Daily Comment (January 22, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with a short discussion of Japan’s surging stock market and one potential reason for its strong rise. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including an apparent Israeli airstrike in Syria that killed members of Iran’s Revolutionary Guard and multiple developments in U.S. politics and financial markets.

Japan: Japanese stock prices continue to surge, with the Nikkei 225 price index now up about 9% year-to-date and within easy striking distance of its record high in the bubble of 1989. In contrast, mainland China’s CSI 300 index is down about 6%, and Hong Kong’s Hang Seng index is down 12%. The Wall Street Journal today notes that part of the reason for Japan’s strong performance may be that Chinese investors are pouring money into the Japanese market.

India: Prime Minister Modi today officially dedicated a controversial Hindu temple built on the site of a 15th-century mosque that was destroyed amid sectarian violence several years ago. The ceremony was attended by many top business leaders, celebrities, and film stars, highlighting how popular the temple’s construction has been with the 80% or so of India’s population that is Hindu. The move has therefore further boosted Modi’s political position. However, the move has been strongly resisted by Muslims and some opposition politicians.

Israel-Hamas Conflict: An apparent Israeli airstrike on a residence in Syria over the weekend killed five members of Iran’s Revolutionary Guard, raising further concerns that the conflict between Israel and Hamas could broaden to draw in Iran. Indeed, Iran-backed militants in Iraq later fired missiles at a U.S. military base in that country, causing several minor injuries.

Germany: Hundreds of thousands of people staged protests around the country yesterday after reports indicated the far-right populist Alternative for Germany party has been exploring a plan for mass deportations of people of foreign origin if its rising popularity puts it in power. Separately, AfD leader Alice Weidel said in a Financial Times interview that the party would hold a Brexit-style referendum on leaving the European Union if it comes to power. These developments show how populism is fracturing societies in the EU as well as the U.S.

U.S. Politics: Yesterday, Florida Governor Ron DeSantis said he is suspending his campaign to be the Republican nominee for president, leaving tomorrow’s New Hampshire primary a two-person race between former President Trump and former UN Ambassador Haley. Although DeSantis endorsed Trump in his statement, one key question is how many of his supporters will now shift their votes to Haley. As we’ve said before, it still looks like Trump will eventually be the Republican nominee, but Haley probably can’t be counted out just yet.

U.S. Stock Market: The S&P 500 price index closed at a new all-time high on Friday, meaning the uptrend that began in late 2022 now meets the conventional definition of a bull market. Since its low on October 12, 2022, the index is now up 35.3%. Importantly, the upswing has recently broadened beyond the “Magnificent 7” large-cap growth stocks that had dominated the market last year. For example, 70.8% of the stocks in the S&P 500 are now trading above their 200-day moving average.

- Momentum indicators also point to possible further gains in the near term.

- Nevertheless, as we noted in our recent “2024 Outlook” publication, moderating growth will leave the U.S. economy at greater risk of a recession this year. A recession, concern about the November elections, or negative geopolitical developments could all push stock prices lower again later in 2024.

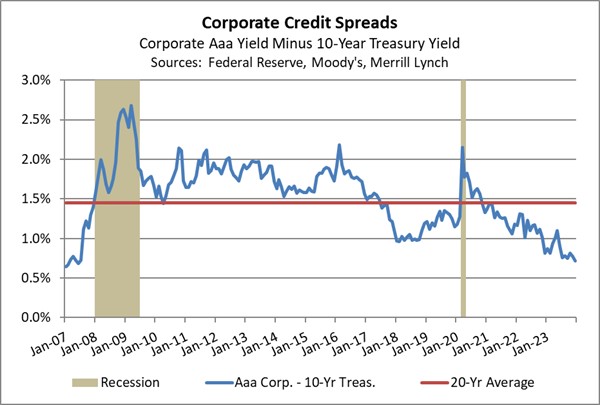

U.S. Bond Market: A report in the Financial Times reveals that investment-grade corporate bond sales have topped $150 billion so far in 2024, marking the strongest year-to-date issuance in three decades. The strong pace of issuance so far reflects both the big decline in yields since last autumn and extraordinarily strong demand by investors. Because of the strong demand, the spread between high-grade corporate bond yields and 10-year Treasury note yields has fallen to its lowest since before the Great Financial Crisis.

U.S. Commercial Real Estate Market: RXR, one of New York City’s biggest property developers, and alternative investment manager Ares Management (ARES, $116.43) are reportedly teaming up to launch a $1-billion fund to invest in the city’s distressed office buildings. Officials involved in the fund say they now sense an opportunity because building owners have finally accepted that they will have to accept losses to restructure or unload their assets, while the fund officials think they can assess where interest rates are going and what assets offer good value.

- The new office fund illustrates one benefit from the vast sums of money that have flowed into U.S. private equity and private debt funds in recent years. The bespoke deals and hands-on management of these investments may give private funds the confidence to seize evolving opportunities more quickly, channeling funds into the office sector and potentially helping to put a floor underneath it before it causes broader economic harm.

- Of course, it could also be the case that such investments are too early. Investing in distressed office properties is likely to be very risky as the market continues to adjust to work-from-home dynamics and high interest rates.