Daily Comment (July 2, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with the US Senate’s passage yesterday of President Trump’s singular “big, beautiful” tax-and-spending bill. We next review several other international and US developments with the potential to affect the financial markets today, including monetary policy discussions by a range of global central bankers and new data pointing to a burgeoning use of robots in a key US firm.

US Fiscal Policy: By the slimmest possible majority, the Senate yesterday passed its version of President Trump’s “big, beautiful” tax-and-spending bill. The final tally was 51-50, with Vice President Vance providing the tie-breaking vote. In broad contours, the bill would cut spending on Medicaid, food stamps, and green-energy subsidies while hiking defense outlays and extending Trump’s 2017 tax cuts. The bill, as passed, is estimated to widen the federal budget deficit by more than $3 trillion over the coming decade, versus the House bill’s $2.4 trillion.

- The bill now goes back to the House of Representatives for its approval, but dozens of Republicans in that chamber have said they can’t accept the Senate’s changes and will vote no. President Trump, House Speaker Johnson, and his whips are expected to spend the next few days furiously arm-twisting the hold outs to pass the bill

- If the House can’t accept the Senate bill as written, the two chambers’ leaders would need to hash out a compromise that can be approved by both bodies, in which case the bill probably wouldn’t get to Trump’s desk for signing until after his deadline of July 4.

- As we’ve noted previously, the likely expansion of the budget deficit in the final bill would provide some stimulus to the economy in the near term, but bond investors could well look askance at the rising deficits, become even less avid in their purchases of Treasury debt, and drive interest rates higher over time.

Global Oil Market: According to the Financial Times today, at least five oil tankers around the world have been attacked by limpet mines so far this year, shortly after visiting Russian ports. The attacks, which haven’t sunk any of the tankers, are suspected of being carried out by Ukrainian operatives as a way to discourage ship owners from helping Russia export its oil. If so, the effort likely aims to reduce Russian oil profits that are helping fund its invasion of Ukraine. The risk is that a high-profile attack or sinking could at some point roil the world’s energy markets.

China-United States: In a Fox News interview yesterday, Treasury Secretary Bessent said Chinese rare-earth magnets are again being shipped to the US after last week’s agreement on the issue, but they still aren’t flowing in the volumes seen before Trump’s announcement of “reciprocal” tariffs in early April. In the interview, Bessent expressed confidence that Beijing will further ramp up the critical shipments, but his statement suggests that the Chinese continue to crimp supplies in a way that could spark a new flare-up in tensions in the coming weeks.

United States-Japan: President Trump yesterday said he doubted the US and Japan could reach a trade deal by his July 9 deadline, so he likely will reinstate his “reciprocal” tariff on Japanese imports at a rate of 30% of more. The tough line on Japan comes despite reports that officials in the administration are now willing to accept narrow interim deals with many countries. As we noted in our Comment yesterday, the EU has also been pushing back strongly against Trump’s tariffs, raising the specter of a snap-back of reciprocal duties on it.

Japan: Bank of Japan Governor Ueda yesterday said his central bank’s benchmark short-term interest rate of 0.50% remains below “neutral” and therefore will contribute to increasing consumer price inflation in the near term. The statement suggests that the BOJ’s next move will be to raise rates again after holding them steady since late January.

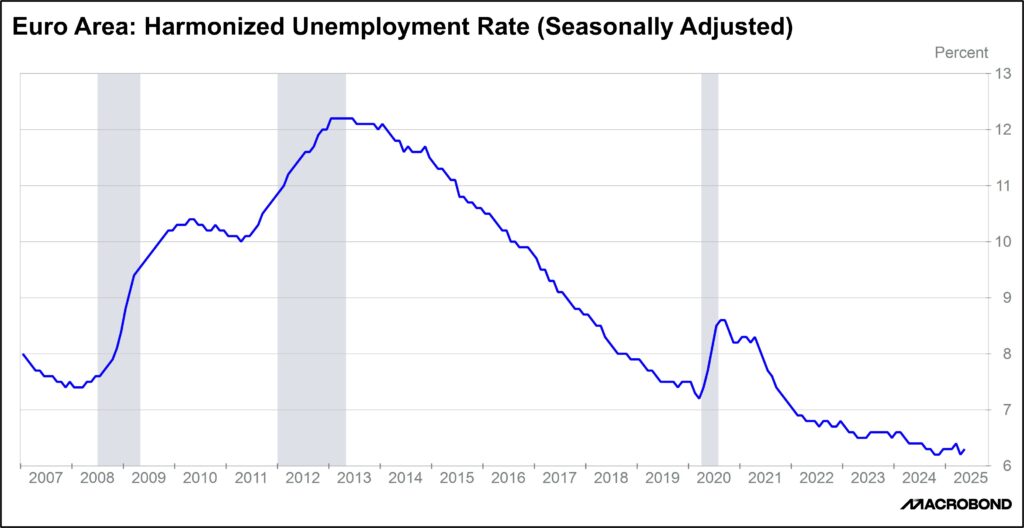

Eurozone: The May unemployment rate rose to 6.3%, compared with expectations it would remain at the record-low rate of 6.2% in April. The increase in joblessness was driven in large part by the volatile Italian unemployment data, but the rebound is still being seen as a sign that European businesses have become more cautious about headcount levels amid modest economic growth and the threat of disruptive tariffs by the US.

United Kingdom: In contrast with the upward trend in Japanese interest rates, Bank of England Governor Bailey said cooling economic growth and wage rates will likely prompt further rate cuts by his central bank. Investors expect the BOE to cut its benchmark short-term rate again in August.

Iran: As widely expected after the US and Israel struck Iran’s nuclear sites last month, Tehran today said it is suspending its cooperation with the International Atomic Energy Agency. The announcement means IAEA inspectors and monitoring systems will no longer be able to track Iran’s nuclear activities or assess any damage from the US and Israeli attacks. The IAEA will also be inhibited from helping determine the whereabouts of the uranium that Iran has already enriched, which raises the chance of Iran making a dash for a nuclear bomb.

US Monetary Policy: Fed Chair Powell yesterday said the US economy’s continued “solid” growth has allowed the monetary policymakers to hold their benchmark fed funds interest rate steady while they analyze the effect of President Trump’s tariff policies. However, despite growing market expectations for a rate cut at the Fed’s next policy meeting in late July, Powell gave no hint of what he might be planning for that meeting. We therefore believe that investors may still be too optimistic regarding further monetary easing.

US Technology Industry: According to the Wall Street Journal, retail giant Amazon now has more than one million industrial robots working in its warehouses and other facilities, largely focused on dangerous or difficult tasks such as heavy lifting. The firm is reportedly on track to soon have more robots than human employees. The report illustrates the growing demand for robots in the economy, as well as the threats and opportunities for workers as robots take over some jobs.