Daily Comment (July 3, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Note: There will not be a Daily Comment tomorrow due to the holiday.

Our Comment today opens with an important sign that foreign central banks may be preparing to support the dollar and drive their currencies back down — a move that could have a big impact on the relative prospects of foreign stocks versus US stocks. We next review other international and US developments with the potential to affect the financial markets today, including fiscal policy turmoil in the UK that has sparked volatility in British bond markets and the latest on today’s House vote regarding President Trump’s “big, beautiful” tax-and-spending bill.

Eurozone: Several officials at the European Central Bank’s international policy conference in Portugal this week signaled that the euro may have appreciated too much versus the dollar this year and that the ECB may need to take action to push it down. Of course, ECB jawboning or policy actions may fail to lift the dollar now that many global investors have become skittish about economic and political stability in the US. Still, any major effort to push down the dollar would risk undermining the current case for foreign stocks versus US stocks.

France: Anyone flying to Europe this week for the Independence Day holiday should be aware that a strike by French air traffic controllers is reportedly disrupting flights and causing delays across Europe. Regulators have asked airlines to cancel about half the flights into and out of Paris today and tomorrow, when the strike is scheduled to end.

UK Fiscal Policy: Prime Minister Starmer has capitulated to a rebellion by his Labour Party’s parliament members and gutted an important welfare reform aimed at reining in costs in the coming years. The failure to cut disability payments has sparked intense concern that the government will have to hike taxes and/or cut other spending.

- In response, investors yesterday aggressively sold off the British pound and UK government bonds. The currency depreciated by about 0.8% to $1.3632, while the yield on 10-year gilts rose to approximately 4.62%.

- So far this morning, however, British markets have stabilized and even rebounded modestly.

UK Stock Market: The chief executive of pharmaceutical giant AstraZeneca is reportedly mulling a transfer of the firm’s stock listing from London to New York, largely due to concerns about oppressive regulation and shallow financial markets in the UK. If the firm does move, its price/earnings ratio could well rise toward the US average. In addition, the FTSE stock price index would lose its largest component, British stocks in general could face increased challenges, and the government of Prime Minister Starmer would suffer a political black eye.

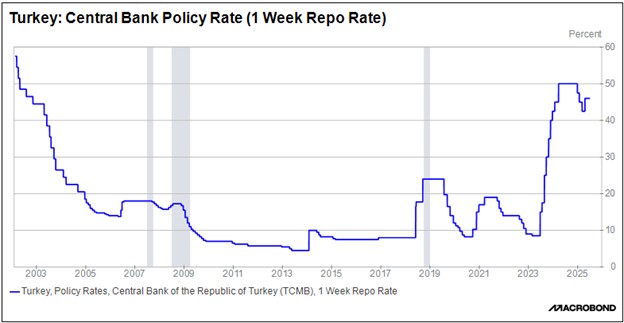

Turkey: The June consumer price index was up 35.1% from the same month one year earlier, marking a slightly cooling from the 35.4% rise in the year to May. Inflation is now only about half the 71.6% rate reached last year, so the renewed cooling at the beginning of summer could encourage the central bank to resume cutting interest rates.

United States-Vietnam: President Trump yesterday said Washington and Hanoi have struck a deal under which Vietnam will charge no tariffs on US imports, while the US will impose 20% tariffs on Vietnamese imports. The deal also calls for a US tariff of 40% on imports from third countries (including China) that are transshipped through Vietnam.

- The agreed tariff rate on Vietnamese imports is less than half the 46% “reciprocal” tariff Trump announced in early April. However, we judge that it is probably still high enough to have a noticeable negative impact on Vietnamese exports and economic growth.

- Given that so many companies have tried in recent years to skirt the US-China trade spat by setting up operations and transshipment operations in Vietnam, the deal could also potentially weigh on exports from China and other countries.

United States-South Korea: President Lee Jae Myung of South Korea said that his country’s trade negotiations with the US are proving “very difficult” and that the two sides are unlikely to reach a deal before President Trump’s July 9 deadline. If the deadline is missed, South Korea would be at risk of Trump reimposing his 25% “reciprocal” tariff on the country. Given that the South Korean economy relies heavily on exports, any such snapback in US tariffs would likely weigh on growth and hurt South Korean stock prices.

United States-Iran: A spokesman for the Department of Defense yesterday said the US attack on Iran last month only set back the country’s nuclear weapons program by about two years, despite President Trump’s assertion that the attack “obliterated” the effort. If the statement is correct, it highlights the risk that Iran will now double down on its effort to build a nuclear weapon, likely leading to renewed tensions with the West in short order.

US Fiscal Policy: Dozens of Republican fiscal hawks in the House pushed back against the newly-passed Senate version of President Trump’s “big, beautiful” tax-and-spending bill yesterday, but arm twisting by Trump, House Speaker Johnson, and their aides has apparently turned the tide, and a final vote is set for later today. If it passes, the bill will go to Trump to be signed into law by his July 4 deadline.

- There is probably still some chance that the House could vote down the Senate’s bill, in which case a reconciliation committee would have to negotiate a compromise.

- The outlook for US tax and spending policies in the near term therefore remains unclear as of this moment. Nevertheless, the longer-term outlook still probably calls for continued big budget deficits, rising federal debt, and higher interest rates or even a potential fiscal crisis at some point in the future.