Daily Comment (July 5, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the Russia-Ukraine war, where Russian forces seem to be on their way toward fully seizing Ukraine’s eastern Donbas region. We next review other international and U.S. developments with the potential to affect the financial markets today with a focus on the disrupted supply of labor and industrial inputs that is keeping inflation so high. Our discussion explains why those supply disruptions are likely to linger and prevent inflation from falling all the way back to pre-pandemic levels.

Russia-Ukraine: Russian forces over the weekend took control of the key city of Lysychansk and the overall province of Luhansk in eastern Ukraine’s Donbas region, while maintaining defensive positions in the areas they hold in southern Ukraine. Following the seizure of Luhansk province, Russian President Putin appeared to order an operational pause so that the involved units can rest and refit, although the Russian military will likely be wary of taking the pressure off Ukrainian forces. Meanwhile, influential Russian military bloggers criticized the seizure of Luhansk as too little gain for the manpower and equipment lost in the battle, probably to increase pressure on the Kremlin to call for a fuller military mobilization. At the same time, the Ukrainian military is increasingly employing Western-provided precision artillery and missiles to destroy Russian military supply resources.

- The Ukrainian government released a $750-billion recovery plan to rebuild and get the economy moving again once the war has ended. Releasing the plan, Prime Minister Shmyhal said Russia’s invasion had caused more than $100 billion of damage to infrastructure and demanded that the “key source” of funds for reconstruction should be the confiscated assets of the Russian government and its oligarchs.

- In Germany, the government has drafted a law that allows it to take stakes in companies crippled by the soaring cost of imported gas as tensions with Russia threaten to plunge the country’s power sector into crisis. If passed by parliament, the law would clear a path for the government to bail out Uniper (UNO1.DE, 10.96), the largest importer of Russian gas into Germany.

Global Semiconductor Market: The recent rout in cryptocurrencies and a slowdown in personal computer sales have combined to put a damper on semiconductor demand, easing the shortages that have caused problems for industries ranging from autos to home appliances. As evidence of the change, Intel (INTC, 36.34) recently initiated a hiring freeze in its PC-chip division. If semiconductor supply and demand now come into balance, it could help ease inflation pressures and eventually prompt the Federal Reserve to cool its interest-rate hikes.

Global Labor Market: We continue to note increasing labor unrest across the globe. In a new example, union workers at Norwegian oil and natural gas producer Equinor (EQNR, 33.83) went on strike last night in a bid for higher wages to compensate for raging consumer price inflation, forcing the firm to shut down three oil and gas fields. The union is threatening even stronger measures in the coming days, which the Norwegian Oil and Gas Association warns could cut Norway’s gas exports by 13%. Since Norway is now Europe’s second-biggest supplier of gas and has become a go-to source to replace supplies from Russia, the move has helped push European gas prices up some 8% so far today.

- The strike at Equinor follows a major British railway strike, a Scandinavian airline pilots’ strike, a picket by U.S. airline pilots over the holiday weekend, a potential strike by West Coast longshoremen, and a move to increase unionization at iconic technology and consumer services firms.

- This labor unrest probably reflects not only the challenges faced by workers during the pandemic, but also the way they’ve gained bargaining power as the pandemic pushed legions of workers out of the labor market (especially Baby Boomers). The fall in labor supply has increased workers’ relative power versus employers, although probably not enough to dramatically bring down wealth and income inequality.

- Since the many workers who finally went into retirement probably won’t come back, labor supply will likely continue to be restrained in the future. As with the supply of key goods, this will likely keep inflation from dropping back to pre-pandemic levels.

- Our labor market analysis has long emphasized that as workers approach and first enter retirement, they tend to reduce their spending and boost saving, helping push down inflation. However, our recent research has focused more on what happens once they are fully into retirement.

- At that point, even though they have dramatically cut their spending, they still consume plenty of food, energy, and other goods and services. The difference is that they are no longer contributing to the production of such goods and services.

- With the demand from legions of retirees (and other dependents) relatively high compared with their production, the result will likely be increased upward pressure on overall prices.

- We see a similar dynamic taking hold in global supply chains. While factors like increased investment, the end of pandemic lockdowns, and demand destruction will probably help bring down global prices for a range of goods in the coming months and quarters, we still think deglobalization and increased geopolitical tensions will keep supplies tighter than they were at the height of globalization over the last decade. That will also tend to keep inflation from falling all the way back to the levels seen in the decade before the pandemic.

- Our labor market analysis has long emphasized that as workers approach and first enter retirement, they tend to reduce their spending and boost saving, helping push down inflation. However, our recent research has focused more on what happens once they are fully into retirement.

Cryptocurrencies-China: The slump in cryptocurrencies has also led to well-publicized problems for crypto lenders, brokerages, and hedge funds, but now we are also seeing more reports of corporate investors facing problems. The latest example is the Chinese selfie app owner Meitu (1357.HK, 0.93), which has said its first-half loss may more than double because of bad bets that it recently made on cryptocurrencies.

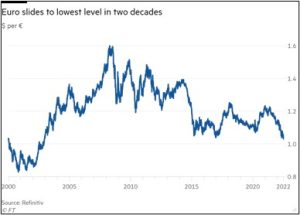

Eurozone: The strikes, the war, and other economic challenges continue to weigh on the euro, driving the currency down as much as 1.4% so far this morning, to a 20-year low of $1.0279. With the Eurozone expected to face continued headwinds even as the ECB continues to tighten monetary policy slowly, it increasingly looks like the currency will soon reach parity with the dollar (a value of $1.00).

Spain-Morocco: In an incident little noticed amid the Russia-Ukraine war and major Western summits last week, some 2,000 migrants tried to storm Spain’s enclave of Melilla on Morocco’s northern coast in late June, resulting in 23 deaths. Spanish Prime Minister Sánchez said the deaths were necessary to defend “the national sovereignty and the territorial integrity of Spain,” but he has been taking intense criticism at home and abroad for the tough response.

United States-China: Reports over the weekend said President Biden this week plans to lift tariffs on some Chinese consumer goods, such as clothing and school supplies, to help bring down inflation. He reportedly also plans to announce a new framework allowing importers to request tariff waivers.

- However, there are sharp disagreements over the move within the administration, so the move could still be delayed.

- Officials including Treasury Secretary Yellen oppose the tariffs on grounds that they are a drag on economic growth and often push up prices unnecessarily. Yellen and Chinese Vice Premier Liu He reportedly discussed the tariffs today in a video conference, which the Chinese state press described as “constructive.”

- Officials including National Security Advisor Sullivan and Trade Representative Tai support the tariffs because they provide leverage in the U.S.’s geopolitical and economic disputes with China. At most, these officials want any reduction in consumer good tariffs to be matched by higher tariffs on key industrial goods.

- In any case, even if the consumer goods tariffs are lifted, we expect the impact on inflation would be minimal.