Additionally, there are concerns that poor conditions could hurt crop yields.

- At the same time, the war in Ukraine is also leading to uncertainty regarding food prices. On Wednesday, Russia announced it would consider all vessels headed to Ukrainian ports to be military threats. The declaration comes a week after Moscow pulled out of the Black Sea grain deal. Wheat futures surged 8% following the report as investors expect grain supply to fall. So far, grain prices remain lower than at the start of the year; however, they could rise if shipments are disrupted or become more expensive to insure. This may lead to an increase in food inflation just as cost pressures were trending downward.

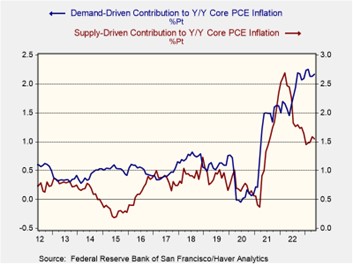

- Adverse weather conditions and the war in Ukraine are likely to dissuade talks of policy cuts. Central banks appear to be indifferent as to whether inflation is supply- or demand-driven. They are instead focused on containing price pressures, regardless of the source. As the chart above shows, most of the progress made in U.S. inflation has come from supply-side factors. Hence, supply disruptions could reverse some of the gains made in the inflation fight. While this does not necessarily mean that they will continue to raise interest rates, they are less likely to consider a cut if there is a chance of inflation accelerating.

There Is a Glimmer: Despite ongoing friction between the two global superpowers, there are signs that both sides are willing to de-escalate and avoid direct conflict.

- The U.S. and China are taking tentative steps to improve relations while trying to avoid actions that could provoke the other side. On Thursday, Washington officials rebuked Taiwanese presidential frontrunner Lai Ching-te’s assertion that his country’s political goal is to “enter the White House.” The “One China” policy prohibits top Taiwanese officials from making official visits to Washington. Meanwhile, Beijing has finally started holding diplomatic talks with U.S. representatives. Special Presidential Envoy John Kerry agreed with his Chinese counterpart to continue to hold discussions about climate change goals. Additionally, Chinese President Xi Jinping met with former Secretary of State Henry Kissinger to discuss warmer U.S.-China ties.

- That said, the two largest economies in the world will continue to take steps to protect their own interests. On Wednesday, China’s envoy to Washington warned that his country would respond if the U.S. proceeds with pushing through laws that hurt China’s advancement in military technology. The threat comes amidst speculation that the Biden administration is considering limiting investment into companies linked to the Chinese defense industry. Although White House officials maintain that the restrictions will be limited in scope, it is possible that the measure could pave the way for more discussion regarding the topic, especially going into the 2024 election.

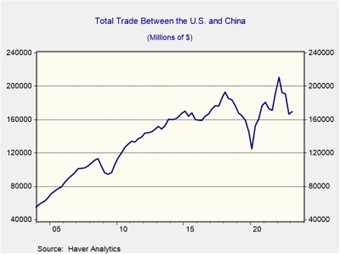

- A deceleration in the global economy is likely to slow the pace of the decoupling between the United States and China, but it is unlikely to disrupt it entirely. The two countries are deeply interconnected, and both would suffer if there were a complete break in economic ties. China’s economic recovery will receive a boost from an increase in exports to the United States and maintaining access to China’s supply chains and materials will help the United States with its green energy transition and prevent trade disruptions. However, trade between the two countries is unlikely to return to its pre-pandemic pace anytime soon.