Daily Comment (July 9, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are actively assessing the latest trade developments. Today’s Comment will delve into the president’s evolving trade strategy, particularly as he considers new tariffs. We’ll also examine the reasons behind calls for Fed Chair Powell’s resignation and other key market-moving news. As always, the report concludes with a comprehensive summary of the latest domestic and international data releases.

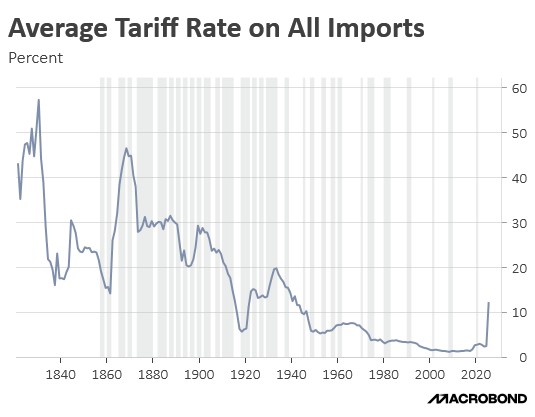

From Countries to Sectors: Despite agreeing to push back the tariff deadline from July to August, President Trump has intensified his trade war measures, suggesting prolonged trade uncertainty.

- The president announced that he does not plan to extend the deadline further for country-specific tariffs set to expire on August 1. Although he expects trade deals to be finalized in the coming days, he still intends to ramp up tariffs, even for countries that are likely to agree on a framework in the near future. He specifically targeted the EU, accusing it of unfairly fining and taxing US technology firms, and threatened unilateral tariffs in response.

- Furthermore, the president appears to be shifting his focus from country-wide tariffs to specific sectors. He has announced plans to impose a 50% tariff on copper by the August 1 deadline, followed by 200% tariffs on foreign-made pharmaceuticals a year later. The threat has already driven COMEX copper prices to a record high, while also weighing on the stocks of drugmakers.

- The shift from country-specific tariffs to sector-specific tariffs may represent a long-term strategy for the president as he seeks to use tariffs to balance the dual objectives of generating revenue and incentivizing the reshoring of manufacturing. We expect he may lower broad, country-wide tariffs to maintain trade flows while imposing sharply higher tariffs on strategic sectors, effectively implementing a restrictive trade policy where it matters most.

- The overall impact of tariffs on equities remains uncertain, as investors have largely begun tuning out the president’s trade actions. However, this dynamic could shift if the next round of earnings reports reveals squeezed corporate margins. We believe the sustainability of the S&P 500’s rally will likely depend on companies’ ability to either absorb higher costs or pass them along to consumers.

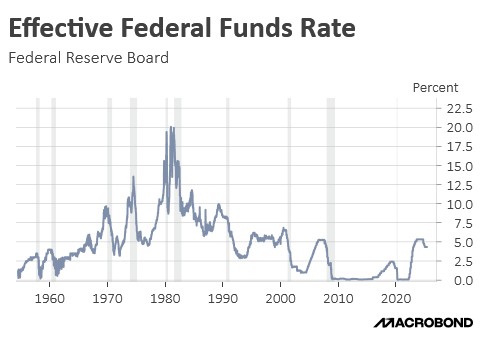

Powell Resignation? President Trump called for Federal Reserve Chair Jerome Powell to resign if allegations that he misled Congress prove to be true.

- Fed Chair Powell faces accusations of misleading Congress regarding reports of extensive renovations to the Fed’s headquarters. When questioned about claims that the central bank was undergoing a “lavish overhaul,” Powell dismissed the reports as inaccurate. However, a New York Post report revealed the renovation costs had ballooned to $2.5 billion, a 32% increase from the initial $1.9 billion estimate, with many of these upgrades documented in official filings that contradict Powell’s testimony.

- The accusation is likely to fuel speculation that the president is attempting to oust Powell. He has consistently pressured Fed Chair Powell to resign, criticizing his refusal to cut interest rates over what the president deems to be unfounded concerns that tariffs could exacerbate inflation. Although the president has limited authority to dismiss a sitting Fed chair, he retains the power to do so if justified cause exists.

- According to The Wall Street Journal, two leading contenders are in line to succeed Powell if he is removed. The first is Kevin Hassett, the president’s director of the National Economic Council and former chair of the Council of Economic Advisers. The second is Kevin Warsh, a former Fed governor who was previously a runner-up for the role during the president’s last attempt to fill the position. The president is expected to value loyalty over qualifications.

- Yet, market reactions could upend those expectations. When President Jimmy Carter accepted Fed Chair William Miller’s resignation, markets plunged into chaos after Vice Chair Frederick Schultz, a prominent Democratic donor, was named interim Fed chair. The intense backlash, fueled by fears that Schultz would be too politically beholden to the president, ultimately led Carter to appoint market approved Paul Volcker, even against the advice of some of his own advisors.

- One name that could emerge as a consensus pick, and would likely soothe market concerns, is Fed Governor Christopher Waller. His research focusing on job openings as a key indicator of labor market tightness gives him a unique advantage, providing a data-driven framework to justify potential rate cuts. Moreover, his selection would extend a longstanding tradition of elevating sitting Fed governors, a pattern unbroken since the days of Paul Volcker.

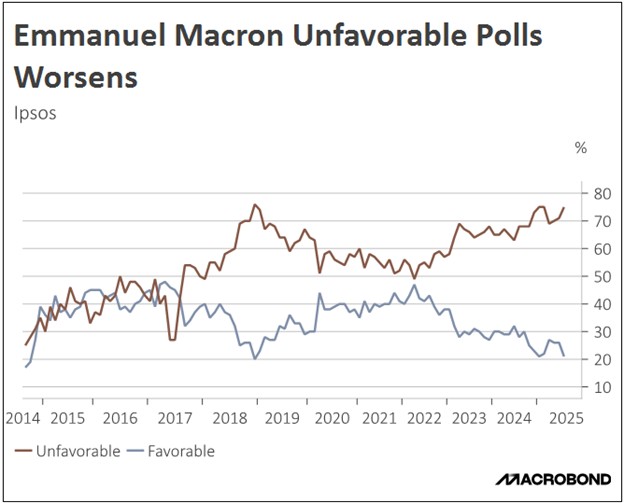

RN Under Fire: France’s far-right movement is confronting intensified scrutiny as the ruling party grapples with eroding popularity.

- French authorities have raided the headquarters of the far-right National Rally party (RN) as part of an investigation into alleged misuse of EU parliamentary funds to finance political campaigns. The operation comes amid ongoing scrutiny of the party’s finances, including a recent conviction against its leader, Marine Le Pen, for embezzling EU funds — a ruling she is currently appealing.

- The crackdown coincides with French President Emmanuel Macron regaining the authority to call snap elections, a power he last exercised a year ago in a failed attempt to curb the far-right’s rising influence. This time, however, Macron appears far less inclined to take such a risk, particularly as his approval ratings have plummeted to near-record lows.

- We believe the crackdown on the far right may inadvertently boost support for the National Rally. Such an outcome could rattle European equities, as it raises the risk of a renewed push for “Frexit,” potentially destabilizing the EU itself. Moreover, markets may get a preview of how populist leaders would navigate increasingly strained US-Europe trade relations.