Daily Comment (January 23, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with signs that European leaders are getting more concerned about future Russian aggression. We next review a range of other international and U.S. developments with the potential to affect the financial markets today, including a potential new stock-market stimulus program in China and a few words on U.S. politics.

NATO-Russia: Illustrating how Russia’s invasion of Ukraine has prompted increased defense efforts by European members of the North Atlantic Treaty Organization, the Baltic states of Estonia, Latvia, and Lithuania last week agreed to start building strongpoints, bunkers, and other fixed defensive installations along their border with Russia. The move mirrors a recent decision by Finland to start building defense works on its border with Russia.

- As we wrote in our recent Bi-Weekly Geopolitical Report, an emboldened Russia may eventually be tempted to grab more territory in Europe despite its mauling at the hands of the Ukrainians so far. The possibility of further Russian aggression means the global investment environment will face elevated geopolitical risks in the coming years, but also potential opportunities in assets such as defense stocks and precious metals.

- Separately, German Defense Minister Boris Pistorius has warned that Russia might attack NATO territory even within the next five to eight years. Swedish officials have also been warning their citizens that a war with Russia could be coming. (By the way, we note that Turkey’s parliament is set to vote today on Sweden’s bid to join NATO. If the vote is positive, Sweden would only need a final approval from Hungary to join the alliance.)

- We want to emphasize that we don’t think further Russian aggression is certain. However, these reports do suggest that officials in Europe are becoming more concerned.

China: Responding to the ongoing slide in Chinese stock values, the State Council yesterday called on authorities to take stronger and more effective measures to stabilize markets and boost confidence. They also called for better regulations, more transparency, and additional measures to improve the quality of listed companies. Coupled with a recent surge in stock buying by state-owned firms, the cabinet statement has raised hopes that the government will soon embark on a program to lift prices. Chinese stocks therefore closed modestly higher today.

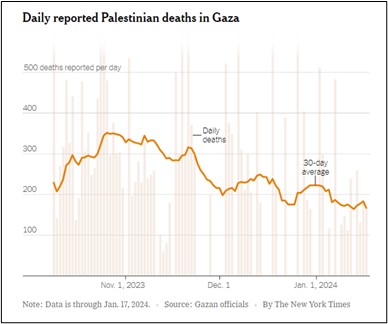

Israel-Hamas Conflict: While Prime Minister Netanyahu has publicly and privately resisted U.S. pressure to tone down Israel’s attacks on Hamas militants in the Gaza Strip, new analysis from the New York Times suggests the intensity of the attacks has indeed declined. The analysis shows that average Palestinian deaths in Gaza are now down to less than 200 per day.

- Of course, the death and destruction is still high enough to spur anti-Israeli attacks by militants around the region, including in southern Lebanon, keeping alive the risk that the conflict could broaden.

- Nevertheless, reduced violence and a more targeted approach by Israel could help to eventually reduce tensions and risks.

Red Sea Shipping: Despite the drop in casualties in Gaza, Iran-backed Houthi rebels in Yemen continue to threaten sympathy strikes on commercial ships in the Red Sea. In response, the U.S. and the U.K. launched a new round of airstrikes on Houthi missile sites and other targets this morning. The strikes mark the U.S.’s eighth attack on Houthi targets over the last several weeks.

European Union: Jean-François van Boxmeer, head of the European Round Table for Industry, has issued a complaint that the 800-billion EUR ($869 billion) NextGen EU pandemic recovery fund is far too difficult to access. According to van Boxmeer, the EU needs to cut the red tape and restructure the fund to get money into its targeted digital and green-tech projects more quickly.

- Indeed, halfway through its planned 2021-2026 life, only about 30% of the fund has been spent on loans and grants.

- That has left the EU with far less fiscal stimulus than the U.S. has had in the same period, which probably helps explain the stronger relative economic growth in the U.S.

France: Farmers’ union FNSEA is launching multiple road blockades and other measures today to protest government red tape and rising production costs. The protests follow similar actions recently in Germany, the Netherlands, Poland, and Romania. They also illustrate some of the rural frustrations that have boosted the support for right-wing populist movements throughout Europe.

Argentina: Key labor unions have announced that hundreds of thousands of workers will go out on strike this week to protest the libertarian economic reforms pushed by President Milei. The country’s courts have already suspended some key reforms, and Milei lacks control of the Argentine legislature, so the mass strike could be a further big impediment to Milei’s effort to reform the crisis-prone economy.

U.S. Politics: New Hampshire today holds the first presidential primary vote of the election season, following Iowa’s caucuses last week. On the Republican side, the latest opinion polls give former President Trump a healthy lead, but former UN Ambassador Nikki Haley is hoping for an upset and follow-on victory in her native South Carolina later.

- In our geopolitical analysis, we write a lot about the rise of right-wing populists around the world, including leaders such as Trump, Italian Prime Minister Giorgia Meloni, and Hungarian Prime Minister Viktor Orbán. However, we usually focus on the populists’ isolationist policies and how they affect international relations.

- An interesting opinion piece in the Financial Times today explores the economic impact of the populists. Specifically, the article notes that even though populist policies could theoretically be negative for the economy, most of today’s populists have presided over good economic growth. The article doesn’t give a definitive answer as to why that has happened, but it’s worth reading the author’s exploration of the topic.

U.S. Fiscal Policy: While it’s widely recognized that expansive federal fiscal policy has been helping buoy U.S. economic growth (reflecting both reduced income taxes and higher spending, especially for various types of entitlements), new analysis reminds us that state and local governments have also been increasing their spending. Key factors boosting state and local spending (and hiring) include infrastructure investment and stronger teacher hiring as schools get back to normal following the COVID-19 pandemic.