Daily Comment (July 18, 2019)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] Global equity markets are trading lower this morning as worries over earnings are pressuring prices. Japan fell on weak export data and the Bank of Korea surprised with a rate cut. Here is what we are watching today:

Fed talk: Perhaps the most important variable in the path of equities this year is monetary policy. The financial markets have built in at least 100 bps of easing over the coming months. The current economy, as noted by yesterday’s Beige Book, doesn’t look weak enough to warrant such strong action. Of course, if policymakers wait until they get unambiguous evidence of economic weakness, they will miss their opportunity to avoid recession. If policymakers key off the financial markets, they do run the risk of the “false positive” and may cut rates when such action isn’t needed. Our position is that the costs for cutting rates too much and too early are low; inflation probably doesn’t become a problem and the real risk is overheating asset markets. And, even the risk there isn’t all that obvious. The risk from financial asset bubbles is usually over-investment as firms use the rising stock market or tighter credit spreads to build capacity, which turns out to be excessive and weighs on future growth. We don’t see that happening, either. The investment reaction to either strong equities or tighter credit spreads has been modest this entire expansion and that factor probably won’t change. The Fed’s leadership may be underestimating the risk of recession to bank independence. When the GOP is pushing to undermine the central bank’s independence, imagine what a left-wing populist would do. To some extent, MMT relies on a central bank that is compliant to the needs of the fiscal authority. So, from where we sit, the risk of easing too much pales in comparison to the risks of reducing rates too slowly or not enough.

However, we carry no illusions that our views matter. Instead, we watch what policymakers do. There remains a fairly large contingent on the FOMC that still relies on some form of the Phillips Curve. These members will have a hard time moving to ease without a rise in unemployment. What this means in practice is if Chair Powell pushes to lower rates, he will need to manage a rising number of hawkish dissenters. If the Fed eases, as expected, at the end of this month, we expect KC FRB President George to dissent. There are others who won’t support the action among the presidents but they don’t vote in this cycle. As a general rule, three dissents are considered a vote of no confidence in a Fed chair, although governors count more in this rule than presidents. The dissents are probably not enough to thwart a move toward easing but the markets will prefer unanimous outcomes.

Stalled trade talks: China wants to know what the U.S. wants. Although there are conversations occurring, there appears to be little progress. According to sources familiar with the U.S.-China trade talks, one reason for their recent lack of progress is that administration officials can’t agree on how to ease restrictions on Chinese telecom equipment firm Huawei (002502.SZ, 3.44). In a major concession to Chinese President Xi at last month’s G-20 meeting, President Trump promised to allow U.S. firms to supply components to Huawei so long as they don’t endanger national security, but officials in the Trump administration are having trouble agreeing on which products meet that standard and wouldn’t give the firm a strategic edge. At the same time, Chinese officials want Huawei off the U.S. “entity list” altogether. The resulting logjam provides more evidence that a final trade agreement is unlikely to be achieved for some time, keeping the issue as a cloud over the markets.

Meanwhile, Larry Kudlow made critical statements about China and the WSJ reports that China’s growth model is fading even excluding the trade tensions. The article suggests that socialism may have undermined China’s growth and prevented it from lifting per capita GDP at a level seen in other Asian nations. Although socialism may have played a role, other factors did as well. The one-child policy, a direct outgrowth of CPC control, gave China an initial lift by reducing its dependency ratio. However, the cost of that policy is being witnessed now as China is aging rapidly and its working age population is beginning to slow. China’s size alone likely played a role too. The U.S. was willing to allow the smaller Asian nations to expand exports for longer because the impact was small in the bigger scheme of things. China doesn’t have that benefit due to its size. Nevertheless, it should be noted that all the Asian growth miracles were based on investment-led development. In all cases, there is a transition that occurs when investment can no longer lead the economy; we would note that Japan was never able to fully make the transition and has been mired in three decades of sub-par growth. In sum, China’s communist system doesn’t make this transition any easier, but no nation makes the transition without trouble. The U.S. transition was seen in the Great Depression.

So, what do we see going forward? We have growing doubts that a deal can be negotiated because we can’t separate out the trade issue from the technology issue. In addition, both sides appear to be overestimating their positions and underestimating their opponents. China may conclude it has a vested interest in stringing out talks and hoping for a new administration in 2020. If we are correct, this issue will remain in limbo and thus be less of a market factor going forward.

In another side note, the WSJ reports that there has been a decline in foreign buyers for U.S. real estate. The National Association of Realtors reports that buying fell by 36% in Q1 compared to the same period last year. It is unclear what is driving the decline. Dollar strength has probably played a role. It is possible that fears of anti-foreign sentiment in the U.S. may be sending this capital flight elsewhere. Or, it is also possible that the amount of capital flight is declining. But, the outcome is a drop in coastal real estate activity.

China: New data shows that Chinese stock buybacks have surged so far this year, with the total through July 17 reaching some $13.6 billion. That’s almost double the total for all of 2018, reflecting an easing of regulations by authorities last year. Stock dilution from new issuance can be a detriment to per-share returns in the emerging markets; in contrast, further increases in buybacks would likely be a positive for Chinese stocks.

Hong Kong: Officials in Beijing are working on a comprehensive strategy to resolve the Hong Kong political crisis, which was sparked by Chief Executive Carrie Lam’s effort to push through a bill allowing extradition to China. The plan, which reportedly would not include the use of military force, will soon be presented to China’s top leadership.

Instex: This is an alternative payments system created by the EU to circumvent U.S. financial sanctions and maintain JCPOA. Russia announced its support for the system, with the clear goal of using it to avoid U.S. sanctions as well. This news may be more than the Europeans were bargaining for as we doubt the EU was planning on the platform becoming a way for rogue nations to avoid sanctions. So far, activity in the platform has been modest at best, but Russia’s actions show the risk of creating mechanisms that might be used for other, more nefarious, purposes.

