Daily Comment (July 10, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is focused on the latest trade updates. Today’s Comment will dive into the newly released Federal Reserve meeting minutes. We’ll also explore what Nvidia’s impressive surge reveals about the increasing influence of technology on equity performance. Plus, we’ll cover other breaking market news. As always, you’ll find a comprehensive summary of recent international and domestic data releases in the report.

A Divided Fed: FOMC members continue to favor a wait-and-see approach on rate cuts, despite their differing views on the long-term inflationary impact of tariffs.

- The minutes from the June 17-18 meeting revealed that while most committee members believed tariffs would remain a long-term inflationary challenge, a significant contingent argued that the effects might be temporary. The disagreement centered largely on firms’ ability to pass price increases on to consumers. Skeptics of sustained inflation questioned whether businesses had sufficient pricing power, whereas proponents doubted whether profit margins could absorb higher input costs without raising prices.

- The discussion also revealed divisions over how tariffs were affecting the labor market. While the committee agreed that labor conditions remained strong, several officials noted that some firms had paused hiring due to trade policy uncertainty. Others pointed to tighter immigration enforcement as a growing constraint on labor supply. The overall view is that labor demand could soften over the next few months.

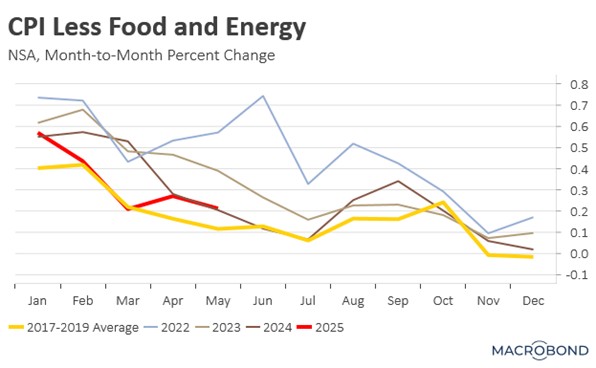

- In short, the meeting minutes suggested that Fed officials were prioritizing inflation over labor market concerns, a sign that the committee may be adopting a more hawkish stance. This heightened focus on inflation stems partly from uncertainty over whether current data fully reflects the tariffs’ impact on prices. Recently, Minneapolis Fed President Neel Kashkari warned that the effects could be delayed, citing firms’ reluctance to raise prices, high inventory levels, and even efforts to bypass tariffs altogether.

- Although two Fed officials, Fed Governors Christopher Waller and Michelle Bowman, have expressed support for a July rate cut, most committee members appear unconvinced unless a labor supply shock materializes. That said, September may be a more likely candidate for action. Historically, summer months tend to produce softer inflation readings, and if the trend of tame inflation readings hold, it could reinforce the view that tariff-related price pressures remain contained.

Nvidia Sets Record: The chipmaker has become the first $4 trillion company as investors pour into the tech sector, betting on its resilience amid easing trade policy concerns.

- The sharp increase reflects growing investor confidence that AI spending will remain robust. The stock overcame earlier concerns following the release of China’s language model, DeepSeek, which demonstrated comparable performance to some US models despite using less advanced chips. Additionally, reduced fears of a severe trade war — and its potential impact on capital spending — provided further support. As a result, the stock rebounded 74% from its 2025 low in April.

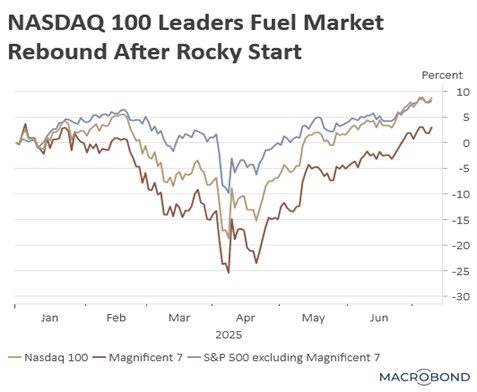

- Nvidia’s meteoric rise underscores the market’s fixation on companies driving the AI revolution. That enthusiasm is no longer confined to the Magnificent 7 tech giants, as investors increasingly turn to smaller, more agile tech firms with higher growth potential. This shift is already showing up in market performance. While the NASDAQ 100 continues to outperform the S&P 500 this year, only three members of the Magnificent 7 have kept pace, with most now trailing the broader index.

