Daily Comment (July 11, 2019)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

Good Morning! Equities continue to trend higher on Powell’s testimony yesterday. Trade tensions are elevated. The Persian Gulf heats up. Here is what we are watching today:

Powell: The chair returns to the hill today but the second day is usually a repeat of the first. However, if the chair does think the markets got something wrong he will try to steer comments to correct that impression. We don’t expect that to occur today. The comments yesterday were unequivocally dovish and signal a near certainty that there will be a rate cut at the end of the month. Normally, the Q&A session with the chair is two hours of political posturing where little new information is revealed. There was a lot of that yesterday but we did note three interesting exchanges.

- The Phillips Curve took a hit in an exchange with Alexandria Ocasio-Cortez (D-NY), who noted that unemployment has fallen over the past few years without any uptick in inflation. This occurred despite persistent warnings from the Fed that inflation could be around the corner because of tightening labor markets. She got the chair to admit that the Fed’s estimates about the relationship between the labor markets and inflation were incorrect. We will be watching for ramifications from this exchange in the future. In our estimate, the FOMC majority continues to cling to the Phillips Curve, probably because without it they have no clear guidance for setting policy. If the Fed isn’t careful, Congress will give it one. As an example, let’s say the Fed cannot allow the unemployment rate to move above 5%? If inflation is dead (and we think it is, if and only if we remain globalized and deregulated) then targeting the unemployment rate is reasonable. Otherwise, this path will take us back to higher inflation.

- Rashida Tlaib (D-MI) noted that the Fed bought commercial paper during the financial crisis to stabilize that market. Tlaib asked if the Fed could buy municipal paper to help cities and states. Powell suggested the Fed didn’t have the legal authority to do that but we are not sure he is correct. Quantitative easing (QE) is something of a “Pandora’s box” to politicize central banks. The BOJ, for example, has been buying equity products. QE in Europe has led to such distortions that even emerging market European debt markets are now offering negative nominal yields. If the Fed opened its balance sheet to buying municipal bonds, it would likely remove the pro-cyclical nature of state and local government borrowing, which is usually constrained by tax revenue. Essentially, the decision of a central bank to buy one asset but not another politicizes the process of monetary policy. Although QE may have been necessary under the strain of the Great Financial Crisis, the opportunity cost was that the Fed now finds itself mired in political decisions. Since the structure of the Fed is isolated from the voters, such decisions may very well eventually be brought under the purview of the voting public.

- Chair Powell took the opportunity to slam Facebook’s (FB, 202.73) proposed cryptocurrency, Libra, suggesting it could destabilize the financial system. We have been wondering how long it would take before governments begin to figure out that the ability to print money is a key element of sovereignty. Cryptocurrencies fell on the news.

We will be watching to see if the Senate takes up any of these issues. We doubt we will hear too much on the first two points but a return to point #3 is highly likely.

U.S.-China trade talks: There wasn’t much positive news on the trade front. Recent Chinese announcements indicate Commerce Minister Zhong Shan, reportedly a hardliner on trade, has been inserted into the Chinese trade team, potentially signaling that China will be taking a tougher stance in the renewed trade talks. Along with Chinese Vice Premier Liu He, Zhong was reportedly on this week’s phone call with top U.S. trade negotiators in which the Chinese participants declined to offer any specific commitments on purchasing U.S. agricultural products. The call also produced no firm timetable for any upcoming face-to-face meetings between the trade teams. One of the factors that may be slowing talks are the informal but critical CPC meetings that take place at the Chinese seaside resort town of Beidaihe later this month. This annual summer retreat of the CPC allows current and retired officials to discuss issues off the record and Xi may be cautious about taking aggressive trade steps only to face criticism from his “elders.” Another trend complicating matters is that the Trump administration views the trade conflict as a source of political strength going into the elections and therefore may not opt for a deal unless the Chinese capitulate. Paradoxically, Chair Powell’s testimony and expectations of easier monetary policy may support this position; if the president is less worried that a trade conflict will hurt the economy, then he may be willing to string the talks out well into next year. The decision by the administration to meet with Hong Kong activists suggests a hardening of positions.

Iran: Iranian speedboats harassed a British flagged oil tanker yesterday, but the Iranian vessels backed off when a Royal Navy warship intervened. Reports say the H.M.S. Montrose positioned herself between the tanker and the Iranian vessels and forced the Iranians to disengage by training her guns on them, although Iranian Foreign Minister Zarif denied any such incident occurred. The incident follows the British seizure of an Iranian tanker earlier this week on grounds that the vessel was carrying oil to Syria in violation of European Union sanctions. Iran had responded to the seizure by threatening unspecified consequences, and as we reported yesterday, reports said at least one British tanker (apparently the one in today’s incident) had temporarily taken refuge in a Saudi port. The U.S. accused Iran of “nuclear extortion” and promised more sanctions. Iran appears to be steadily ratcheting up its nuclear enrichment but doesn’t seem to be moving rapidly to cross the threshold of a nuclear weapon. The steady enrichment process appears to be a negotiating stance; if talks do occur, Iran can offer to pull back on enrichment in return for sanctions relief, which it clearly needs. The risk to Iran is (a) the U.S. doesn’t really care if it goes nuclear because its missiles can’t reach the U.S. mainland,[1] so sanctions never end, and (b) the U.S. does care and bombs its nuclear sites with greater effectiveness than expected. The potential for escalation remains and this is putting a bid under oil prices.