Libra: Testimony between Congress and Facebook (FB, 201.80) grew contentious yesterday. Rep. Maxine Waters (D-CA) called for a moratorium on the Libra project and was rebuffed. Tech firms are moving into difficult waters; they have generally been given a pass by governments, dazzled by the products and services they offered. However, sentiment has turned to some extent and managing domestic and foreign legislatures and regulators is going to become increasingly difficult. For example, the EU competition commission has hit U.S. semiconductor firm Qualcomm (QCOM, 75.76) with a fine of €242 million for dumping baseband chipsets in the EU market at below-cost prices. That’s the second major EU fine against Qualcomm in the last year, and it continues a long series of EU competition actions against U.S. technology firms. The twist this time? The EU says Qualcomm’s dumping aimed to secure more business with Chinese technology firms Huawei (002502.SZ, 3.44) and ZTE (ZTCOY, 5.77). Separately, at a meeting of G-7 finance ministers in France, U.S. Treasury Secretary Mnuchin continued to complain about France’s new 3% tax on digital services. Mnuchin complained the tax unfairly hits big, dominant U.S. technology firms, while Le Maire stressed that the tax would only be temporary until a broader, international approach to digital taxation is agreed upon by the Organization for Economic Cooperation and Development (OECD).

Debt ceiling: Speaker Pelosi (D-CA) has indicated that the deadline for a deal is Friday. Although the White House and the Speaker have been in close contact, it is still unclear if a deal can be struck. If not, we will likely face a debt ceiling issue. Perhaps a bigger concern is that even if a deal is made, the president may not, in the end, accept it. If a deal can’t be made, we will see automatic spending cuts that will tend to dampen the economy.

International Monetary Fund: The G-7 finance ministers have also been discussing who should replace Christine Lagarde as the head of the IMF. The frontrunners appear to be Jeroen Dijsselbloem, the former finance minister of the Netherlands, and Olli Rehn, the current head of the Finnish central bank. Portuguese Finance Minister Mário Centeno and Spanish Economy Minister Calviño are also in the running. Reflecting Britain’s loss of status amidst its Brexit convulsions, Bank of England Governor Mark Carney didn’t make the short list.

Mexico: President López Obrador has released his plan to bolster the finances of state-owned oil company Petróleos Mexicanos (Pemex) and reverse its flagging production. The plan would include significant tax relief in 2020 and 2021, as well as capital injections from the government. However, private-sector firms would only be allowed to participate in the country’s oil sector through incentivized service contracts rather than the production-sharing joint ventures that had begun to be implemented under a 2014 constitutional reform. Pemex would also push ahead with an expensive new refinery project that many observers think doesn’t make economic sense. The plan is being taken as more evidence that López Obrador really does intend to fully implement the populist, nationalist policies that many investors fear.

Odds and ends: The EU’s alternative to GPS, Galileo, has “gone dark” now for almost a week. Operators have not offered any reason why. The new EU Commission president is likely to face a throng of MEPs essentially trying to leverage her narrow win into their own pet projects. As PM May leaves, she warns against political division.

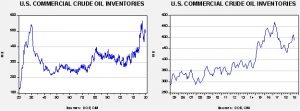

Energy update: Crude oil inventories fell 3.1 mb last week compared to the forecast drop of 2.8 mb.

In the details, refining activity fell 0.3%, modestly less than the 0.35% decline forecast. Estimated U.S. oil production rose by 0.3 mbpd to 12.0 mbpd; Hurricane Barry probably was the reason for the decline. Crude oil imports fell 0.5 mbpd, while exports fell by the same amount. Stocks fell due to the decline in production.

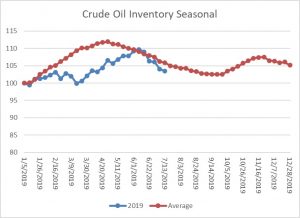

This is the seasonal pattern chart for commercial crude oil inventories. We are now well within the spring/summer withdrawal season. This week’s decline is consistent with the seasonal pattern in terms of direction but was larger than normal.

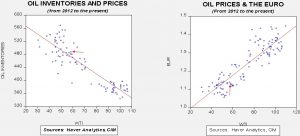

Based on oil inventories alone, fair value for crude oil is $56.02. Based on the EUR, fair value is $52.70. Using both independent variables, a more complete way of looking at the data, fair value is $52.62. We have seen a sharp decline in oil prices in the recent week. There are two factors behind this drop. First, there has been some movement on the diplomatic front with Iran. Rand Paul (R-KY), who leans libertarian and tends to support avoiding global conflicts, may lead a U.S. negotiating team to Iran. It would be unlikely that he would support a war so this news is taking some of the geopolitical risk premium out of the market. However, we do note reports that say Iran’s Revolutionary Guards have seized a foreign oil tanker in the Persian Gulf on grounds that it was smuggling fuel. The tanker appears to be a United Arab Emirates ship that disappeared from radar screens last Sunday. The news has heightened concerns about Iran’s response to new U.S. sanctions over its nuclear program, so global oil prices have jumped.

Second, although oil inventories are declining, product inventories are building which may undercut refining activity.

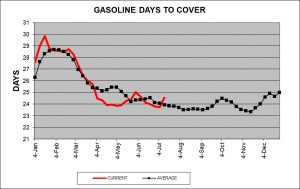

This chart shows the level of inventory divided by the four-week average of consumption, showing how many days of inventory there are available relative to demand. This time of year, the days to cover tend to decline. The ratio rose this week, suggesting product inventories are rising. If they continue to build, especially for gasoline, we would not be surprised to see falling refining activity and lower oil demand.