Daily Comment (July 29, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with the latest US-China trade talks, which mostly aim to extend the current trade truce between the two countries. We next review several other international and US developments that could affect the financial markets today, including new signs that the threat from Russia is sparking more public investment in Europe and new details on an unexpected industrial tax break in President Trump’s recent “big, beautiful” tax-and-spending bill.

United States-China: Last night, US Treasury Secretary Bessent, Chinese Vice Premier He, and other top economic officials from the US and China began a new round of trade talks in Stockholm. Following previous talks in Geneva and London, the Stockholm talks aim to extend the current 90-day trade truce, which ends August 12. If the officials fail to extend the deal, President Trump’s ultra-high tariffs on Chinese imports would be applied again, and the Chinese would likely renew their debilitating embargo on rare-earth exports.

United States-Taiwan: The Financial Times late yesterday said President Trump has denied Taiwanese President Lai’s request to transit through New York on an upcoming trip to Central America to avoid riling Beijing. The move is consistent with the FT’s previous report that Trump has also frozen new curbs against US technology exports to China to avoid spoiling the prospects of a US-China trade deal.

- Trump’s ban on new US technology curbs against China comes despite national security concerns about the Chinese military gaining access to advanced US technologies.

- The reporting suggests that Trump is extremely focused on getting a US-China trade deal over the goal line. Given Beijing’s demonstrated willingness to play tough in the talks, that suggests Trump could accept unfavorable terms from Beijing. Any such deal could be taken well by the financial markets because it would eliminate a lot of uncertainty, but the result could be longer-term disadvantages for the US.

China: New data from cloud computing platform PPIO indicates that China’s well-known DeepSeek artificial-intelligence models are rapidly losing market share to Alibaba’s Qwen model. DeepSeek burst into the world’s consciousness earlier this year with its low-cost, open-source models. Qwen’s success in catching up rapidly is a reminder for investors that in today’s hyper-competitive AI industry, the current leading firms can easily lose their rank, while apparent laggards have the potential to catch up quickly.

Japan: The government has announced a new “employment for skill development” system to bring in foreign workers and address labor shortages in higher-skill job categories. The new system will replace the current technical-intern training program, which many firms have abused to simply bring in low-cost labor from developing countries. That has displaced many Japanese workers with lower skills, helping spark an anti-immigrant backlash that boosted the right-wing nationalist Sanseitō Party in this month’s elections for the upper house of parliament.

Philippines: The Supreme Court, which is dominated by judges appointed by former President Rodrigo Duterte, has ruled that procedural errors nullify the congress’s February impeachment of Vice President Sara Duterte-Carpio, the daughter of the former president. As a result, the pending Senate trial of Duterte-Carpio must be cancelled, at least temporarily thwarting current President Ferdinand Marcos, Jr.’s effort to sideline the China-friendly Duterte-Carpio ahead of the 2028 presidential election.

European Union: In an interview yesterday, Transport Commissioner Apostolos Tzitzikostas warned that the EU’s roads, bridges, and railways would be unfit for rapid military mobilization in case of war with Russia. To remedy that, Tzitzikostas noted that the EU’s proposed 2028-2034 budget includes 17 billion EUR ($19.6 billion) for military mobilization projects, such as strengthening and widening bridges. The plans illustrate how Europe’s improved near-term economic prospects don’t just reflect higher defense spending per se, but also broader fiscal loosening.

- As we have often noted, economies often get a bigger-than-expected boost from an external military threat, since the threat helps justify investments that otherwise wouldn’t get made.

- A prime example in the US was the interstate highway system, officially designated the “Dwight D. Eisenhower National System of Interstate and Defense Highways.” It was the brainchild of former President Eisenhower based on his logistics experience leading allied forces in Europe in World War II.

- Many aspects of the interstate highway system were designed to support military mobilization and evacuations in case of war with the Soviet Union. Building out the system is widely assessed to have boosted US economic growth, especially in the 1960s.

Eurozone: A workers’ committee at the European Central Bank has written a scathing letter to ECB President Lagarde and her staff, accusing them of operating in an anti-democratic manner and mistreating employees through favoritism and unreasonable work expectations. The letter is only the most recent example of bad labor relations at the ECB. There is no sign that the unrest threatens Lagarde’s position, but it could influence who becomes her successor when her term ends in October 2027.

US Monetary Policy: The Fed today begins its latest policy meeting, with the decision due tomorrow at 2:00 PM ET. Based on interest-rate futures trading, investors are almost unanimous in expecting the policymakers to hold the benchmark fed funds rate steady at 4.25% to 4.50%. Traders expect the next rate cut at the September meeting. However, all eyes will be on Chair Powell and whether he gives a hint of other plans in his post-decision press conference.

US Manufacturing Industry: The Wall Street Journal today highlights a previously unreported detail of President Trump’s recent “big, beautiful” tax-and-spending bill that should cut income taxes for many big, capital-intensive industrial firms. The provision restructures and broadens the Foreign-Derived Investment Income deduction to make it more useful for capital-intensive firms with international operations. It has therefore given big US exporters an unexpected tax break and added incentives to move production back home.

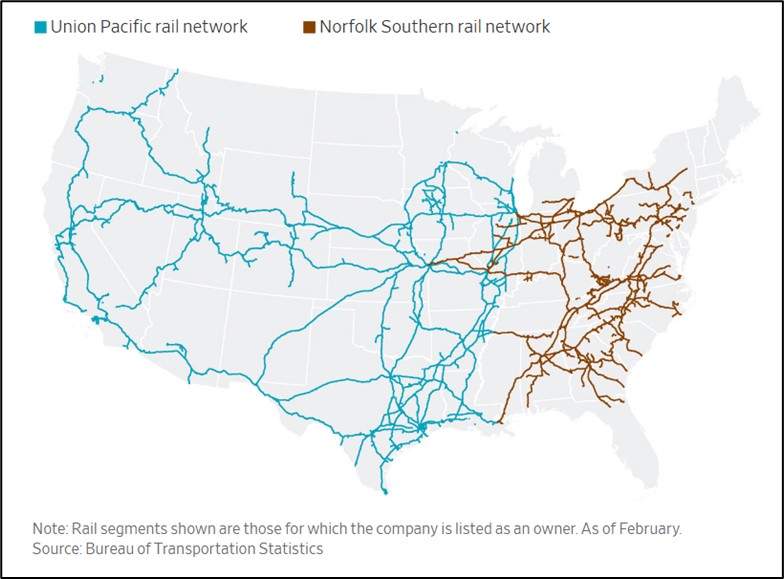

US Railroad Industry: Railroad giant Union Pacific today said it has made a deal to purchase rival Norfolk Southern for $85 billion. One notable aspect of the deal is that, if approved, it would create the nation’s first coast-to-coast freight railroad, allowing shippers to send goods all the way across the country using just one company. However, while that sounds positive, we note that past railroad mergers have sometimes faltered because of the difficulty in tying firms’ operations together safely and efficiently.

Current Union Pacific and Norfolk Southern rail networks

Current Union Pacific and Norfolk Southern rail networks

(Source: US Bureau of Transportation Statistics)