Daily Comment (July 29, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment will begin with a discussion of a broad macroeconomic outlook focusing on the central bank transition away from forward guidance, the U.S. GDP contraction in Q2, and a surge in Eurozone inflation. Next, we discuss U.S.-China relations. Finally, we examine how the Russia-Ukraine war has led to greater cooperation among Western countries.

Macroeconomic Outlook: The U.S. economy has contracted two quarters in a row, but it is still too soon to call it a recession. Calls for the end of the Fed’s tightening cycle may be premature as the lack of forward guidance raises the likelihood of a market surprise, and elevated inflation in the Eurozone pressures the European Central Bank to raise rates more aggressively.

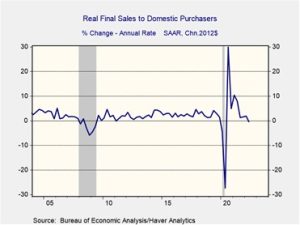

- Recession? The economy shrank an annualized 0.9% in the second quarter. Back-to-back contractions in Q1 and Q2 have led to concerns that the country may be in a recession. Although consecutive contractions are typically associated with a recession, the NBER officially makes that call. The group looks at various measures of economic activity at the general and micro levels. As a result, the group takes a very long time before officially confirming that the economy is in recession. For example, the group waited 15 months after the Great Recession ended to announce that the economy was in recovery, and therefore, it is essential not to put too much weight on the latest GDP report. In our view, the economy is not in recession as Final Sales to Domestic Purchases, which excludes volatile elements of GDP, has contracted in one quarter but is still subject to revision.

- Farwell, Forward Guidance: Central banks may be transitioning from forward guidance as economies slow, and inflation remains elevated. The ECB was the first of the major central banks to ditch forward guidance, and the Federal Reserve followed suit a week later. When inflation was low, forward guidance reassured investors that the central bank policy would not change in the future. However, consistently higher than expected inflation and economic deceleration have led banks to value policy flexibility over market clarity. The shift away from forward guidance will make speeches from voting members and central bankers even more critical.

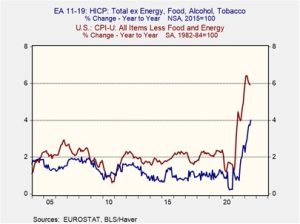

- Eurozone inflation: The flash estimate of the Eurozone Consumer Price Index jumped 8.9% from the year prior, setting a new record. Although inflation remains lower than in the U.S., the core CPI suggests that the momentum of the price increases continues to build in Europe. The strong reading will pressure the European Central Bank to become more aggressive in its tightening cycle in order to tame inflation. Before the report, Governing Council Member Martins Kazaks hinted at the possibility of a significant rate hike at the next ECB meeting in September. Although there is speculation that the central bank may raise rates by 50 bps, there is a strong possibility that the planned hike could be higher.

In short, the unpredictability of economic data has made it difficult for central bankers to make predictions about upcoming monetary policy. Therefore, the lack of guidance may mean the ECB and Federal Reserve could surprise markets in their next meeting depending on the latest inflation data. Although it is tempting to view a decline in GDP as a sign that the Fed could implement a pause, it is worth noting that the ECB and the Fed are mandated to maintain price stability. As a result, inflation will likely be their top focus when determining future monetary policy. When the central banks hold their respective meetings in September, they will be determining policy based on the August inflation numbers, so investors should take the July reports with a grain of salt.

China: President Biden and Chinese President Xi discussed Taiwan on Thursday, China hints at a possible slowdown in its economy, and Beijing tries to use TikTok to send propaganda to the West.

- The phone call: Yesterday, President Biden and Chinese President Xi Jinping had their long-awaited phone call. As usual, both sides offered each other reassurances that the status quo should remain intact. Although the call allowed the two to clear the air, tensions between the countries persist. There is still no word on whether Speaker of the House Pelosi will travel to Taiwan next month; however, she is still set to leave for her trip to Asia on Friday. Pelosi may be pressured to travel to Taiwan to avoid looking like she is kowtowing to Beijing. In that event, China may be forced to retaliate. As a result, we believe that the trip has the potential to lead to direct conflict between the U.S. and China.

- China slowdown: Leaders in Beijing signaled that China might miss its goal of a 5.5% expansion of GDP this year. This downbeat assessment reflects the negative impact of the property market crash and the country’s controversial Zero-COVID Policy on the economy. The candidness should not be a surprise as the rest of the world is currently distracted by talks about whether the U.S. is in recession. As the economy continues to show weakness, China may inject stimulus to boost growth.

- China propaganda: S. lawmakers have consistently labeled TikTok as a national security threat due to its supposed ties to the Chinese government. On Thursday, a Bloomberg report revealed that a state entity related to public relations tried to create an account to target Western audiences with propaganda. Although TikTok executives supposedly pushed back on the report, the company’s association with Chinese government officials will likely unnerve U.S. politicians that feel that the social media platform may act as an arm of Beijing. Over the last few years, governments have weaponized social media to destabilize rival countries. As a result, we believe this report will not only lead to a more significant push from U.S. officials to have TikTok removed from app stores, but also lead to more regulatory oversight with how these companies manage their users’ data. Hence, this report may also have ramifications for the broader tech sector.

As we have warned in our 2022 Mid-Year Geopolitical Outlook, China is likely to push its narrative of a “rising China, falling West” going into the 20th National Congress of the Chinese Communist Party. Therefore, it will likely view any move by the U.S. to recognize Taiwan as an independent nation as a direct threat to its national sovereignty.

Russia-Ukraine Update: The war in Ukraine continues to force the West to build closer ties with each other as it looks to respond to Russian aggression.

- Preventing a crisis: The European Union aims to diversify its energy sources to ensure it has ample supply in the winter months. France and Belgium have turned to nuclear energy, Italy has explored Algeria as its new natural gas provider, and Spain has offered to deliver some of its reserves to other countries within the bloc. The sudden change in reducing their energy consumption may not successfully solve the EU’s supply needs by winter, but it will likely position the bloc to make a long-term shift away from using Russian energy in the future. In addition, the EU is planning investments to build pipelines from alternative sources, such as Algeria, Nigeria, Niger and Azerbaijan. As a result, we view the move away from Russian energy as a reflection of a long-term trend of countries looking to sever ties with unfriendly nations.

- Arms sales: The U.S. approved $8.4 billion in arms sales to Germany. The purchase of U.S. weapons signals Russia’s invasion of Ukraine has strengthened the NATO alliance. The trading of weapons among allies reflects a closer military cooperation among Western allies. Over the next few years, NATO allies will ramp up purchases with each other as they look to ensure their security from outside threats. U.S. defense companies should benefit from this push initially; however, nascent European companies could also profit from the increase in defense spending.

As the war continues, we believe the world will begin to break into regional blocs. Thus, the recent moves by the European Union to diversify away from Russia reflect the West’s need not to rely too heavily on a single country outside of its bloc.