Daily Comment (July 10, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with multiple China-related reports highlighting the country’s growing frictions with the West and its sharply slowing economy. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including the collapse of the Dutch government and a preview of U.S. bank earnings in the second quarter.

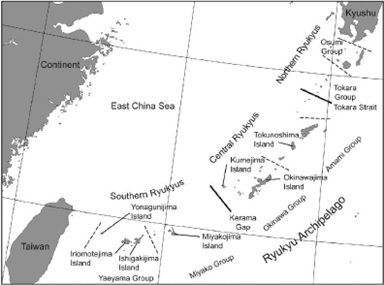

China-Japan: We’ve noted many times that geopolitical tensions between China and the U.S. bloc are in a clear escalatory spiral, and that China’s increased military aggressiveness is a big driver of that spiral. In an important recent example, the People’s Liberation Army naval force sailed its second-largest warship and a destroyer escort through the Osumi Strait, which lies just 40 miles south of Japan’s key island of Kyushu and north of the major U.S. military bases on Okinawa.

- The sailing was unusual because the PLA Navy doesn’t typically use the Osumi Strait to transit to the Western Pacific Ocean. Just as important, the vessel in question was the Guangxi, a Yushen-class, Type 075 amphibious assault ship, which can carry some 800 troops, 60 armored fighting vehicles, and 30 helicopters. Chinese state media trumpeted the transit as the first time a Yushen-class assault ship had “broken the island chain” south of Japan.

- Now that Japan is strengthening its alliances with the U.S., South Korea, and Taiwan, and now that it is rapidly building up its defenses on its southwestern islands, the sailing of the assault ship so close to Japan’s home islands was likely a subtle reminder that China is prepared to take a fight to Japanese territory if necessary.

- Just as concerning, the sailing came just weeks after President Xi gave a speech in which he described China’s historical relationship to the Ryukyu Islands in Okinawa prefecture in the same way he described China’s relationship with Japan’s Senkaku Islands, which China openly claims.

- In other words, it appears that Xi is issuing the following warning to Japan: If you boost your support for Taiwan, South Korea, and the U.S., we will boost our claims on your southwestern islands. To reiterate, this Chinese military aggression will likely feed the current spiral in tensions and further increase risks for investors, especially those investing in China. (And if there’s any doubt about that, one should consider how U.S. voters would react if Guangxi had sailed between Maui and the big island of Hawaii.)

China-India-Philippines: Concerns about China’s aggression also continue to drive countries into the evolving geopolitical and economic blocs. In the latest example, the Indian government for the first time has expressed its opposition to Beijing’s territorial claims against the Philippines. Our analysis still puts India in the “China-Leaning” bloc, but New Delhi continues to slowly align itself more closely with Washington. At the same time, Iran this month formally became a member of the China-led Shanghai Security Organization, which cements Tehran as a key member of the China-led bloc.

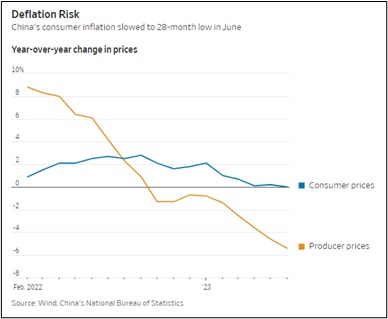

China: Within China, the June consumer price index was unchanged from the same month one year earlier, weakening further after the tepid gains of 0.2% in the year to May and 0.1% in the year to April. The almost nonexistent inflation reflects just how weak Chinese domestic demand has become as the economic recovery from President Xi’s “zero COVID” policy continues to falter. Separately, the June producer price index was down 5.4% year-over-year, reflecting weak demand both at home and abroad. The reports are weighing modestly on the value of global risk assets so far this morning.

Russia-Turkey-Ukraine: Some key “borderland” leaders continue trying to play the China bloc off the U.S. bloc. Over the weekend, President Erdogan allowed the release of Ukrainian prisoners of war being housed in Turkey, evidently reneging on an agreement with Russia, a key member of the China-led bloc. Under Erdogan, the Turkish government has alternatively supported both sides in Russia’s invasion of Ukraine. The release of the prisoners was likely aimed at mollifying the rest of the NATO alliance ahead of its summit this week.

