Daily Comment (January 7, 2026)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment opens with an analysis of the evolving US policy toward Venezuela, following its recent action against the Maduro government. We then examine the growing US strategic interest in Greenland, assess signs of shifting housing affordability, and analyze rising tensions between Japan and China. The report also includes a roundup of key domestic and international data releases for the coming period.

The Transition: The White House has announced its latest measures to exert influence over the situation in Venezuela. On social media, President Trump stated that the country would export up to 50 million barrels of sanctioned oil to the US, a move that could generate approximately $2.8 billion at current market prices. Meanwhile, administration officials have sought to downplay the possibility of military boots on the ground in the region. These actions provide a clear template for how the White House intends to project influence and manage regime transitions abroad.

- The decision to facilitate these oil sales comes as Washington seeks to decouple Venezuela from the US’s traditional rivals, specifically China, Iran, Cuba, and Russia. President Trump has urged the interim government to not only sever economic ties and expel suspected foreign intelligence agents but also to align closely with US energy interests.

- While there has been extensive discussion regarding the structure of the next administration, there appears to be no appetite for a military occupation due to the high political risks involved. Instead, the focus has shifted to internal leadership, where significant friction remains. The White House currently favors acting President Delcy Rodríguez as a stabilizing figure, though a vocal contingent of policymakers continues to advocate for opposition leader María Corina Machado.

- Managing the political transition in Venezuela represents a critical test of the White House’s capacity to navigate complex foreign regime changes. The outcome will establish a significant precedent, as the administration increasingly frames foreign policy through a lens of national security ahead of the 2026 agenda. Success or failure here will directly inform potential strategies for other adversarial or unstable governments, such as Cuba, and ultimately, a post-war Ukraine.

- The administration’s expansive foreign policy may be strategically aimed at consolidating access to global mineral resources. While its approach will likely differ from the more confrontational posture adopted toward Venezuela, the underlying objective appears to be reshaping the international order to secure cheaper and more reliable resource supply chains. This, in turn, directly supports the overarching ambition of expanding domestic manufacturing capacity and securing economic sovereignty.

Greenland, Next? Following the recent military capture of Nicolás Maduro in Venezuela, international attention has shifted to the White House’s renewed interest in Greenland. (For a deeper dive into why the US is so interested in Greenland, see our previous Bi-Weekly Geopolitical Report on the topic) On Tuesday, US Press Secretary Karoline Leavitt confirmed that the president is exploring ways to acquire the territory, explicitly stating that military options remain available. While it is debated whether this is simply high-stakes bravado, the rhetoric signals a clear shift from a soft, diplomatic approach to foreign policy to a harder, more assertive approach.

- The controversy intensified as Secretary of State Marco Rubio and Senior Aide Stephen Miller confirmed the White House’s sights are set on Greenland. Rubio maintained the administration’s interest in a formal purchase, but Miller went further, questioning the legitimacy of Danish claims to the territory by calling it a colony and suggesting that Europe lacks the resolve to fight for the island.

- By threatening a sovereign ally like Denmark, the White House is signaling a break from the transatlantic relationship. This shift follows a pattern of 2025 policies where the US excluded European leaders from Ukraine peace talks and moved to dismantle EU-led digital and trade frameworks. The push for Greenland is the latest evidence that the US now prioritizes its own strategic interests over long-standing diplomatic ties with the EU.

- The administration’s recent maneuvers suggest that the EU must accelerate its path toward strategic autonomy to reduce its security dependence on the United States. This pivot will likely manifest in significantly increased defense spending and could eventually force a European-led restructuring of NATO — or even a total US exit from the alliance.

- Regarding the Western Hemisphere, the aggressive push to exert control over sovereign territories suggests that the “Modern Monroe Doctrine” we previously identified in our geopolitical outlook may be far more expansive than we initially predicted. That said, our conclusion remains the same: Those who fall within the US sphere of influence will likely receive preferential economic treatment in exchange for cooperation.

- The administration’s recent moves indicate that the 2025 surge in international equities has room to run in 2026. Specifically, we see significant upside for the European defense sector as military budgets expand in response to US unilateralism. Additionally, this modern Monroe Doctrine creates a clear path for countries within the Western Hemisphere to receive preferential trade and investment treatment — provided they align with US interests.

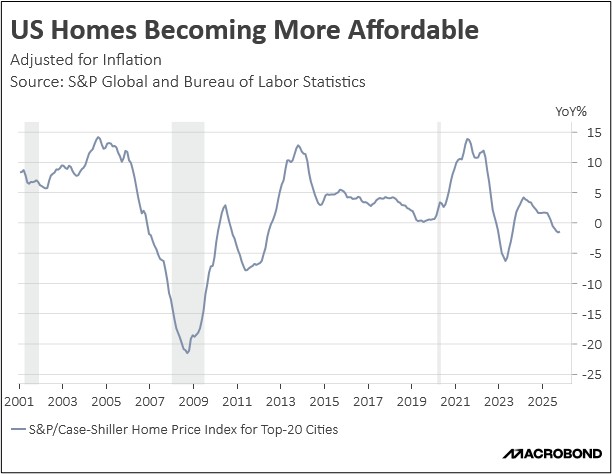

Home Affordability: US mortgage rates have retreated to their lowest levels since September 2024, signaling a meaningful easing of borrowing costs. This decline coincides with a sustained slowdown in home price appreciation, which has recently fallen below the rate of inflation for the first time since 2023. These improved conditions are expected to bolster the economy as households leverage lower rates to refinance existing debt and consolidate high-interest obligations.

Samsung Price Hikes: Surging demand for AI is beginning to drive up costs across multiple sectors. On Tuesday, Samsung reported that intense competition for chip procurement has increased production costs for its latest Galaxy smartphones, a trend now extending to televisions and home appliances. This escalation serves as a prime example of how the AI boom is creating spillover effects and is increasingly acting as a catalyst for goods-related inflation.

Iran Protests: The Iranian president has instructed security forces to avoid targeting peaceful protesters as the government moves to prevent further civil unrest. This directive follows nationwide demonstrations sparked by a sharp devaluation of the country’s currency, which has deepened public distrust. Now in their second week, the protests have resulted in at least 36 deaths. The US is monitoring the situation closely as it considers its policy response and the possibility of intervention.

Japan and China Ties: Tokyo is weighing a response to Beijing’s recent ban on dual-use exports and potential curbs on rare earth elements. Japan’s strongest countermove lies in its near-monopoly on high-end photoresists and chip-packaging materials, where it controls 90% of the global market. However, it may be reluctant to use it due to its export dependence on China. The dispute highlights the deepening security ties between the US and Japan at a time when analysts are increasingly wary of a potential conflict over Taiwan in the coming years.