Daily Comment (January 18, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Chip optimism is electrifying the market, while a potential trade could heat up the Pacers’ playoff hopes. In today’s Comment, we dive into the latest topics: the semiconductor surge, the central bank pivot, and the Basel III Endgame controversy. Plus, we provide our usual roundup of global and domestic economic data.

Chips Making a Comeback? Despite the waning enthusiasm for AI-related services, semiconductors are blazing back, rebounding from their 2023 lows.

- Taiwan Semiconductor Manufacturing Company (TSM, $111.71)), the main manufacturer of chips for Apple (AAPL, $186.80) and Nvidia (NVDA, $571.99), expects to have a strong first quarter in 2024 and plans to raise its capital expenditure. The optimistic outlook suggests that the company is confident that demand for smartphones and computing should rebound from the previous year and anticipates that its revenue will increase by at least 20%. Additionally, according to data collected by the Semiconductor Industry Association, chip sales rebounded toward the end of 2023.

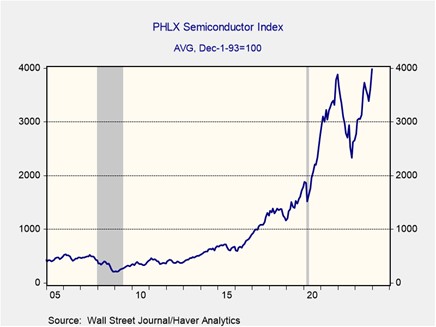

- Throughout 2023, fueled by AI ambitions, software ruled the tech world. Investors flocked to companies promising the next big algorithm, leaving chipmakers in the dust. However, the tide may be turning. The “Magnificent 7” (AMD, Nvidia, and their peers) have surged in 2023, outpacing the PHLX Semiconductor Sector by nearly tenfold. This recent surge suggests a renewed interest in hardware, the very foundation on which software thrives. While the broader market remains cautious, the two indexes are now roughly in tandem, hinting at a potentially strong year for chipmakers.

- The surge in chip stocks signals a broader market tilt, with investors on the hunt for hidden gems. Predicting the top dog is still a crapshoot, but last year’s champions could face a reckoning. Lofty valuations hinge on major tech companies meeting ambitious earnings projections, and any stumbles could leave them vulnerable to a sell-off. However, falling interest rates could be a boon for companies with strong fundamentals, potentially giving mid- and small-caps, last year’s neglected stars, their moment in the spotlight.

Market Takes a Breather: Uncertainty over global rates has spooked investors, but guarded risk appetite could offer pockets of opportunity.

- Central bankers have looked to rein in investor expectations of interest rate cut expectations. On Wednesday, European Central Bank President Christine Lagarde ruled out the possibility of a pivot in the spring in favor of summer. Meanwhile, officials from the Federal Reserve have cautioned the market that this easing cycle will not be as aggressive as previous cycles. Their skepticism was reinforced by incoming data that showed that the headline in inflation in the U.S. and the European Union accelerated in December. Although market expectations show that traders do not expect the ECB to cut in the spring, that is not true for the Fed. Implied overnight swaps suggest there is a 56% chance that U.S. policymaker will lower rates in March, down from 83% a week ago.

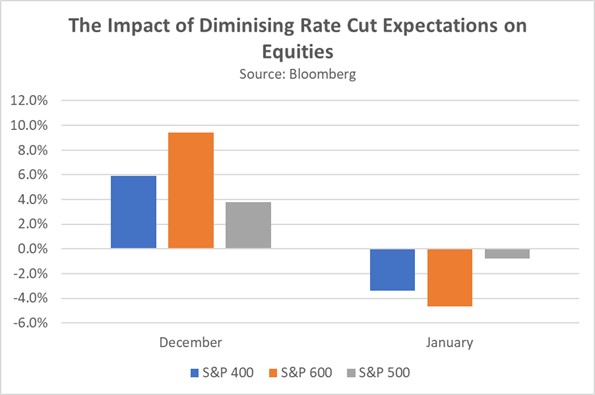

- As interest rate expectations shifted recently from anticipating six Fed rate cuts by year-end to a more modest stance due to push back from several Fed officials, investors rushed to unwind their earlier bullish positions in small- and mid-cap stocks. These companies had previously attracted significant inflows as investors sought higher returns in anticipation of a dovish Fed-fueled rally. However, a change in rate expectations has led investors to position their portfolios to protect against the possibility that policymakers may be preparing to hold rates at their current levels for a longer-than-expected period.

