Daily Comment (January 27, 2026)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with a renewed threat of US tariff hikes against South Korea, illustrating how global trade tensions could rekindle at any time. We next review several other international and US developments with the potential to affect the financial markets today, including a new free-trade deal between the European Union and India and a US decision to limit Medicare payments to health insurers — a move that has put intense downward pressure on health insurance stocks.

United States-South Korea: President Trump late yesterday said he will hike the US tariff on South Korea’s imports to 25% to punish the country for its slow approval of the bilateral trade deal reached by Washington and Seoul last year. The tariff hike would apply to all goods covered by Trump’s reciprocal tariffs, along with cars, lumber and pharmaceutical goods. As with the president’s weekend threat to impose new tariffs against Canada, the development shows that trade tensions remain a potential threat to financial markets.

United States-Iran: Reports yesterday said the USS Gerald R. Ford aircraft carrier and her strike group have arrived in the Middle East, greatly enhancing the US military presence in the region if President Trump wants to launch his threatened attack on Iran to retaliate for its brutal crackdown on protestors. There is no certainty that such an attack will happen, but investors should be aware that it remains possible. If it happens, there is some risk that it could spark a regional war that would disrupt the global economy and financial markets.

European Union-India: Officials from the EU and India today signed a free-trade deal that is expected to cut or remove tariffs on more than 96% of EU exports to India, including machinery, autos, and alcohol. However, sensitive agricultural exports on each side won’t be affected. For EU exporters, the deal is expected to yield savings of about 4 billion EUR ($4.8 billion). The deal is also expected to help boost EU exports to India, helping Brussels diversify its foreign sales away from the US as the trans-Atlantic relationship sours.

Canada-China: Top Chinese mining company Zijin Mining Group yesterday announced that it is buying Canadian miner Allied Gold in an all-cash deal valued at about $4 billion. The deal, which still requires shareholder and regulatory approval, illustrates how Prime Minister Carney has quickly moved to boost ties with China as a counterweight to the increasingly fraught relationship between the US and Canada. Of course, such deals probably raise the chance that the Trump administration will impose new tariffs or trade barriers on Canada in retaliation.

United Kingdom-China: The British government is reportedly planning to place tighter curbs on Chinese agencies and companies operating in the UK. The enhanced scrutiny will likely focus on China’s Ministry of State Security, the Chinese Communist Party, and state-owned Chinese firms operating or investing in sensitive sectors. The move comes despite UK Prime Minister Starmer’s effort to improve relations with China in order to diversify British trade away from the US, illustrating the risks inherent as countries embark on that strategy.

United Kingdom: As top Conservative Party politicians continue to defect to the right-wing populist Reform UK Party, pulling the Conservative Party to the right, several moderate Conservative officials yesterday launched a new centrist movement called Prosper UK to drag the Conservatives back toward the centrists. The officials said Prosper UK is also designed to counter the way the Labour Party has been pulled to the left. The development is further evidence that the British political system is fracturing, which will likely paralyze policy going forward.

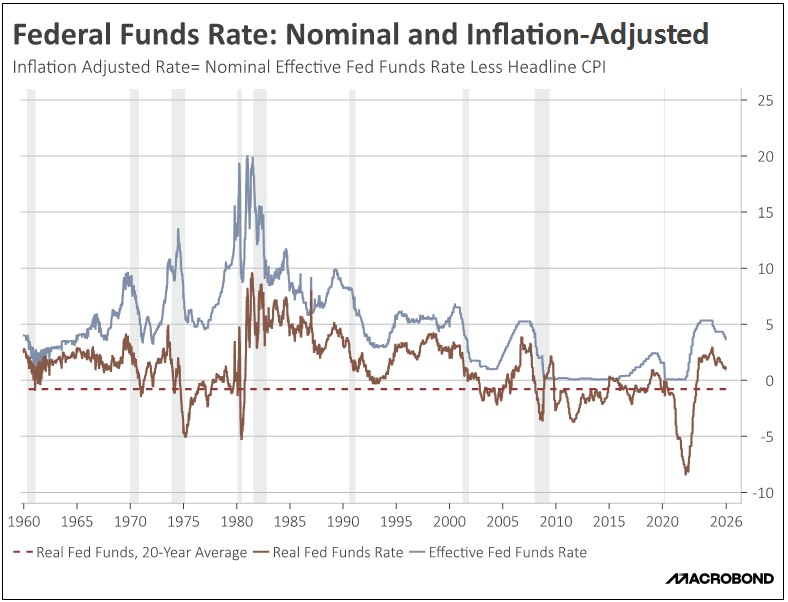

US Monetary Policy: The Fed’s policy committee begins its latest conclave today, with its decision expected tomorrow at 2:00 PM ET. Based on interest-rate futures trading, investors are almost unanimous in expecting the officials to hold their benchmark fed funds rate unchanged at 3.50% to 3.75%, after cutting rates at each of the previous three meetings. We expect that the officials will resume cutting rates at some point this year, but we continue to think that the bulk of any further cuts will be backloaded in the second half of the year.

US Health Insurance Industry: The administration yesterday said it would hike Medicare reimbursements to health insurers by a paltry 0.09% in 2027, versus their 5.0% increase in 2026. In response, health insurance giants UnitedHealthcare and Humana both saw their share prices fall by at least 10%. CVS and Elevance saw their share prices drop by more than 5%. The news illustrates how any firm that relies on federal reimbursement or fees, including defense contractors, is now at risk as the administration refocuses on cutting government spending.

US Airline Industry: Today marks the beginning of a new era as Southwest Airlines finally abandons open seating for assigned seating. For Southwest customers who love the airline’s extensive flight network (like yours truly), the move will put an end to the “seating roulette” that most travelers endured until now.