Daily Comment (July 25, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the Russia-Ukraine war, where all signs point to Ukraine launching a significant counteroffensive in its southern region around the occupied city of Kherson. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, many of which involve increased Western pushback against China.

Russia-Ukraine: Officials in Kyiv continue to hint more openly that Ukrainian forces have either opened up a counteroffensive against Russian occupiers in the southern Kherson region or are setting conditions to do so. Meanwhile, nationalist influencers on Russian social media are increasingly expressing alarm over the way Russian troop advances have been brought to a standstill by the advanced weapons Ukraine has recently received from the West. The analyses echo U.S. Defense Department assessments that HIMARS mobile rocket systems have been particularly effective in disrupting Russia’s massed artillery attacks by forcing Russian troops to adopt mitigation tactics like camouflage and frequent relocation of their batteries. At the same time, the Russians continue to attack cities across Ukraine with artillery and long-range missiles, including a Saturday attack on Odessa’s port facilities that appeared to violate their agreement to stop hindering Ukraine’s seaborne grain exports.

- CIA Director Burns last week said the Russian military suffered approximately 15,000 troops killed and 45,000 wounded in the war. While that’s significantly less than the Ukrainian government estimates, it’s still a sizable proportion of the 130,000 or more Russian troops that invaded Ukraine beginning in February. The CIA figures, which ring true to us, underscore how badly the Russians have been mauled in the conflict and why they’re having trouble maintaining their fighting power.

- As we’ve noted before, Russia’s aggression has touched off what is likely to be a multi-year trend of increased defense budgets among the Western democracies. Reflecting that, the U.S. Navy recently sent Congress an assessment that carrying out its missions around the world would require a battle force of 373 ships, up 75 from the current battle force of 298 ships.

- On the other hand, rebuilding military forces may face challenges. For example, last week U.S. Army Vice Chief of Staff Gen. Joseph Martin told Congress that the service will end Fiscal Year 2022 with just 465,000 troops, compared with an initial end-strength goal of 485,000. The Army’s troop shortfall is far worse than in the Navy or Air Force.

- Army personnel continue to re-enlist at record rates. The main problem comes from a huge shortfall in recruiting stemming from problems such as tougher medical screenings, a shrinking proportion of Americans eligible to serve, poor marketing practices, and low civilian unemployment.

- In a recent experiment, the Army allowed applicants without a high school diploma or GED to enlist if they scored in the top 50% of Americans on their entry aptitude tests, but the policy was cut less than a week after it came out.

- As widely expected, the European Union’s proposal last week for a mandatory 15% cut in each member country’s natural gas consumption to prepare for a Russian supply embargo has touched off bickering and demands for exemptions. The plan is due to be discussed at a meeting of EU energy ministers this week.

Brazil: Yesterday, President Bolsonaro launched his re-election bid with a colorful campaign rally aimed at burnishing his conservative credentials. To further bolster his chances, he also recently convinced Congress to pass a 50% hike in cash handouts to Brazil’s poorest citizens. Nevertheless, polls show his support continues to trail that of left-wing Former President Lula da Silva by 10% to 15%.

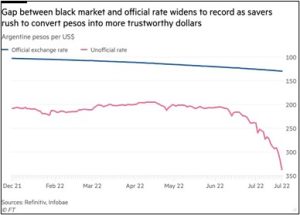

Argentina: Confidence in the Argentine government and its currency is (again) evaporating, with consumers rushing to convert their pesos to dollars despite an official limit of buying $200 per month. The black-market exchange rate has now risen to 337 pesos per dollar, up 15% just in the last week.

China: The State Council has reportedly passed a plan to establish a real estate fund worth up to $44.4 billion to support at least a dozen property groups whose operations have been stalled by government demands that they curb their debt.

- To diffuse popular anger over housing units that have been paid for but not delivered, the fund will be used in part to complete stalled development projects. It may also be used to buy developers’ bonds, issue them loans, or take equity stakes.

- Chinese developer’s stocks soared on the report, although it is important to remember that Beijing is still intent on keeping tight control over the sector and reining it in. President Xi undoubtedly wants to defuse consumer anger over the disruptions in the housing market, but once he secures a third term in office at a Communist Party conclave in October, the government could well crack down on the developers once again.

United Kingdom-China: In the race to succeed Boris Johnson as Conservative Party leader and prime minister, Former Chancellor Rishi Sunak called for a number of measures to cut China’s influence in Britain, including shutting down dozens of its “Confucius Institutes” that promote Chinese culture in the country and using national security laws to protect British technology start-ups from Chinese investment. Foreign Secretary Liz Truss, his rival in the race, countered that she has always been tougher on China than Sunak has.

- The Sunak-Truss argument shows how political dynamics in some Western countries are moving inexorably toward more distrust and disengagement regarding China. That will likely bolster the current trend toward deglobalization and a fracturing of the world into relatively separate geopolitical and economic blocs.

- Separately, Truss today will announce plans for a series of “investment zones” with looser planning rules, low regulation, and tax breaks, which she claims would lead to the building of a new generation of model towns and faster economic growth. However, the plan is being panned as being similar to Sunak’s proposal to create a series of freeports around the country — also with tax breaks and streamlined planning processes.

United States-Taiwan-China: The Chinese government has reportedly issued unusually stark private warnings to the Biden administration about Speaker of the House Pelosi’s upcoming trip to Taiwan. The Chinese warnings, which reportedly included threats of military force, have been much stronger than the threats Beijing has made in the past when it was mad about U.S. actions or policy on Taiwan.

- The administration is now trying to determine whether China is making serious threats or just engaging in brinkmanship to pressure Pelosi to abandon her trip. If serious, China’s military could try to block Pelosi from landing in Taiwan or take other actions to impede her visit, such as using fighter jets to intercept her U.S. military aircraft.

- In any case, the result could be a dangerous confrontation that would likely drive down global stock prices and boost gold and other commodities.

United States-China: As the U.S. continues threatening to delist Chinese companies over their failure to share audit information, Beijing is reportedly preparing a system to sort its U.S.-listed firms into groups based on the sensitivity of the data they hold. Beijing could then allow firms with less sensitive data to meet the U.S. audit information demands; firms with more sensitive data could potentially be restructured to allow more data sharing. Coupled with an earlier concession that eased Chinese data-sharing rules, the new idea is designed to forestall any further rupture in U.S.-China capital flows, but there is little indication that U.S. regulators are willing to play ball.

U.S. Monetary Policy: The Federal Reserve will hold its latest two-day monetary policy meeting this week, with the decision expected to be announced on Wednesday afternoon. The officials have signaled they will hike their benchmark fed funds interest rate by another 0.75% to a range of 2.25% to 2.50%, and investors widely expect further aggressive rate increases through the end of the year before the officials reverse course sometime in 2023.

- Reflecting those expectations, the yield curve remains inverted.

- As of this morning, the yield on the 2-year Treasury note stands at 3.012%, while the yield on the 10-year Treasury stands at 2.817%.

U.S. Weather: As the country continues to deal with an extensive, long-lasting heat wave, there is an increasing concern about its negative effects on U.S. agriculture operations. Continuing high heat and drought not only threaten to push down crop yields, but they also raise feed and other operational costs for ranchers.

U.S. COVID-19 Treatments: Even though Paxlovid, made by Pfizer (PFE, $51.23), has quickly become the most popular drug for treating COVID-19, health data analytics group Airfinity has warned that lower-than-expected patient uptake could dent sales over the coming months and result in a surplus of 70 million doses by the end of the year. COVID-19 is still big business, but the estimates show that waning concern over the disease and broadening immunity are starting to take the wind out of it.