- Over the last thirty years, the Fed hiked rates gradually but cut them aggressively. Recent comments suggest a different approach this time. While a March cut is still possible, recent comments from Fed policymakers indicate a less aggressive pace than markets anticipate. This shift could be due to concerns about inflation or financial stability. A slower pace of cuts might delay investor’s shift toward stocks with more value. That said, the ECB’s lower relative rates give it room to wait before following the Fed’s eventual cut. Thus, it is likely that European policymakers may be more patient before they decide to lower their benchmark rates.

Regulatory End Game: U.S. federal banking regulators closed public comment on the Basel III Endgame framework this week as they reconsider a key provision related to capital requirements.

- The proposed capital requirements remain a major sticking point in the wake of the Silicon Valley Bank and Signature Bank collapses. These rules would force banks with over $100 million in assets to boost their capital cushion by 16%, aiming to protect against future financial crunches. However, Federal Reserve Governor Michelle Bowman warns that the current requirement miscalculates the actual cost of new capital and could push lending activity to the riskier shadow banking system. In a sign of potential compromise, Vice Chair of Supervision Michael Barr acknowledged the need for changes and his openness to industry feedback.

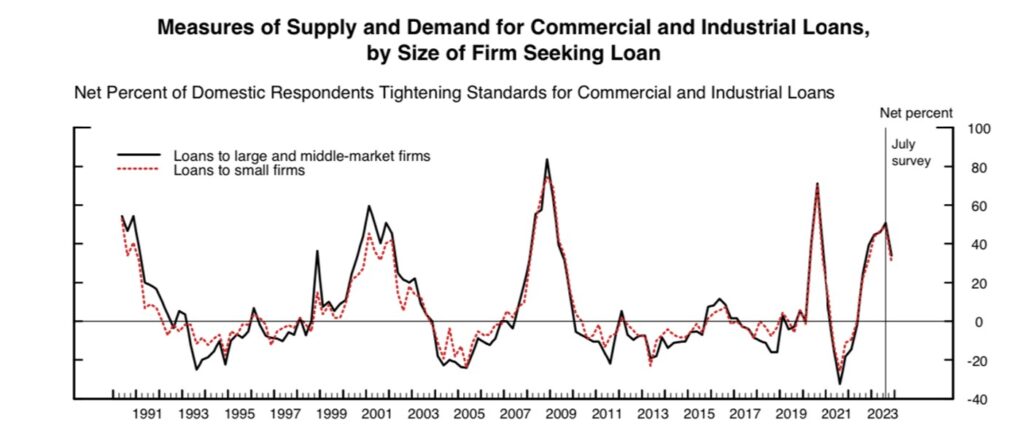

- Looming regulatory changes cast a dark cloud over financial stocks. New regulations threaten to handcuff major banks, forcing them to ditch risky bets and hoard more cash than they’d like. This could stifle lending, especially for riskier borrowers, as early signs are already suggesting. American banks could face a competitive disadvantage compared to their British and European counterparts who have less stringent rules.

- Despite the anticipation of watered-down regulations, banks are already tightening credit, casting a shadow on future economic growth. The Senior Loan Officer Survey reveals that banks are already starting to reduce loans due to perceived economic headwinds. This year could see even tighter credit, as banks bolster capital reserves to weather the still-distant regulatory storm of late 2025. While the full impact won’t be immediate, this preemptive tightening casts a long shadow on economic activity.