Russia: The Kremlin spokesman today said that just days after Yevgeniy Prigozhin and his Wagner Group mercenaries staged their short-lived mutiny in late June, President Putin met for three hours with Prigozhin and his top subordinates. As more details are provided, we’re hopeful that we’ll get a better read on why Putin has gone so easy on Prigozhin and what it all means for Russian political stability.

Netherlands: The parties in Prime Minister Mark Rutte’s government decided to disband the coalition on Friday after failing to reach an agreement on migration policy. The collapse of the Dutch government means Rutte will now submit his resignation to the king, triggering a new general election in the autumn.

- The collapse also illustrates how migration policy continues to create internal divisions in many European governments. In this case, the key issue was how tight the rules should be for asylum seekers trying to enter the Netherlands.

- These divisions have made some European governments more unstable and have created openings for politicians on the far right of the political spectrum. This increasing instability has the potential to undermine the value of European assets.

Israel: Prime Minister Netanyahu and his far-right government have again launched a judicial reform effort aimed at weakening the power of the supreme court. The new proposal is somewhat watered down from the one the government put on ice in March after mass protests, but it is nevertheless generating calls for new protests and strikes.

Brazil: The lower house of Congress has approved an important tax reform that could greatly improve the country’s investment environment, cut compliance costs for businesses, and boost economic growth. If approved by the Senate, the reform would replace today’s large number of different levies with just two value-added taxes, one federal and the other local. After a transition period from 2026 to 2032, the total VAT rate is expected to be about 25%. The reform is likely to be positive for Brazilian assets going forward.

U.S. Pension Industry: Stephen Meier, chief of the New York City Retirement System, said the increase in bond yields over the last two years has been healthy and will allow him to shift the allocation of his $250 billion portfolio away from equities and toward fixed income, high-yield bonds, and private assets such as private credit and infrastructure. The report didn’t indicate the maturity structure of Meier’s planned fixed income allocation, but we continue to believe that longer-maturity obligations may be valued too richly and stand at risk of more price declines.

U.S. Banking Industry: As they kick off earnings season this week, the nation’s largest banks are expected to report their biggest jump in loan losses and reserves against them since the depths of the coronavirus pandemic. The six biggest banks are expected to show that they benefited to some extent from higher interest rates in the second quarter, but they are also expected to say they had to write off a collective $5 billion in bad loans as borrowers struggled with higher rates and slowing economic growth. They are expected to announce new loan loss reserves of $7.6 billion. Both those figures would be about twice as high as in the second quarter of 2022.

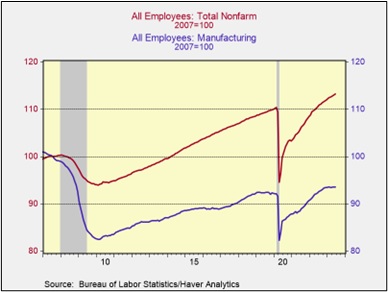

U.S. Labor Market: As usual, our Comment on Friday provided a quick overview of the monthly employment report shortly after it came out. Today, we want to mention one deeper aspect of the report related to our recent argument that the U.S. economy appears to be on the verge of a massive re-industrialization as companies bring production back home from Asia or elsewhere.

- The data show U.S. manufacturing payrolls in June were at their highest level since 2008.

- Nevertheless, factory employment has hit a plateau in recent months.

- We still believe re-industrialization will boost manufacturing jobs in the coming years. Nevertheless, the recent plateau in those jobs is consistent with our view that re-industrialization is just beginning and that the impending recession will hold down factory payrolls in the short term before the full impact of re-industrialization becomes clear in the future.

U.S. Postal Rates: For the six people or so who still use snail mail, the U.S. Postal Service yesterday hiked the cost of a first-class stamp to $0.66, up 4.8% from the previous cost of $0.63. It was the second price hike this year and the third in the last 12 months. With the latest price hike, the cost of a stamp is now up 13.8% since 2021. Inflation, indeed!