Daily Comment (January 15, 2019)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] U.S. equity futures are roughly flat, giving up most of their overnight gains. Asia was higher on hopes of Chinese stimulus, but the big news is that today is Brexit Day. Here is what we are watching this morning:

Brexit: So, it all comes down to this.[1] A vote on PM May’s Brexit plan is scheduled for 7:00 GMT, (which is 2:00 EST). The only real question is how badly will the measure fail? We note that MP Gareth Johnson, an assistant whip,[2] resigned from government, the 13th member of May’s government to resign over Brexit. The loss could be colossal, perhaps by more than 200 votes. After the loss, we expect two things to occur. First, May will have three days to come up with a “Plan B.” Second, Labour leader Corbyn is expected to call for a no-confidence vote. We have no idea what a Plan B will look like; we expect the MPs to offer tons of new amendments to the plan that May proposed but, since there is no consensus on what Brexit should look like, it seems unlikely that the House of Commons will draft a plan. Thus, in three days, look for the government to ask for an extension of the March 29 deadline. Corbyn’s bid to bring down the government will be interesting to watch. Although May isn’t popular, the Tories loathe Corbyn and we suspect they will coalesce around May to prevent her loss.

Financial markets continue to lean toward some sort of resolution that avoids a hard Brexit. Although that is the desired outcome by nearly everyone involved, there is no obvious plan to achieve this goal. The fear is that, in the absence of a plan to go forward, Britain and the EU will stumble into a hard break that would be expected to crush the U.K. economy and the GBP. Since neither side wants this outcome, the most likely result of all this is a delay. That’s why the currency is holding up. But, the risks of an unwanted hard Brexit are rising.

China: Bank lending for December came in a bit better than expected, rising CNY 1.08 trillion ($198 bn). However, given the drop in reserve requirements, this level of loan growth won’t keep growth at the 6% level. The Chinese government announced plans for tax cuts and other stimulus measures.[3] Hopes surrounding those measures sent Asian equities higher overnight. However, for growth to be sustainable, more of it needs to come from the household sector and less from investment. We believe the most effective measures China could implement in support of consumption growth would be to extend the social safety net, including health care and pensions. Both actions would reduce households’ incentives to save. However, it would also deprive the powerful members of the Chinese Communist Party cheap money for investment. Thus, aggressive action that would be effective in restructuring the economy isn’t likely.

China and Canada: China has issued a death sentence for Robert Schellenberg,[4] a Canadian citizen living in China. He was arrested on a drug trafficking charge. Ottawa strongly suspects that China is arresting Canadians in response to Canada’s arrest of Meng Wanzhou of Huawei. Tensions between the two countries remain elevated with no obvious path to easing short of releasing Meng, who awaits extradition to the U.S. on sanctions-busting charges.

Shutdown issues: TSA absences are increasing rapidly, now representing 7.6% of the workforce, more than double normal levels.[5] So far, the system is dealing with the security issues but if the absences increase, which appears likely, it will eventually affect the air transportation system. There is no sign of budging from either side.

Iran oil: The State Department indicated yesterday that the Trump administration is not planning to issue further oil export waivers.[6] If they stick to that position, Iranian oil exports will be further curtailed by the end of May. Although we would not expect Iranian oil exports to fall to zero, they will decline from current levels.

Iranian populism? U.S. sanctions have hurt the Iranian economy. Interestingly enough, we are hearing reports of a backlash against the well-connected wealthy in Iran. The ones catching most of the flack are the young of those connected to the government who have a habit of flaunting their lifestyles on social media (sound familiar?).[7] What makes this trend dangerous for the ruling class is that they are pushing policies that have led to American sanctions and are calling for shared sacrifice in response. If it isn’t seen as shared, they could face civil unrest.

Oil sales to China: The U.S. is exporting oil to China, likely part of the trade talks currently underway.[8] Three cargos departed from the Gulf of Mexico on their way to China, the first oil sale in three months between the two countries. We suspect this news lifted oil futures this morning.