- While the surge in technology stocks (including Nvidia) has been remarkable, we believe it represents a key market vulnerability. Earnings reports in the coming weeks will serve as a critical test of the rally’s sustainability. As long as tech companies demonstrate sales growth, investor enthusiasm will likely persist. However, any signs of softening demand could trigger a pullback, potentially undermining market sentiment.

More Tariff News: President Trump issued a series of tariff letters to emerging markets, notifying them of increased rates and pressing for additional requirements.

- The president issued eight additional letters to countries, notifying them of updated tariff rates targeting emerging market economies. Of these, only two nations, the Philippines and Brunei, faced increases, with rates rising by 1% and 3%, respectively. The remaining countries saw their tariffs either hold steady or drop by as much as 25%. The adjustments dealt a blow to hopes that country-specific rates would fall uniformly to 10% across the board.

- The president escalated tensions with Brazil by threatening to impose tariffs of up to 50%, citing political disputes between the two nations. The warning specifically referenced Brazil’s treatment of former President Jair Bolsonaro and its government’s crackdown on social media platforms accused of spreading election misinformation. The announcement immediately rattled markets, triggering a sell-off of Brazilian equities, while President Lula da Silva vowed retaliatory measures in response.

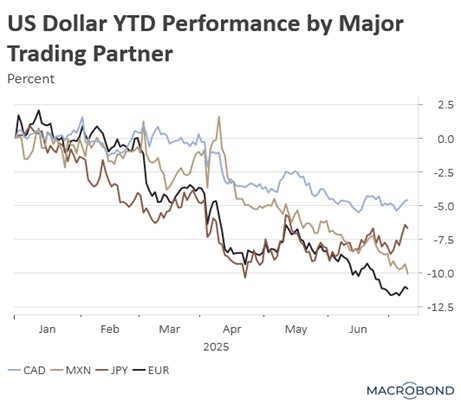

- The president’s treatment of emerging market economies suggests a broader shift in US strategy from benevolent hegemony toward a more malevolent approach. His willingness to impose harsh tariffs on countries with limited import capacity implies they may be viewed as a form of tribute. Furthermore, his targeting of Brazil reinforces the perception that tariffs are being weaponized to influence foreign policy, signaling a departure from cooperative engagement in favor of coercive economic leverage.

- If our assessment is correct, this is likely to further damage global perceptions of the United States, potentially weakening confidence in holding the US dollar. Recent surveys indicate a notable shift in international sentiment, with more countries now favoring China over the US — a stark reversal from just a year ago. Data from Morning Consult and Nira Data reveals that not only does the US trail China in global favorability but it has also fallen into net-negative territory, while China maintains a positive image.

Canary in the Coal Mine: There are some warning signs that the economy may be heading toward a slowdown.

- Amazon Prime Day’s opening sales fell sharply short of expectations, with preliminary data showing a 41% year-over-year decline in purchases. The event — traditionally a bellwether for consumer demand — has long served as a key indicator of household spending trends. While the drop may partly reflect Prime Day’s extension from two days to four, the weak start will likely fuel concerns about consumers tightening their budgets amid economic uncertainty.

- Additionally, WPP, the world’s largest advertising agency, reported a sharp decline in ad spending during the first half of the year and expects the trend to persist through the second half. While some losses may stem from the disruptive impact of AI on the industry, WPP has primarily blamed the slowdown on deteriorating macroeconomic conditions. Advertising budgets are often among the first cuts businesses make when bracing for an economic downturn.

- While we maintain optimism about the economy’s resilience in the coming quarters, we are closely monitoring for any shifts in the business cycle. Currently, economic conditions remain favorable and should continue to support equity markets. However, as new signals emerge, we may recommend investors adjust their risk exposure accordingly.