Daily Comment (July 28, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning. We have a lot to discuss today. Today’s Comment will begin with an overview of the latest Fed meeting. Next, we will analyze the latest development in the Russia-Ukraine war and explain why we think the conflict could end in 2023. Afterward, the report examines the latest international news, including rising tensions on the Korean peninsula. We conclude the report by discussing the latest domestic developments.

FOMC: Stocks rallied and Treasury yields plunged on Wednesday after the Federal Reserve raised its benchmark rates by 75bps to 2.25% and 2.50%, in line with market expectations. Although the central bank statement maintained that further increases in its policy rate would likely continue, the market’s reaction suggests that investors believe that the tightening cycle could end soon. During the press conference, Fed Chair Jerome Powell stated that the Fed aims to lift rates into a moderately restrictive territory and described the current level as being neutral. Powell reiterated that another 75 bps might be appropriate for the September meeting.

- What does it mean? The Fed is likely committed to taming inflation; however, we expect the central bank to raise rates at a slower pace throughout the remainder of the year. Powell’s insistence that the Fed will not likely provide forward guidance suggests that the central bank is open to raising rates less than 75 bps. Assuming that the latest dot plot reflects the Federal Open Market Committee’s current thinking, the Fed is set to raise rates another 100 bps this year. Barring a change, the Fed could raise rates in its next two meetings and pause in December.

- Other central banks may follow the Fed if it scales back its rate hikes. The ECB in particular is likely to reconsider its monetary path as higher rates can cause fragmentation throughout the Eurozone.

Russia-Ukraine: Russia is slashing natural gas deliveries, Ukraine forces are slowing Russian advances with U.S. weapons, and grain exports are set to leave Ukrainian ports. These developments suggest that the war will persist. However, we do see a path for potential de-escalation.

- Russian gas flow to Europe dropped on Wednesday after operation capacity for Nord Stream 1 fell to 20%. Gazprom, a state-owned energy company, warned that further problems with its turbines could continue the possibility of further reduction in gas flows. As a result, gas prices in Europe surged 30% over the last two days over concerns that Russia may stop delivering gas to the EU in retaliation for the bloc’s support for Ukraine in the war.

- That said, we are not sure how long Moscow plans to withhold gas from Europe. Russia does not have the pipelines needed to redirect its natural gas to other countries; therefore, if it chooses to deny gas to Europe, it risks taking some of its wells offline due to the lack of production. Gazprom reports that natural gas production has been down 10.4% since January and 33% from a year ago.

- Ukrainian forces attacked critical Russian supply routes with U.S.-supplied long-range missiles. Ukraine has used high-grade weaponry to prevent further advances from Russia into Ukraine. So far, U.S. private estimates show that over 75,000 Russians have been killed or injured or roughly half of the troops sent into Ukraine during the spring.

- Wheat futures have dropped over the last few days as Ukraine prepares to deliver its grains exports through the Black Sea. Since the Russian invasion, more than 20 million tons of grains have been stranded in Ukrainian ports. The delivery should help global wheat prices. However, there are still concerns that the grain may not make it to markets.

Despite grain exports offering some price relief, commodities will perform well if Russia and Europe continue to play chicken with natural gas. Much has been made of Europe’s dependence on Russian gas, and it is therefore easy to ignore Russia’s limitations. For example, suppose Europe can make it through the winter. In that case, the Russian economy will feel the force of the sanctions, pressuring the government to reallocate its funds away from the war effort and toward bolstering the domestic economy. Remember, Russian President Vladimir Putin plans to run for an unprecedented third term in 2024. The fusion of rising inflation, a slowing economy, and burdensome sanctions is likely to cloud his election push. As a result, we expect there to be a possibility for Russia to pause its invasion in 2023 to regroup and possibly try again in the future.

International News: Rising tensions on the Korean peninsula, the increased likelihood of a left-wing populist president in South America’s largest economy, and declining consumer confidence suggest rising economic and geopolitical risks abroad.

- North Korean Leader Kim Jung Un threatened to wipe out South Korea if provoked by his southern neighbor. The threat is in response to the U.S. and South Korea’s plans to have joint military exercises next month. The two sides have not carried out in-person joint military drills since 2018. While threats from North Korea are not new, there are concerns that joint exercises may agitate the country after having made progress in its missile program earlier this year.

- Brazil’s Presidential front-runner Luiz Inacio Lula da Silva, revealed that if he wins the election, his economic minister will need to be politically-minded rather than a bureaucrat. Given the former president’s pro-leftist leanings, investors are concerned that Lula could pick a minister that would not support fiscally sound policies. Brazilian equities performed well during Lula’s first term in office due to a global rally in commodity prices. However, the policies he introduced toward the end of his tenure partly contributed to the downfall of his successor Dilma Rousseff.

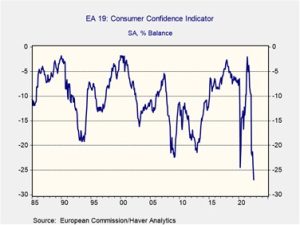

- Eurozone consumer confidence fell to an all-time low in July. The drop in sentiment reflects household concerns regarding the rising energy prices, a slowing economy, and the continuing war in Ukraine.

Domestic Developments: The U.S. is poised to pass new legislation that should provide some stimulus to the economy. Meanwhile, today’s phone call between President Biden and President Xi has the potential to be mutually beneficial for both the U.S. and China.

- Democrats may have reached a deal on Biden’s scaled-back agenda. Senator Joe Manchin (D-WV) and Senate Majority Leader Chuck Schumer (D-NY) agreed to legislation that would address climate change, modify tax policy, and extend the Affordable Care Act subsidies. The bill will spend $369 billion on energy-climate initiatives. Democrats still need support from Senator Kyrsten Sinema (D-AZ) for the bill’s passage. In other related news, the Senate passed legislation to support chip manufacturing in the U.S. The move will likely pave the way for additional stimulus for the economy.

- The Congressional Budget Office projects government debt as a percent of GDP to rise to 185% by 2052. The possibility of additional stimulus will likely provide some economic relief for the country. However, not enough to alter its GDP growth trajectory.

President Xi and President Biden will talk on Thursday. The focus of the discussion will be Speaker of the House Nancy Pelosi’s planned trip to Taiwan, China’s role in the Ukraine war, and possible plans for the U.S. to drop tariffs. A conversation between the world leaders will likely help the sides moderate tensions. Beijing is reeling over the news that Pelosi plans to visit Taiwan in August. Meanwhile, the U.S. does not like that China continues to elicit support for Russia. In light of rising tensions between the two countries, both seem to be in a position to make concessions. Beijing wants U.S. businesses to invest in China to generate growth before the 20th National Congress of the Communist Party. Meanwhile, Washington is pushing China to support a price cap on Russian oil. Although we expect no significant breakthroughs in this phone call, we believe that discussions could pave the way for smoother relations.