Daily Comment (July 19, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the Russia-Ukraine war, including further evidence that Russia’s aggression has sparked a major, long-lasting increase in global defense spending. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including a swing in investor expectations toward a view that the European Central Bank will hike its benchmark interest rate this week by more than previously anticipated.

Russia-Ukraine: Both Russian and Ukrainian forces appear to be ramping up their ground attacks, or preparing to do so, after their partial operational pauses of the last several weeks. Russian forces also continue to launch missile strikes across the country, while Ukrainian forces are reportedly concentrating and converging for what may be a counteroffensive near the southern city of Kherson. Reports also indicate that the Russian government has been forming volunteer units comprised of non-ethnic Russians, demonstrating President Putin’s political reluctance to order a mass mobilization of ethnic Russians.

- By reminding government leaders that major countries can and do invade their neighbors, the Russian attack on Ukraine continues to spur greater defense spending worldwide. In the latest example, Japanese Prime Minister Kishida will allow his country’s armed forces to request as much funding as they want for the coming fiscal year, while all other ministries will have their budget requests strictly capped.

- Significantly, there have been almost no objections to the plan by opposition parties, left-leaning media or Japanese society in general.

- Former Prime Minister Abe consistently faced strong opposition to his proposal to double defense spending to 2% of GDP, but current Prime Minister Kishida has faced no such pushback to similar plans.

- In the EU, the European Commission issued a first-ever proposal to provide financing for the joint procurement of weapons by member states to help their armies restock and improve military hardware in response to the war. The proposal seeks to channel the increase in EU defense spending toward coordinated procurement and prevent larger member states from monopolizing the continent’s arms companies.

- As Germany solidifies plans for energy rationing in case Russia completely shuts off its natural gas exports to Western Europe, as European officials now expect, a fierce debate has opened up regarding whether households or industry should get priority access to limited supplies. Major firms and industry groups are pushing for protection, although political considerations probably mean consumers will be given priority.

- In a bid to encourage European countries to share gas and cap prices if necessary, the IMF warned that a full cut-off of Russian gas would trigger economic contractions of more than 5% over the next year in Italy, the Czech Republic, Hungary, and Slovakia.

- The IMF modelling suggests that the European economy could manage with Russia curtailing supplies by 70%, but a complete cut-off would cause painful shortages.

- In a worst-case scenario, the worst affected European countries would only be able to access 15% to 40% of their needs.

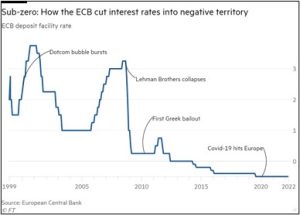

European Union: Based on new comments from ECB President Lagarde and other monetary policymakers in the Eurozone, investors have become increasingly convinced that the officials will hike their benchmark short-term interest rates on Thursday by an aggressive 50 bps, to 0.0%, rather than the 25 bps Lagarde insisted on earlier in the summer. In recent days, speculation that the ECB could end negative interest rates in the Eurozone has helped drive the euro higher after it essentially reached parity with the dollar last week.

United Kingdom: Yesterday, in the race to replace Boris Johnson as Conservative Party leader and prime minister, a vote of parliamentary party members eliminated Tom Tugendhat, chairman of the Foreign Affairs Committee. The remaining candidates include Former Chancellor Rishi Sunak (115 votes), Trade Minister Penny Mordaunt (82 votes), Foreign Minister Liz Truss (71 votes), and Former Equities Minister Kemi Badenoch (58 votes).

- Further votes are scheduled for today and tomorrow to whittle the field down to just two candidates.

- At that point, the remaining candidates will have several weeks to campaign before a poll of the broad party membership at the end of the summer.

Chinese Real Estate Sector: With dozens of real estate developers on the verge of bankruptcy and unable to finish paid-for housing units due to government efforts to rein in their debt, Beijing is scrambling to quell a move by furious homebuyers to stop making mortgage payments on undelivered homes. One government tactic has been to censor social-media posts about the crisis. More importantly, the China Banking and Insurance Regulatory Commission has instructed banks to provide credit to eligible property developers “based on market principles and in compliance with the law” to help them complete unfinished homes.

- Compared with the total amount of outstanding mortgages in China, the loans threatened by the buyers’ payment strike are probably not enough to threaten the banking system.

- Rather, the government seems more focused on averting more social disruption, especially ahead of the Communist Party’s 20th National Congress this autumn, at which time President Xi aims to win a precedent-breaking third term in office.

- In any case, the move by the CBIRC opens the liquidity taps to developers for the first time in almost one year. In response, Chinese developer stocks jumped sharply. The intervention also underscores the government’s willingness to goose the economy in order to support growth ahead of the party conclave.

Chinese Technology Sector: The Cyberspace Administration of China is reportedly preparing to impose a fine of more than $1 billion on ride-hailing company Didi Global (DIDIY, $2.93) for data security breaches discovered last year. However, the government will also ease a ban on Didi’s adding of new users to its platform and will allow the company’s mobile apps to be restored to domestic app stores. Although China’s tech sector remains under high regulatory risk, the move is another example of Chinese authorities easing up on firms to bolster growth ahead of the party congress.

United States-China: If you’re looking for a silver lining in today’s high U.S. inflation rate, you can find one in the comparison of U.S. to China gross domestic product (GDP). Such comparisons are typically calculated in nominal terms at current exchange rates, so galloping U.S. prices and a weak renminbi mean China GDP will likely lag U.S. GDP for years to come. However, when adjusted for the purchasing power of the currency, China’s GDP surpassed that of the U.S. many years ago.

United States-European Union: Tomorrow, Secretary of State Blinken will hold a meeting with officials from the EU and 17 other countries to discuss ways to strengthen industrial supply chains among themselves. Besides the EU, the key countries involved will include Australia, India, Indonesia, Japan, Singapore, and South Korea. Consistent with the administration’s push to increase “friend shoring,” neither China nor Russia was invited.

- We have long warned that the U.S. is pulling back from its traditional role as global hegemon, contributing to deglobalization and a fracturing of the world into separate geopolitical and economic blocs. In our Bi-Weekly Geopolitical Report of May 9, 2022, we took a stab at forecasting which countries were likely to join each of the evolving blocs, and what that would imply for the global economy and financial markets going forward. We note that most of the countries Blinken will meet with tomorrow are in our projected U.S.-led bloc.

- To date, the Biden administration has tried to nurture the development of the U.S.-led bloc mostly by incentives and persuasion, and that will likely be the main approach at tomorrow’s meeting. However, it is important to remember that the administration could eventually take a more forceful approach to building the U.S.-led bloc and sealing it off from the Chinese-led bloc, as the Trump administration did.

U.S. Labor Market: In a call with financial analysts yesterday, Goldman Sachs (GS, $301.26) warned it may slow hiring and eventually cut underperforming staff in response to tightening monetary conditions. Coming on top of hiring slowdowns and job cuts announced recently by major technology firms, the statement adds to concerns that U.S. economic growth and labor demand are already slowing.

U.S. Corporate Earnings: U.S. multinational firms like Johnson & Johnson (JNJ, $174.23) have begun to indicate that the strong dollar is weighing on their profits. Along with higher costs for materials and labor, the super-strong dollar suggests that large companies’ margins and earnings may be set to surprise to the downside through the rest of the year.