Daily Comment (July 15, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with further evidence that President Trump has soured on Russia and President Putin, creating a risk of greater US-Russia tensions. We next review several other international and US developments with the potential to affect the financial markets today, including surprisingly strong economic growth in China in the second quarter and new pressure on Federal Reserve Chair Powell to resign.

United States-Ukraine-Russia: In perhaps the most surprising sign of President Trump’s recent souring on Russian President Putin, the Financial Times today reports that Trump has privately encouraged Ukrainian President Zelensky to step up deep military strikes on Russian territory. According to the report, Trump has even asked Zelensky whether Ukraine could hit Moscow and St. Petersburg if the US provided long-range weapons. Indeed, the report says Trump encouraged Zelensky to do so.

- Sources cited in the report say Trump wants to “make them [Russians] feel the pain” and force the Kremlin to the negotiating table to end its war against Ukraine. Of course, the risk is that Ukrainian attacks on Moscow or St. Petersburg using US weapons could prompt Putin to retaliate against the US.

- The news comes just a day after Trump threatened to impose severe tariffs on Russia and its trading partners if Putin doesn’t come to the negotiating table to end his war against Ukraine within 50 days.

- Domestically, Trump’s apparent new antagonism toward Russia will likely exacerbate the growing schism between him and his more isolationist political base. Many in the “Make America Great Again” camp are already angered by recent Trump actions, such as his decision to join Israel’s attacks on Iran and his government’s report that Jeffrey Epstein died by suicide and left no “client list” of compromised officials.

European Union-United States: EU officials yesterday published a list of US goods on which they say they will impose tariffs if Washington and Brussels can’t soon agree on a trade deal. The tariffs would be imposed if President Trump slaps his threatened 30% import tariff on the EU on August 1. After Trump issued his latest tariff threat, EU officials had said they wouldn’t immediately retaliate. However, the new list raises the risk that any failure in the negotiations could lead to a spiral of tariffs and counter-tariffs between the two economies.

United States-China: Semiconductor giant Nvidia today said it has been assured by the Trump administration that it will soon be allowed to sell its H20 artificial-intelligence chip to China again. The firm still won’t be allowed to sell its most advanced AI chips in China on concerns about that country gaining military or technological superiority over the US. Still, reports say Beijing sees today’s news as a concession in the ongoing US-China trade talks, which could help facilitate a deal. The news is also driving Nvidia’s stock price sharply higher so far today.

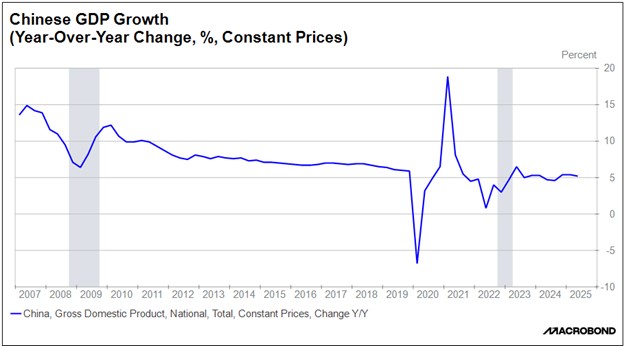

China: Official data today showed second-quarter gross domestic product was up 5.2% from the same period one year earlier, slightly beating expectations. The annual growth rate in the second quarter was still a bit weaker than in the previous two periods, but it still pointed to unexpected resilience in the face of the US-China trade war. In turn, that suggests Beijing could still hit its goal to have the economy grow 5.0% for all of 2025.

Japan: The yield on 10-year Japanese government bonds (JGB) today rose to the highest level since 2009, closing at 1.58%. The jump in JGB yields appears to reflect investor concerns that the ruling Liberal Democratic Party (LDP) will lose its majority in the upper house of parliament in Sunday’s elections. If the LDP does lose its majority, it might have to make fiscal concessions to smaller parties to form a coalition, and those concessions could blow out the deficit and drive Japanese debt even higher.

US Politics: Former New York Governor Andrew Cuomo yesterday said he will run as an independent in the upcoming election for mayor of New York City. The move comes after Cuomo lost in the Democratic Party primary election to avowed socialist Zohran Mamdani. Many moderate Democrats around the country fear that a Mamdani victory in the general election could paint their party as too liberal, so Cuomo and a number of other Democrats are running in the election as independents.

US Monetary Policy: To force out Fed Chair Powell before his term is up in May and replace him with someone more apt to cut interest rates, officials in the Trump administration have started to accuse Powell of malfeasance related to what press reports say are “renovations” at the central bank’s headquarters in Washington. However, as this author can attest after seeing the site many times over the last year, the project isn’t a mere renovation, but a major teardown and reconstruction of the north half the building.

- Such a major project often suffers from major cost overruns as unexpected reconstruction issues arise. That suggests that the attacks on Powell may be unfounded.

- If so, the attacks could set a bad precedence in which presidents would be free to conjure up legal reasons to sack a Fed chair, undermining the central bank’s independence and setting the stage for overly loose monetary policy and higher inflation.

US Drone Industry: The Commerce Department yesterday said it has launched national security probes into foreign drones and a raw material used for chips and solar panels. The investigation into unmanned aircraft systems would focus on the US’s dependency on foreign drones and whether foreign countries (such as China) could hurt US national security by suddenly cutting off supplies. The investigations could well lead to new import tariffs on foreign drones to help spur the development of the US drone industry, which is widely seen as lagging.

US Food Prices: As announced in April, the US yesterday officially exited a nearly 30-year old trade agreement with Mexico and slapped a 20.91% antidumping tariff on tomatoes from south of the border. Some economists have predicted that the move will boost prices for tomatoes and tomato products by as much as 10% in the near term. However, that expectation may be wrong, given that the US imports few fresh tomatoes during the summer (when tomatoes can be grown even in Maine), and processing tomatoes come largely from California.