Broader Persian Gulf security: Today’s U.K.-Iran incident also seems likely to accelerate the current plans for a multi-nation naval operation to monitor and protect shipping in the broader Persian Gulf. Echoing his calls for NATO members to fund more of the alliance’s defense, President Trump has also been calling for oil-consuming countries to contribute more ships to the security effort in the Gulf. However, as in NATO, those countries seem to be slow-walking any additional contributions. For example, Japanese officials today said their contribution to any Gulf protection plan would probably be limited to logistical support, given the country’s pacifist constitution. Researcher Sachi Sakanashi of the Tokyo-based Institute of Energy Economics is quoted today as saying, “(Japan) will prioritize de-escalation over creating tensions by joining the U.S.-led coalition.”

French tech tax: The U.S. has been of two minds on tech regulation. American regulators are concerned about the power, reach and influence of U.S. tech firms and are considering ways to regulate them, including using anti-trust measures. However, these are American firms and the U.S. is clearly uncomfortable with other nations, especially European ones, using state power to affect these companies. The Europeans have mostly missed out on e-commerce and social media and so they can increase the cost of tech firms doing business with little repercussions and so European states have a clear incentive to tax the activities of tech firms. The Macron government is proposing to tax large technology companies; this has caught the attention of the U.S. which is investigating whether such a plan would be considered a hostile trade action. The Trump administration is considering tariff retaliation if the tax is implemented.

Brazil: The lower house of Congress yesterday preliminarily approved President Bolsonaro’s plan to reform the country’s pension plan in order to dramatically cut its cost. The bill received 379 votes in favor and 131 against, suggesting it should also pass on its second and final vote, at which time it would be sent to the Senate for its approval. Even though the bill has been watered down compared with its original version, it is still expected to cut the country’s pension costs sharply and help shore up government finances. The bill has therefore been a strong positive for Brazilian assets recently.

A brewing Italian scandal? There are reports that deputy PM Salvini may have been willing to accept money from Russia to support his political aspirations. Russia’s attempts to affect political outcomes in the West are well known, but it isn’t clear if such a scandal would seriously harm Salvini.

Odds and ends: Merkel’s health continues to be a concern among European leaders. Although U.S. politicians often use European public health systems as an alternative to the private systems in the U.S. the overseas systems are not without issues. Recently, Europe has been suffering through serious shortages of key drugs. Although some of this problem may be due to industry structure, a truism of economics is that if one fixes prices, the risk is that one trades the problem of high prices for the problem of shortages. Finally, one repercussion of legalized pot—a rise in candy and snack demand! Who knew?

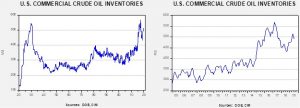

Energy update: Crude oil inventories fell 9.5 mb last week compared to the forecast drop of 2.9 mb.

In the details, refining activity rose 0.5%, above the 0.1% rise forecast. Estimated U.S. oil production rose by 0.1 mbpd to 12.3 mbpd. Crude oil imports fell 0.3 mbpd, while exports rose 0.1 mbpd. Stocks fell on weaker imports and rising refining demand.

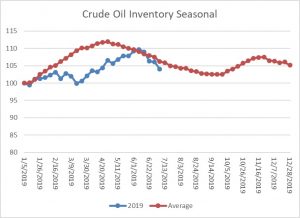

This is the seasonal pattern chart for commercial crude oil inventories. We are now well within the spring/summer withdrawal season. This week’s decline is consistent with the seasonal pattern in terms of direction but was larger than normal.

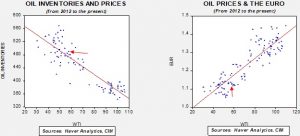

Based on oil inventories alone, fair value for crude oil is $55.03. Based on the EUR, fair value is $52.70. Using both independent variables, a more complete way of looking at the data, fair value is $52.67. Oil prices are getting a bit above fair value, likely due to tensions with Iran and tropical storm worries. However, the market is probably also expecting further declines in inventories given the seasonal patterns; thus, prices are moving higher in anticipation.

[1] This stance creates the same problem for Iran’s neighbors that a nuclear North Korea without ICBMs poses for Japan, China and South Korea.