Trump versus the Wilsonians: As we noted yesterday, Trump tends to be best characterized by the Jacksonian archetype.[9] However, most members of his foreign policy staff have tended to be either Hamiltonians (the early “generals”) or Wilsonians. His current staff, Pompeo and Bolton, are clearly in the Wilsonian camp. Wilsonians tend to have a moralistic view of foreign policy, seeing the world in terms of “good and evil,” unlike the Hamiltonians, who tend to view the world through the veil of “interests.” Both groups have been attempting to prevent Trump from exercising his Jacksonian tendencies; Jacksonians are essentially isolationists who are driven to intervene globally on issues of “honor.” Thus, President Trump sees no disconnect between firing cruise missiles against Assad and pulling troops from Syria. Assad besmirched America’s honor by using chemical weapons after being told not to, but Trump has no interest in being tied up in the Middle East indefinitely. Today, we are seeing reports that Trump was considering pulling out of NATO.[10] Both the “generals” and the “Wilsonians” have been trying to corral the president from this action. The paper of record, the NYT, frames the news as a “gift to Russia,” putting it in the narrative that Trump is favoring Putin. Perhaps. Our view is that the biggest risk to pulling out of NATO isn’t the risk of Russian influence on Europe, it’s that the “German Problem” will return, a conflict zone that was frozen by the U.S. In other words, the real risk is the remilitarization of Germany and a return to the world of 1870-1945.

It’s worth noting that SOS Pompeo made pointed criticisms of President Obama’s policies in the Middle East during a speech in Egypt. In our opinion, Obama was a Jeffersonian, the most isolationist of the four archetypes. However, the primary difference between the Jacksonians and the Jeffersonians is the concept of honor. In practice, both want to retreat from the world and avoid involvement. Pompeo’s criticism of Obama could easily be said of Trump as well. As time passes, we will be watching to see how long the president tolerates both his national security director and secretary of state working to prevent the execution of the president’s worldview.

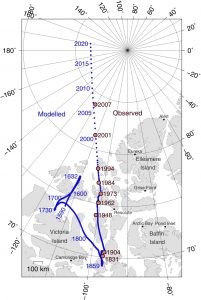

And, one more thing to worry about: The world’s magnetic pole isn’t static; it moves around over time. Usually, the movements aren’t enough to make compass readings unreliable; however, over geologic time, the North and South magnetic poles have actually flipped (the last time was estimated to have been 780,000 years ago). The map below shows how the pole has moved over time. The last maps adjusting to the movement of the magnetic pole were completed in 2015. Although they weren’t scheduled to be updated until next year, the movement was enough to accelerate the process. The new maps would have been published today, but have been delayed until January 30 due to the government shutdown.[11] These maps are needed for navigation; not only do ships at sea and aircraft use them, but they are also now part of our everyday lives as they assist in smartphone navigation.

[1] https://www.ft.com/content/efb7088a-17eb-11e9-9e64-d150b3105d21?segmentId=a7371401-027d-d8bf-8a7f-2a746e767d56

[2] A whip is a legislative role held by a member who counts and steers voters in the legislature.

[3] https://www.reuters.com/article/us-china-economy/china-signals-more-stimulus-as-economic-slowdown-deepens-idUSKCN1P9090

[4] https://www.washingtonpost.com/world/asia_pacific/china-sentences-canadian-man-to-death-in-drug-case-linked-to-huawei-row/2019/01/14/058306a0-17fb-11e9-a804-c35766b9f234_story.html?utm_term=.188f1c9e417d&wpisrc=nl_todayworld&wpmm=1

[5]https://www.apnews.com/a50e00cb683b4b9697c1c957bae39cd2?utm_source=newsletter&utm_medium=email&utm_campaign=newsletter_axiosam&stream=top

[6] http://www.arabnews.com/node/1434591/business-economy

[7] https://www.washingtonpost.com/world/middle_east/crazy-rich-iranians-face-blowback-at-a-time-of-sanctions-and-economic-stress/2019/01/13/f45bc594-ffb6-11e8-a17e-162b712e8fc2_story.html?wpisrc=nl_todayworld&wpmm=1

[8] https://www.reuters.com/article/us-usa-crude-exports/first-u-s-crude-cargoes-head-to-china-since-trade-breakthrough-sources-idUSKCN1P82LN

[9] See WGR, The Archetypes of American Foreign Policy: A Reprise (4/4/2016).

[10] https://www.nytimes.com/2019/01/14/us/politics/nato-president-trump.html?emc=edit_mbe_20190115&nl=morning-briefing-europe&nlid=567726720190115&te=1

[11] https://www.livescience.com/64486-earth-magnetic-pole-moving.html